How Novo Nordisk’s (CPSE:NOVO B) Wegovy and Ozempic Price Cuts Could Reshape Its Investment Story

Reviewed by Sasha Jovanovic

- In November 2025, Novo Nordisk began offering US cash payers early access to Wegovy at $349 per month and introduced substantial price reductions for select Ozempic doses, with introductory pricing as low as $199 monthly for certain strengths until the end of March 2026.

- This move reflects Novo Nordisk’s efforts to broaden patient access to its GLP-1 medicines and strengthen competitive positioning in the fast-evolving weight-loss drug market.

- We'll explore how this accelerated pricing initiative for Wegovy and Ozempic may alter Novo Nordisk’s investment outlook and long-term growth story.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Novo Nordisk Investment Narrative Recap

To believe in Novo Nordisk as a shareholder is to see the long-term opportunity in global obesity and diabetes treatment, built on the rising adoption of its GLP-1 medicines. The recent early price reductions for Wegovy and Ozempic are set to support short-term US volume growth, a key catalyst, but could intensify margin pressure, which is currently the biggest risk, rather than materially change the outlook for market share expansion.

Among recent announcements, Novo Nordisk’s renewed five-year partnership with Team Novo Nordisk stands out as an example of its ongoing commitment to diabetes awareness. This visibility and educational outreach may indirectly reinforce brand loyalty and uptake at a time when affordable access initiatives are reshaping the playing field for volume growth.

However, while increased access has clear upsides, the risk of sustained price erosion for key GLP-1 products is something investors should carefully consider, especially if...

Read the full narrative on Novo Nordisk (it's free!)

Novo Nordisk's outlook anticipates DKK396.7 billion in revenue and DKK142.5 billion in earnings by 2028. This scenario is based on analysts' expectations for an annual revenue growth rate of 8.3% and an earnings increase of DKK31.4 billion from current earnings of DKK111.1 billion.

Uncover how Novo Nordisk's forecasts yield a DKK431.99 fair value, a 38% upside to its current price.

Exploring Other Perspectives

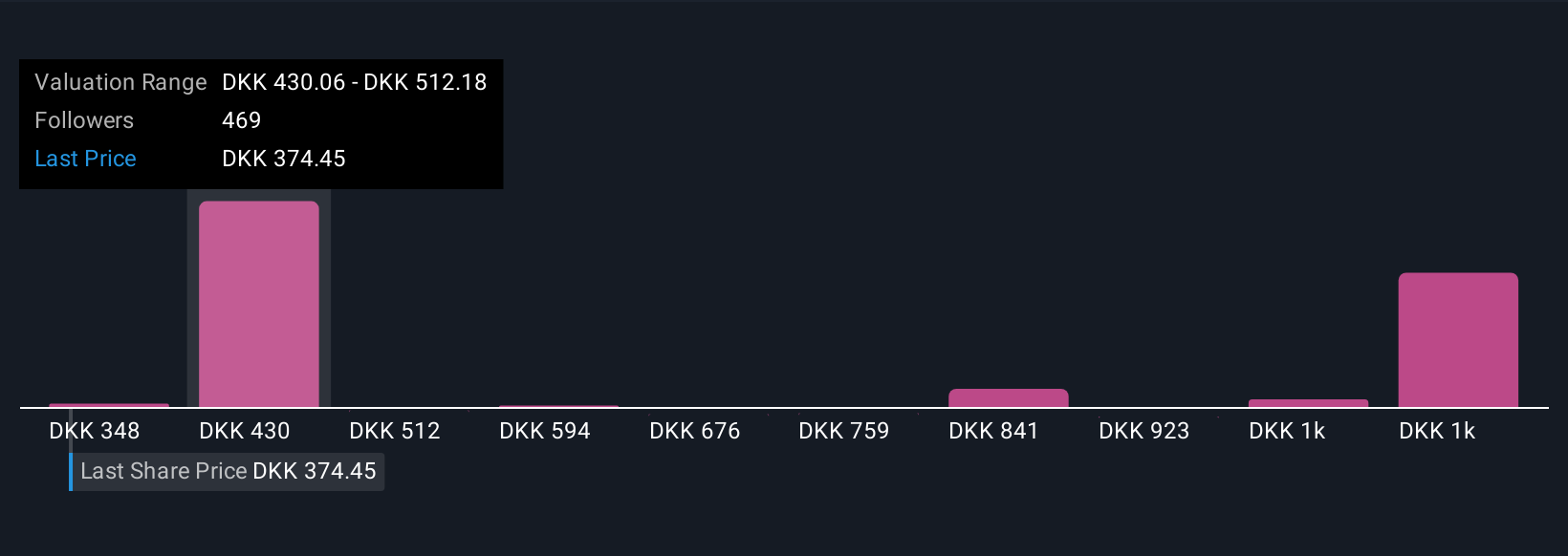

Simply Wall St Community members provided 123 fair value estimates for Novo Nordisk ranging from DKK 340 to DKK 1,076. With widening cash channel access potentially pressuring net margins, these varied opinions highlight how differently future earnings quality and growth may be viewed. Explore a range of perspectives to understand this contrast for yourself.

Explore 123 other fair value estimates on Novo Nordisk - why the stock might be worth just DKK340.00!

Build Your Own Novo Nordisk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novo Nordisk research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Novo Nordisk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novo Nordisk's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novo Nordisk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NOVO B

Novo Nordisk

Engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives