One Analyst Just Shaved Their cBrain A/S (CPH:CBRAIN) Forecasts Dramatically

Market forces rained on the parade of cBrain A/S (CPH:CBRAIN) shareholders today, when the covering analyst downgraded their forecasts for this year. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analyst has soured majorly on the business.

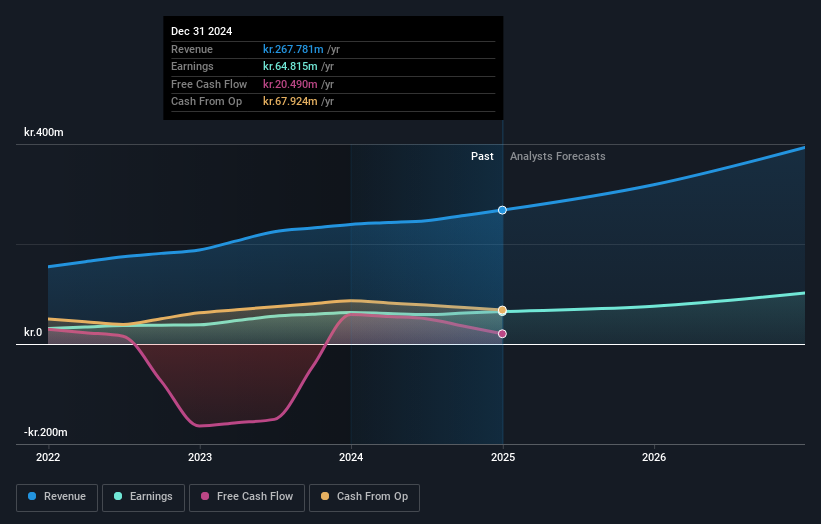

Following the downgrade, the current consensus from cBrain's sole analyst is for revenues of kr.319m in 2025 which - if met - would reflect a decent 19% increase on its sales over the past 12 months. Per-share earnings are expected to grow 17% to kr.3.86. Before this latest update, the analyst had been forecasting revenues of kr.359m and earnings per share (EPS) of kr.5.34 in 2025. Indeed, we can see that the analyst is a lot more bearish about cBrain's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

View our latest analysis for cBrain

It'll come as no surprise then, to learn that the analyst has cut their price target 27% to kr.150.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the cBrain's past performance and to peers in the same industry. We can infer from the latest estimates that forecasts expect a continuation of cBrain'shistorical trends, as the 19% annualised revenue growth to the end of 2025 is roughly in line with the 20% annual revenue growth over the past five years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 11% annually. So it's pretty clear that cBrain is forecast to grow substantially faster than its industry.

The Bottom Line

The most important thing to take away is that the analyst cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately, the analyst also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of cBrain.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At least one analyst has provided forecasts out to 2026, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if cBrain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:CBRAIN

cBrain

A software company, provides software solutions for government, private, education, and non-profit sectors in Denmark, rest of the European Union, and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Q3 Outlook modestly optimistic

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.