- Denmark

- /

- Real Estate

- /

- CPSE:PARKST A

We Think Some Shareholders May Hesitate To Increase Park Street Nordicom A/S' (CPH:PSNRDC A) CEO Compensation

The share price of Park Street Nordicom A/S (CPH:PSNRDC A) has increased significantly over the past few years. However, the earnings growth has not kept up with the share price momentum, suggesting that some other factors may be driving the price direction. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 22 April 2021. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

See our latest analysis for Park Street Nordicom

Comparing Park Street Nordicom A/S' CEO Compensation With the industry

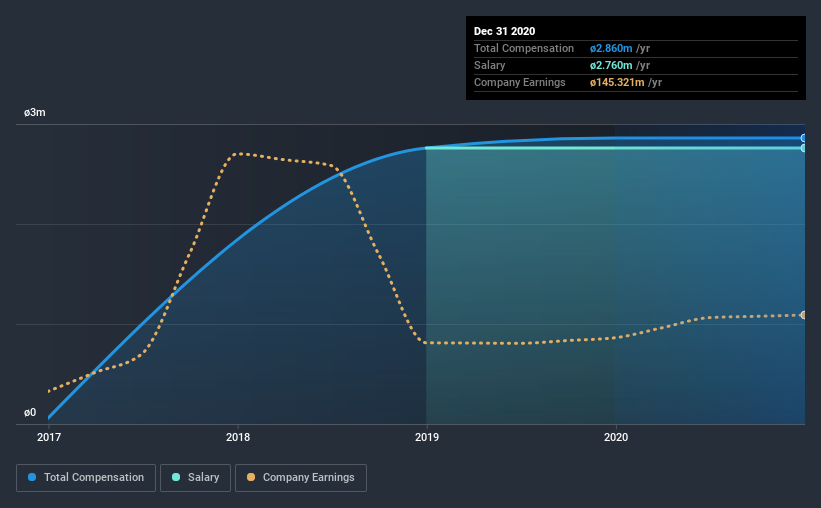

At the time of writing, our data shows that Park Street Nordicom A/S has a market capitalization of kr.697m, and reported total annual CEO compensation of kr.2.9m for the year to December 2020. This was the same as last year. In particular, the salary of kr.2.76m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below kr.1.2b, reported a median total CEO compensation of kr.1.5m. This suggests that Pradeep Pattem is paid more than the median for the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | kr.2.8m | kr.2.8m | 97% |

| Other | kr.100k | kr.100k | 3% |

| Total Compensation | kr.2.9m | kr.2.9m | 100% |

On an industry level, roughly 57% of total compensation represents salary and 43% is other remuneration. Park Street Nordicom pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Park Street Nordicom A/S' Growth Numbers

Park Street Nordicom A/S has reduced its earnings per share by 36% a year over the last three years. Its revenue is down 15% over the previous year.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Park Street Nordicom A/S Been A Good Investment?

Most shareholders would probably be pleased with Park Street Nordicom A/S for providing a total return of 43% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Park Street Nordicom pays its CEO a majority of compensation through a salary. Despite the strong returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 2 warning signs for Park Street Nordicom (1 can't be ignored!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Park Street Nordicom, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:PARKST A

Park Street

Operates as a real estate investment and asset management company in Denmark.

Slight risk and overvalued.

Market Insights

Community Narratives