The Bull Case For Genmab (CPSE:GMAB) Could Change Following EPKINLY’s Expanded FDA Approval for Follicular Lymphoma

Reviewed by Sasha Jovanovic

- On November 18, 2025, Genmab announced that the U.S. Food and Drug Administration granted full approval for EPKINLY (epcoritamab-bysp) in combination with rituximab and lenalidomide for adult patients with relapsed or refractory follicular lymphoma, expanding its label and confirming prior accelerated approval based on Phase 3 study data.

- This milestone represents a significant advance for patients with this type of cancer, further strengthening Genmab’s position in developing innovative treatments for B-cell malignancies.

- We'll now examine how EPKINLY's expanded approval could influence Genmab's outlook for future revenue growth and pipeline strength.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Genmab Investment Narrative Recap

To own shares in Genmab, investors need confidence in the company's ability to consistently advance innovative oncology therapies and bring its late-stage pipeline to market. The recent full FDA approval for EPKINLY in follicular lymphoma directly reinforces Genmab’s key short-term catalyst, pipeline execution and successful expansion into new indications. However, risks like increasing drug price pressures or reimbursement constraints in the US and Europe remain an ongoing consideration, and this latest news does not significantly reduce these risks.

Among Genmab’s recent announcements, the company’s updated earnings guidance for 2025 is most relevant given this FDA approval. Management maintained a revenue forecast of US$3.5 billion to US$3.7 billion, citing higher royalties and product sales. This underscores how regulatory wins, such as EPKINLY’s expanded label, are closely tied to near-term financial expectations and the ability to meet or exceed current growth targets.

But despite this regulatory milestone, investors should be aware that growing pricing pressures in the US and Europe could still...

Read the full narrative on Genmab (it's free!)

Genmab's narrative projects $5.1 billion in revenue and $1.8 billion in earnings by 2028. This requires 11.8% yearly revenue growth and a $0.4 billion earnings increase from the current $1.4 billion earnings.

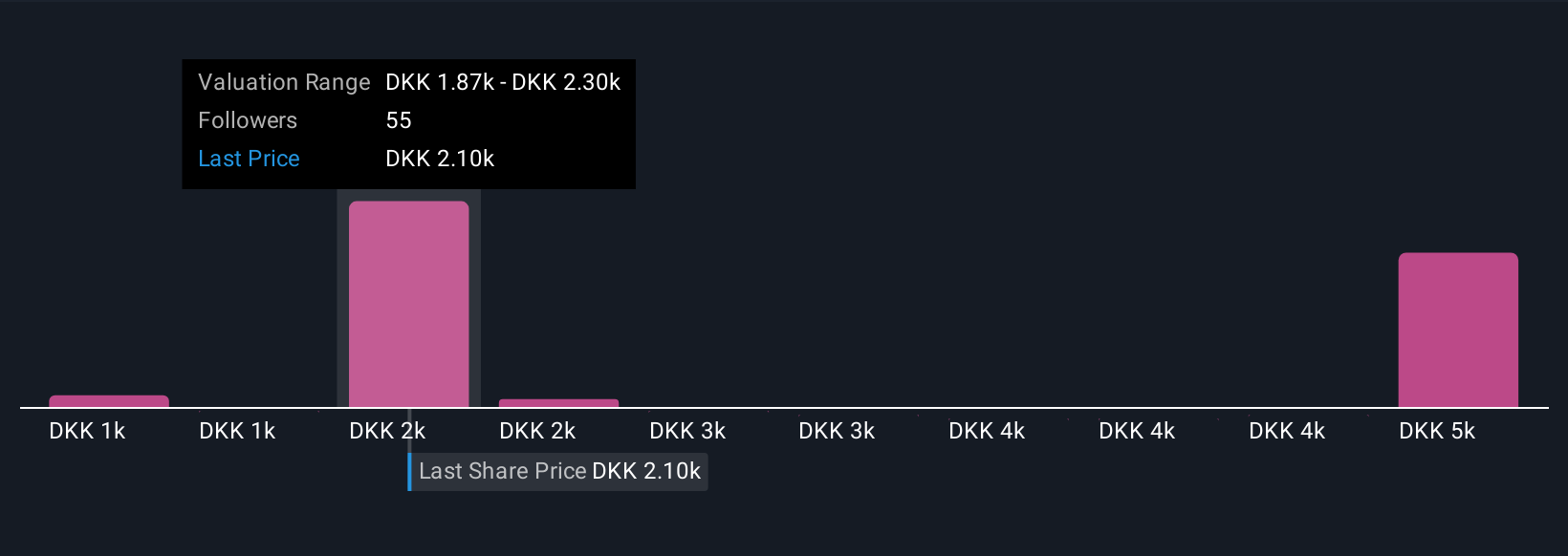

Uncover how Genmab's forecasts yield a DKK2058 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Sixteen unique fair value estimates from the Simply Wall St Community range from DKK1,015 up to DKK5,729 per share. While many see opportunity in Genmab’s expanding pipeline, continued drug pricing and reimbursement headwinds could limit upside, making it important to compare different views before deciding your next step.

Explore 16 other fair value estimates on Genmab - why the stock might be worth 49% less than the current price!

Build Your Own Genmab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genmab research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Genmab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genmab's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:GMAB

Genmab

A biotechnology company, develops antibody-based products and product candidates for the treatment of cancer and other diseases in Denmark.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives