Will Wegovy's New Trial Results and Regulatory Progress Change Novo Nordisk's (CPSE:NOVO B) Story?

Reviewed by Sasha Jovanovic

- In recent days, Novo Nordisk presented new STEP UP phase 3b trial results for Wegovy, highlighting substantial improvements in both weight loss and obesity-related complication risks, and confirmed that the investigational higher dose is under regulatory review in multiple regions.

- This comes as the company revises its 2025 growth outlook amid intensifying sector competition, legal disputes over a $10 billion bid for Metsera, and ongoing business transformation efforts.

- We'll examine how Wegovy's advanced clinical results and regulatory progress may influence Novo Nordisk's future market position and growth story.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Novo Nordisk Investment Narrative Recap

Novo Nordisk’s investment thesis rests on sustained, long-term demand for GLP-1 therapies in obesity and diabetes as global access, new indications, and product launches accelerate adoption. Recent lawsuits from Pfizer contesting Novo Nordisk’s $10 billion Metsera bid, while headline-grabbing, do not currently pose a material risk to its most important short-term catalyst: further label and dose expansion for Wegovy, which remains anchored in regulatory and clinical progress rather than M&A turbulence.

The most relevant announcement is the STEP UP phase 3b trial results for Wegovy, confirming significant weight loss and cardiovascular risk reduction, with a new higher dose under regulatory review. This directly strengthens Novo Nordisk’s product-led growth catalysts in obesity, regardless of external legal or deal-related headlines, and supports the core belief in medical innovation fueling future revenue streams.

In contrast, it is important for investors to be aware that upcoming patent expiries and pending generics in key markets may present...

Read the full narrative on Novo Nordisk (it's free!)

Novo Nordisk's outlook anticipates DKK396.7 billion in revenue and DKK142.5 billion in earnings by 2028. This scenario calls for annual revenue growth of 8.3% and an earnings increase of DKK31.4 billion from the current earnings of DKK111.1 billion.

Uncover how Novo Nordisk's forecasts yield a DKK438.59 fair value, a 43% upside to its current price.

Exploring Other Perspectives

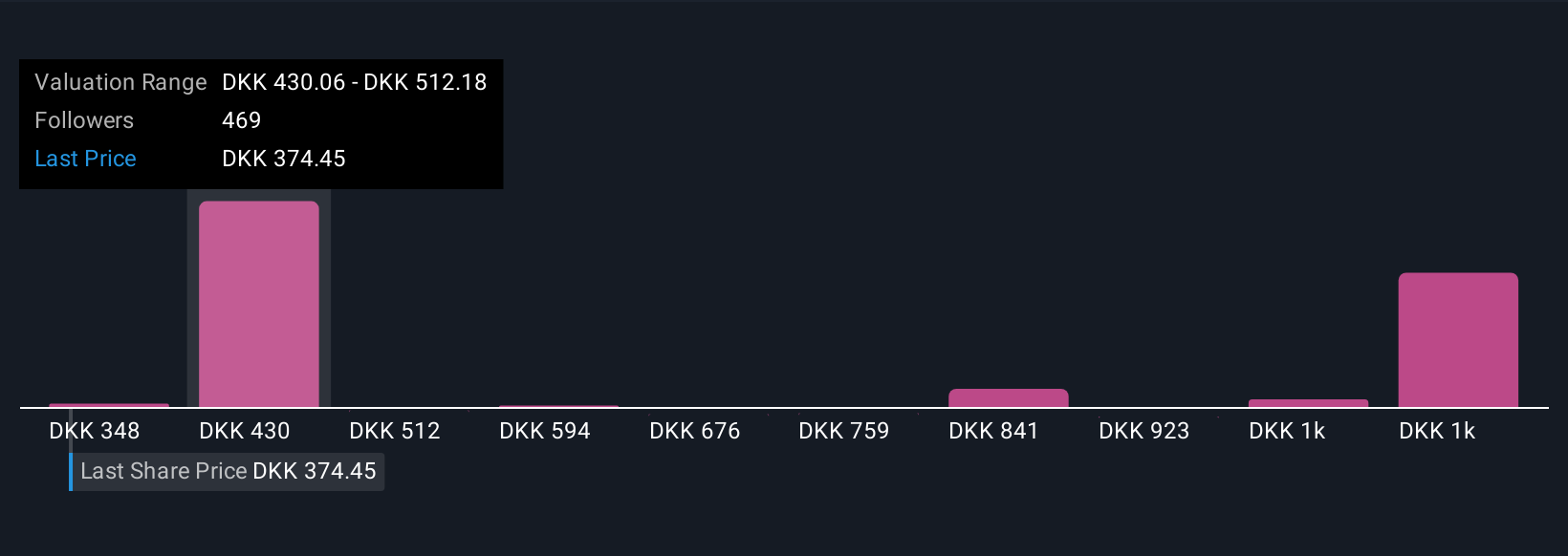

Across 126 community perspectives, Simply Wall St users estimate fair value for Novo Nordisk from DKK340 to DKK1,120.60 per share. Many believe new obesity indications and regulatory gains could drive returns, but slowing GLP-1 growth highlights why comparing diverse opinions matters.

Explore 126 other fair value estimates on Novo Nordisk - why the stock might be worth over 3x more than the current price!

Build Your Own Novo Nordisk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novo Nordisk research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Novo Nordisk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novo Nordisk's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novo Nordisk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NOVO B

Novo Nordisk

Engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives