Is Novo Nordisk Attractively Priced After a 22% Drop in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Novo Nordisk is a smart buy right now, or if you might be overpaying? You are not alone, especially with all the buzz around its valuation.

- In just the last month, Novo Nordisk shares have dropped a steep 22.1%, and are down 58.7% over the past year. This suggests big swings in either growth expectations or risk perception.

- Recent headlines highlight changing pharmaceutical regulations and heightened competition in the diabetes and obesity markets. Both factors help explain the dramatic price shift. With analysts and the market watching every move, these developments provide important context for understanding the stock’s trajectory.

- Novo Nordisk currently scores a 5 out of 6 on our valuation checks, showing that by most standards the stock appears undervalued. Next, we are going to dig into how those valuation methods stack up and why there might be an even better way to assess the company’s real worth by the end of this article.

Find out why Novo Nordisk's -58.7% return over the last year is lagging behind its peers.

Approach 1: Novo Nordisk Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model is one of the most rigorous ways to estimate the fair value of a business by projecting its expected future cash flows and discounting them back to today's value. This method helps investors understand what a company might be worth by taking into account both forecasted performance and the time value of money.

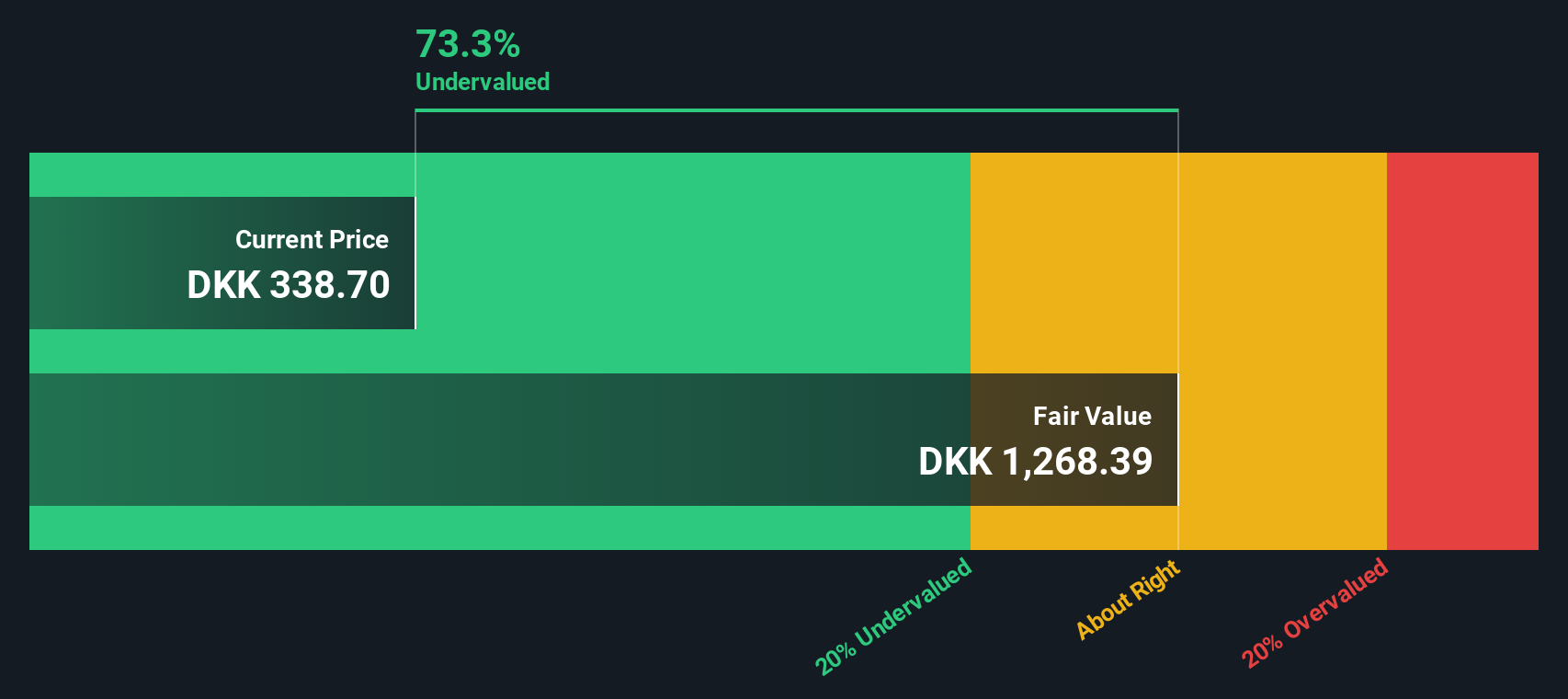

For Novo Nordisk, the most recent twelve months' Free Cash Flow sits at DKK 68.4 billion. Looking ahead, analysts expect Free Cash Flow to steadily increase, reaching projections as high as DKK 135.3 billion by 2029. While estimates from analysts typically extend only five years out, the longer-term projections used here are extrapolated based on those trends and provide a forward-looking view to 2035.

Based on these projections and a 2 Stage Free Cash Flow to Equity model, the estimated fair value for Novo Nordisk is DKK 1,131.35 per share. This represents a significant intrinsic discount of 73.4% compared to the current share price. This suggests the stock may be trading well below its calculated worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Novo Nordisk is undervalued by 73.4%. Track this in your watchlist or portfolio, or discover 839 more undervalued stocks based on cash flows.

Approach 2: Novo Nordisk Price vs Earnings

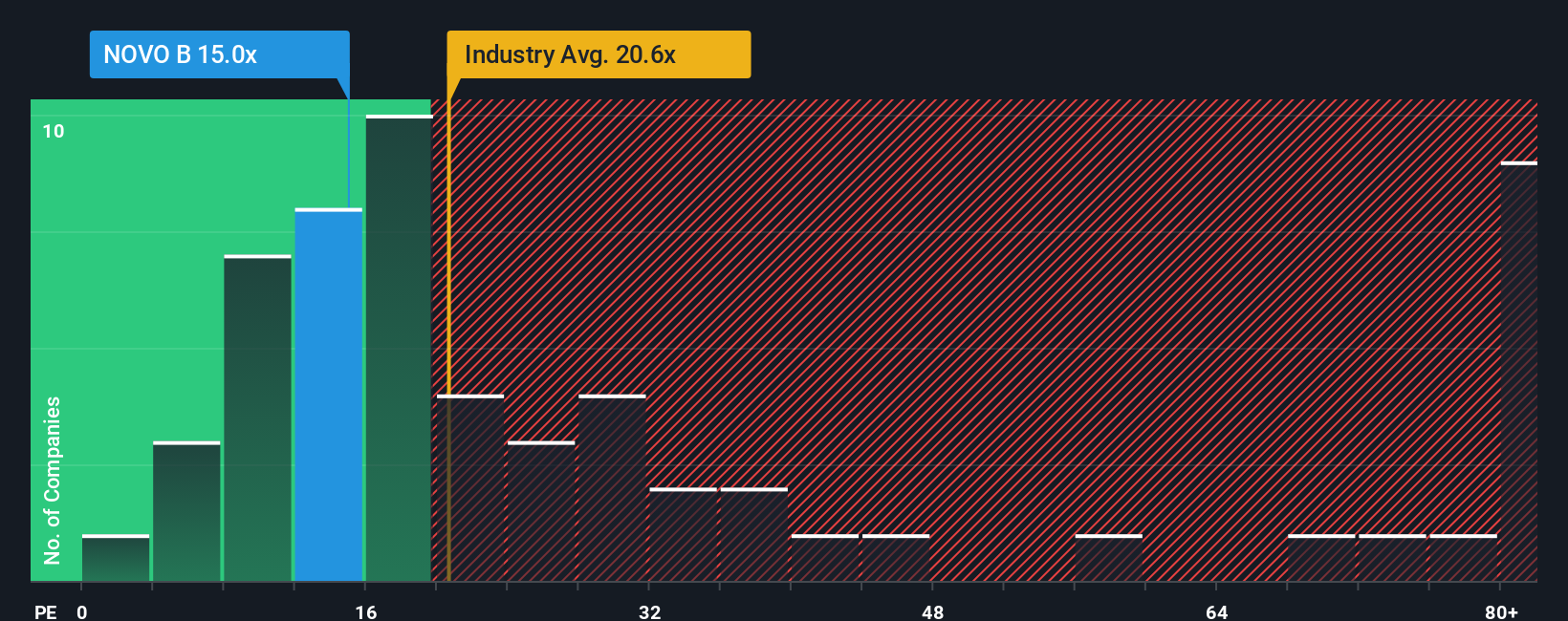

The Price-to-Earnings (PE) ratio is a key metric for valuing profitable companies like Novo Nordisk, as it measures how much investors are paying for each Danish Krone of earnings. PE is especially informative for healthcare businesses where steady profits are expected, making it a strong starting point when assessing if a stock is attractively valued.

What constitutes a “fair” PE varies depending on growth and risk. Companies expected to grow faster or offer more stability typically deserve a higher PE, while higher risk or slower growth tend to warrant a lower one. That context is crucial when comparing Novo Nordisk’s 12.0x PE to the Pharmaceuticals industry average of 24.1x and its closest peers averaging 21.5x. At first glance, Novo Nordisk appears significantly cheaper than comparable companies in the sector.

However, Simply Wall St’s “Fair Ratio” metric provides an additional perspective. It is tailored to Novo Nordisk’s specifics, weighing factors like projected earnings growth, risk profile, profit margins, market cap, and its operating environment. By combining these variables, the Fair Ratio of 28.9x offers a more nuanced benchmark than peers or industry averages alone. The result suggests that Novo Nordisk’s actual PE is materially below what would be justified by its performance and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Novo Nordisk Narrative

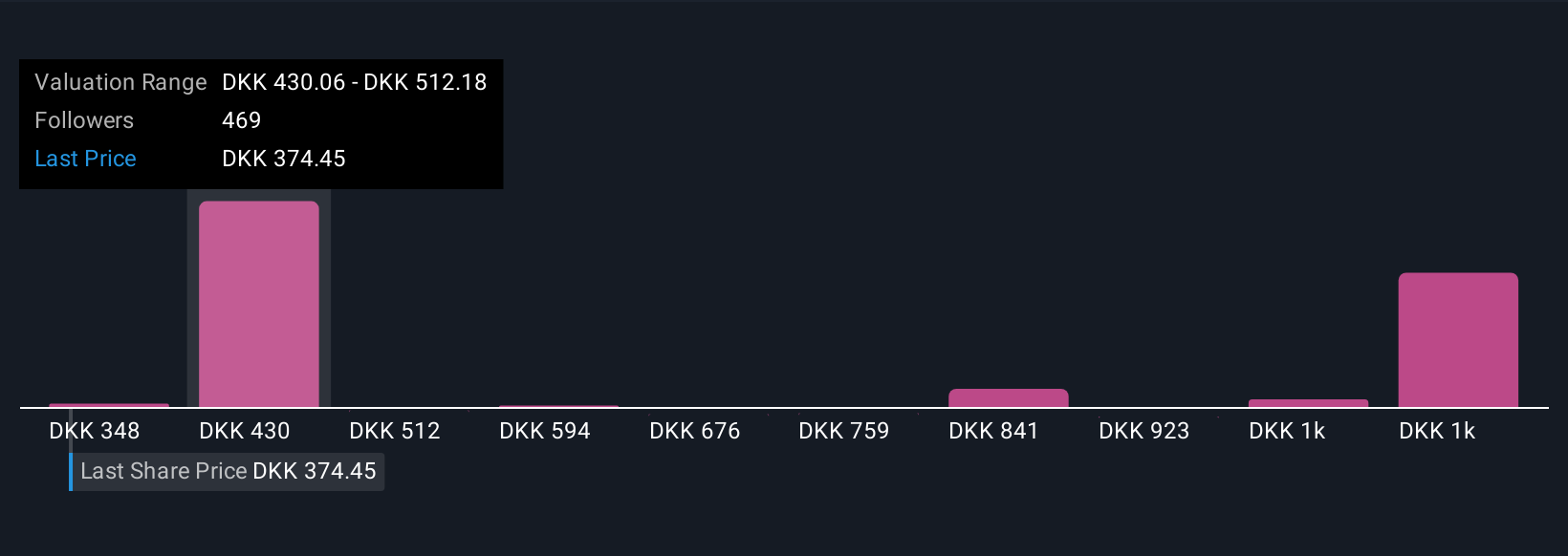

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, structured way to tell your story about a company, connecting your expectations for future revenue, earnings, and fair value directly to your view of its business and prospects.

Unlike traditional models that just output a number, Narratives combine your financial assumptions with the reasons behind them. This makes your investment thesis explicit and transparent. On Simply Wall St’s Community page, millions of investors use Narratives to articulate, justify, and share exactly why they think a stock is undervalued or overvalued, turning raw data into actionable insights.

Narratives make it easy to track your thinking over time and compare Fair Value estimates to the current share price, helping you decide when to buy or sell. They also update automatically as new news, earnings, or industry changes are factored in, ensuring your perspective always reflects the latest information.

For example, some investors currently believe Novo Nordisk’s fair value is as high as DKK 1,036, while others estimate it as low as DKK 439. This shows just how much room there is for different, well-reasoned views on the same company.

Do you think there's more to the story for Novo Nordisk? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novo Nordisk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NOVO B

Novo Nordisk

Engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives