Is Novo Nordisk a Hidden Opportunity After 11% Drop and New Weight Loss Drug Deals?

Reviewed by Bailey Pemberton

- Wondering if Novo Nordisk could be a bargain, overpriced, or hiding in plain sight? You are not alone in trying to answer that question. Let's cut through the noise together.

- After a wild ride including a 58.4% return over five years, the stock has dropped 11.3% in the last month and is now down 52.3% since the start of the year. This can shift how investors weigh both growth potential and risk.

- Recent headlines have been swirling around Novo Nordisk, with news of expanding production facilities and partnerships for weight loss drug development making waves in the market. These developments have fueled both optimism and debate about the company's longer-term prospects.

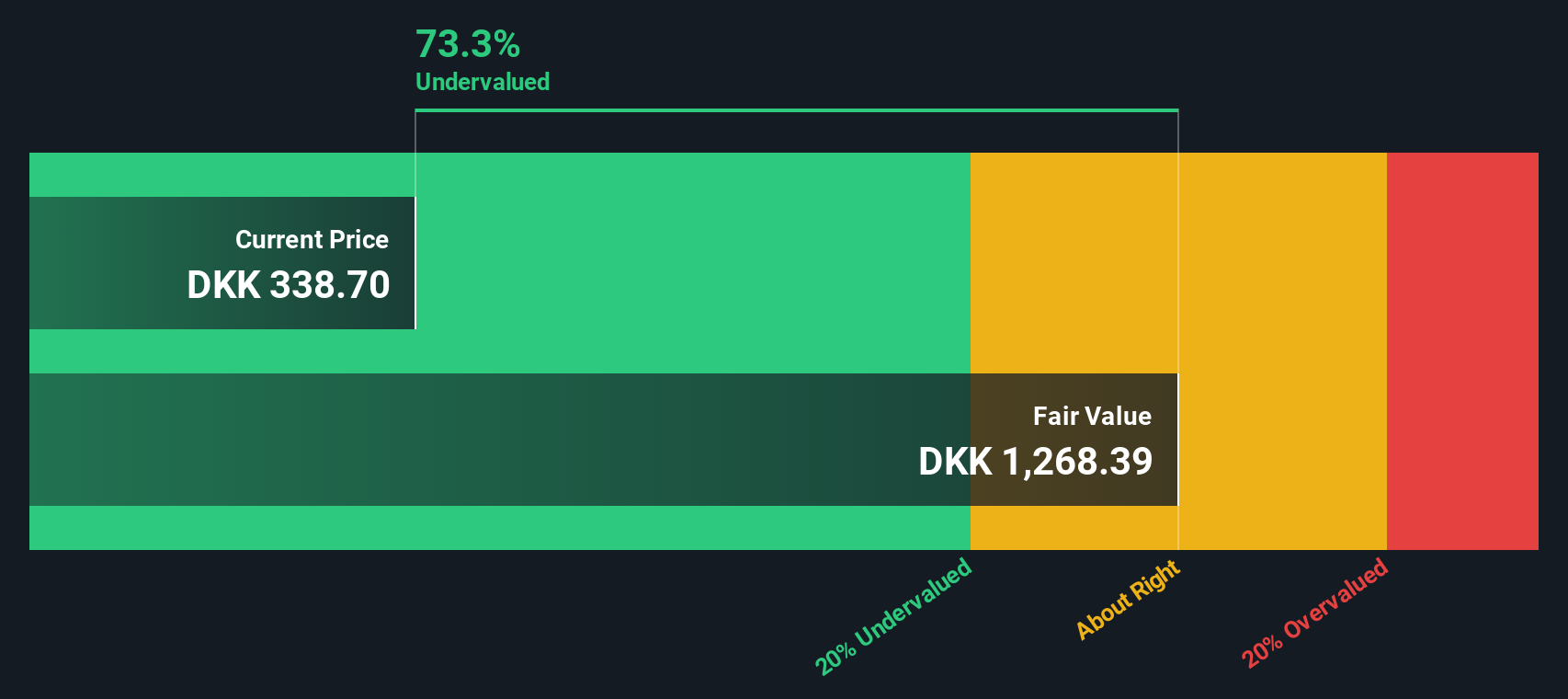

- As of now, Novo Nordisk scores a 5/6 on our latest valuation checks, which means it is considered undervalued in nearly every way we measure it. Next, we will break down the main valuation approaches, but make sure to stick around for a fresh way to put all this in context at the end.

Find out why Novo Nordisk's -58.3% return over the last year is lagging behind its peers.

Approach 1: Novo Nordisk Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future cash flows and then discounts those amounts back to today’s value using a required rate of return. This provides an estimate of what the business is worth right now, based on potential future performance.

Novo Nordisk currently generates Free Cash Flow of approximately DKK 67.5 billion. Analyst forecasts, supported by extrapolated data, suggest this could grow to just over DKK 127 billion by 2029. After the next five years, future cash flows are projected with decreasing annual growth rates, although the trajectory remains positive. All projections are denominated in DKK, Novo Nordisk's reporting currency.

Discounting these forecasted flows back to the present, the model estimates the intrinsic value per share to be DKK 1,076.17. This intrinsic value is 71.7% above the current trading price, indicating that the stock appears significantly undervalued according to this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Novo Nordisk is undervalued by 71.7%. Track this in your watchlist or portfolio, or discover 921 more undervalued stocks based on cash flows.

Approach 2: Novo Nordisk Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a tried and true valuation metric for profitable companies like Novo Nordisk. It helps investors gauge how much they are paying for each unit of earnings and remains particularly relevant for mature firms with stable or growing profits.

Growth expectations and risk play a key role in determining what a “normal” or “fair” PE ratio should be. Companies with higher growth prospects or lower perceived risks often command higher PE multiples, while those facing tougher business conditions tend to trade at lower ratios.

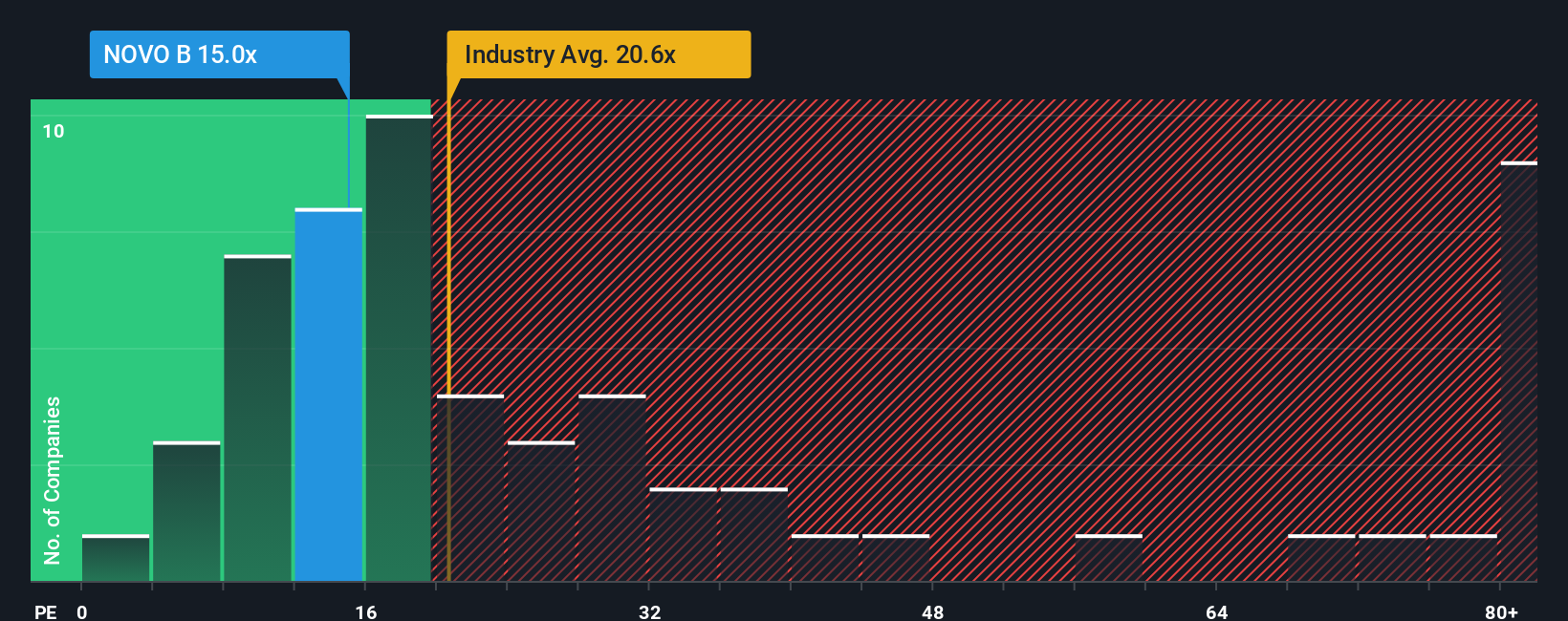

Currently, Novo Nordisk trades at a PE ratio of 13x. This compares favorably with both the Pharmaceuticals industry average of 23.5x and the broader peer group average of 21.6x. On a surface level, this might suggest the company is deeply undervalued based on price-to-earnings alone.

However, Simply Wall St’s proprietary Fair Ratio brings more nuance. This metric estimates a “just right” multiple for Novo Nordisk by adjusting for factors such as its specific earnings growth outlook, profit margins, industry context, company size, and risk. This approach is a step above simple peer or sector comparisons as it customizes the benchmark to the company’s actual profile instead of relying on broad averages that may not be fully relevant.

Novo Nordisk’s Fair Ratio is calculated to be 28.9x, more than double its current 13x PE. This implies the stock is undervalued based on what would be considered a fair price-to-earnings multiple, factoring in its strengths and future prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Novo Nordisk Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a straightforward tool that allows you to create your own investing story: you set assumptions about future revenue, margins, and fair value, turning numbers into a clear outlook backed by your personal perspective on a company’s direction and potential.

Narratives seamlessly connect a company’s story, such as its innovation strategy, product launches, or market challenges, to a tailored financial forecast and resulting fair value. They are easy to use and accessible right on Simply Wall St’s Community page, where millions of investors compare, challenge, and refine investment ideas together.

With Narratives, when you set your view and see your Fair Value estimate alongside the current share price, you can easily decide whether now is the time to buy, hold, or sell. No spreadsheets or complex models are required. Each Narrative also updates automatically as new information, such as news or earnings, is released so your insights stay sharp and current.

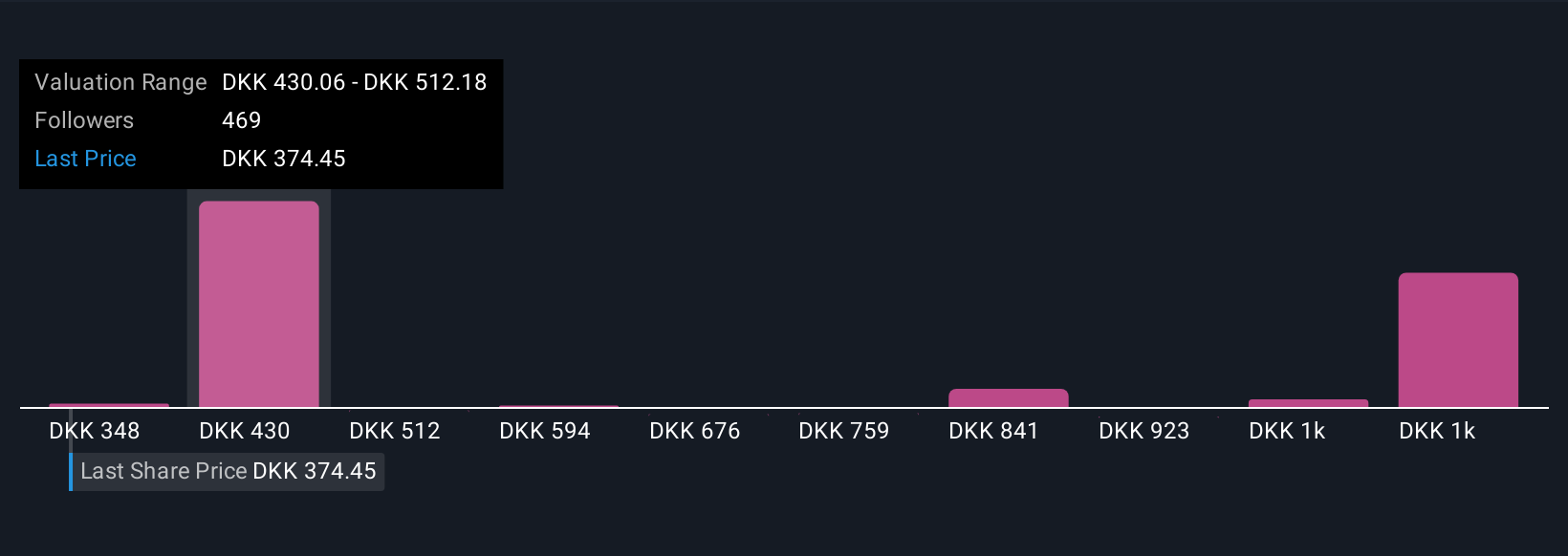

For example, when analyzing Novo Nordisk, one investor’s Narrative (factoring in rapid pipeline expansion and high profit margins) calculates a fair value near DKK 1,036 per share, while another, weighing lower projected growth and upcoming patent risks, estimates DKK 431. This illustrates how Narratives help you compare and decide for yourself, with all forecasts and reasoning made transparent.

Do you think there's more to the story for Novo Nordisk? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novo Nordisk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NOVO B

Novo Nordisk

Engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives