- Denmark

- /

- Life Sciences

- /

- CPSE:GUBRA

Subdued Growth No Barrier To Gubra A/S (CPH:GUBRA) With Shares Advancing 60%

Despite an already strong run, Gubra A/S (CPH:GUBRA) shares have been powering on, with a gain of 60% in the last thirty days. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

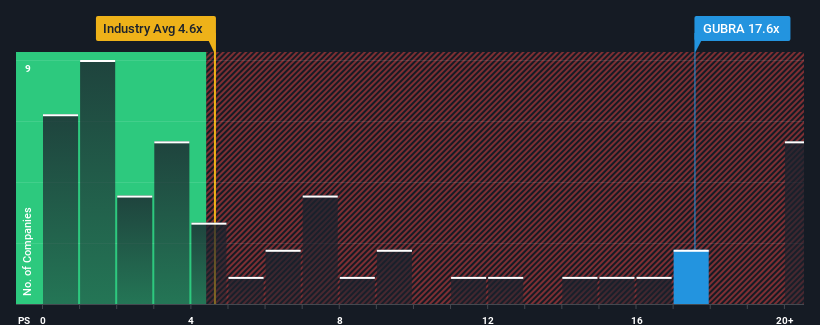

Following the firm bounce in price, Gubra may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 17.6x, when you consider almost half of the companies in the Life Sciences industry in Denmark have P/S ratios under 4.6x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Gubra

How Has Gubra Performed Recently?

Gubra has been doing a decent job lately as it's been growing revenue at a reasonable pace. One possibility is that the P/S ratio is high because investors think this good revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Gubra will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

Gubra's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a decent 2.8% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 19% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

It's interesting to note that the rest of the industry is similarly expected to grow by 6.3% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Gubra is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Gubra's P/S?

The strong share price surge has lead to Gubra's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We didn't expect to see Gubra trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 1 warning sign for Gubra that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:GUBRA

Gubra

A biotech company, focuses on the pre-clinical contract research and peptide-based drug discovery within metabolic and fibrotic diseases in Europe, North America, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives