- Denmark

- /

- Marine and Shipping

- /

- CPSE:DNORD

Norden (CPSE:DNORD) Margin Decline Undercuts Bullish Narratives Despite Strong Five-Year Earnings Growth

Reviewed by Simply Wall St

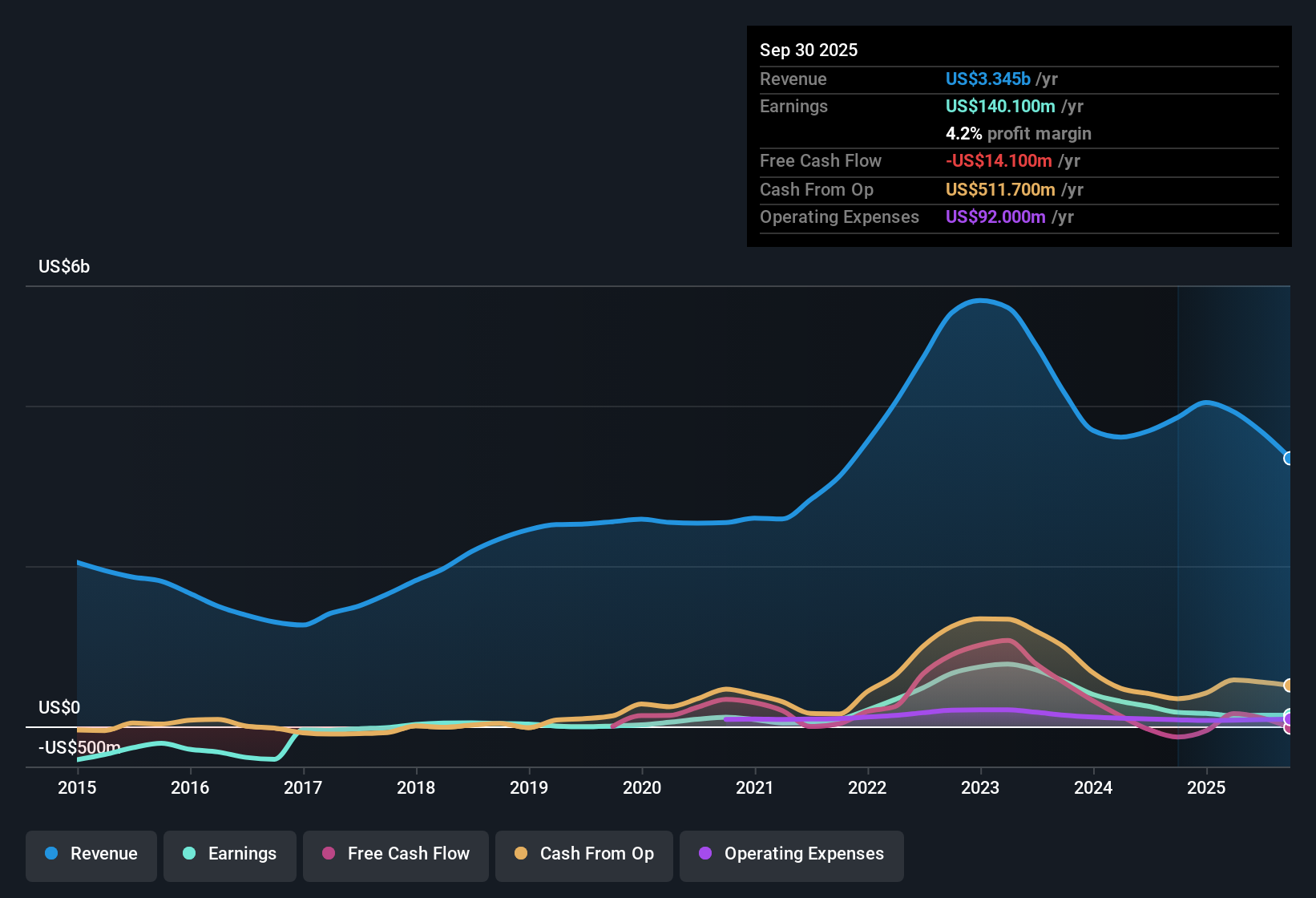

Dampskibsselskabet Norden (CPSE:DNORD) delivered average annual earnings growth of 8% over the last five years. However, the most recent 12 months saw a decline, with net profit margins slipping to 3.8% from 6.8% a year ago. Notably, this year’s earnings included a one-off gain of $62.1 million, making direct comparisons and the assessment of recurring performance more difficult. While the lower margin and negative year-over-year earnings growth met a muted reception from investors, the market may still see value in the stock’s trading multiples relative to peers.

See our full analysis for Dampskibsselskabet Norden.Next, we will see how this latest batch of numbers compares to the widely discussed narratives and expectations in the Simply Wall St community, as well as where the results might surprise.

Curious how numbers become stories that shape markets? Explore Community Narratives

Recurring Profit Lacks Momentum

- Excluding the $62.1 million one-off gain, DNORD’s earnings quality this year was significantly weaker. This signals that core profitability was not as strong as headline numbers first suggest.

- What is surprising is that, even with an 8% annualized growth rate over five years, the most recent period saw net profit margins slip well below last year’s 6.8% to just 3.8%.

- This fall in underlying profitability reveals a notable risk for long-term investors seeking stable performance. Short-term boosts from one-off items can mask ongoing trend reversals.

- Bulls may point to the multi-year growth trend but must grapple with this year’s clear drop in high-quality, recurring earnings power.

Dividend Safety Comes Into Focus

- DNORD’s declining profit margins and reliance on one-off gains increase pressure on dividend sustainability, a key concern for income-focused shareholders.

- Critics highlight that shrinking core earnings make it harder to cover ongoing dividend payments in the future.

- Investors comfortable with DNORD’s lower Price-To-Earnings Ratio of 8.3x, compared to peers, must still weigh whether dividends are being paid out of steady profits or one-off windfalls.

- This calls into question the long-term reliability of the payout, especially with margins at their weakest in several years.

Shares Trade Well Below DCF Value

- With a share price of DKK259 and a DCF fair value estimate of DKK796.16, DNORD trades at a dramatic discount. This suggests the market remains cautious, possibly due to its profit quality issues.

- Prevailing market view suggests that while the low Price-To-Earnings Ratio (8.3x vs. industry 8.8x) and sharp discount to DCF fair value may appear attractive, margin deterioration and inconsistent earnings temper bullish enthusiasm.

- Investors attracted by the valuation must balance the numerical discount against real concerns about whether DNORD can rebuild profit momentum without reliance on extraordinary income.

- Sector-wide cyclicality may also keep a lid on valuations until operating performance shows clear, recurring strength.

To understand how these financial tensions and valuation gaps fit into the broader investment story, see the full consensus narrative for DNORD below. 📊 Read the full Dampskibsselskabet Norden Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Dampskibsselskabet Norden's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

DNORD’s declining profit margins, reliance on one-off gains, and weakening core earnings raise concerns about dividend sustainability and long-term income potential.

If that makes you rethink your income strategy, check out these 2008 dividend stocks with yields > 3% to focus on stocks offering more reliable dividends backed by consistent profitability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:DNORD

Dampskibsselskabet Norden

A shipping company, owns and operates dry cargo and tanker vessels worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives