A Valuation Check on ALK-Abelló (CPSE:ALK B) After Upgraded Outlook and Strong 2025 Q3 Results

Reviewed by Simply Wall St

ALK-Abelló (CPSE:ALK B) just delivered its third quarter results, reporting higher sales and net income year-over-year. The company also announced an upgraded full-year outlook, which points to continued strength in its allergy and anaphylaxis business.

See our latest analysis for ALK-Abelló.

Reflecting this positive momentum, ALK-Abelló’s share price has surged 43% so far this year, while the past twelve months delivered an impressive 49% total shareholder return. The combination of solid earnings growth and an upgraded outlook has clearly caught investors’ attention, fueling both short-term and long-term gains.

If the latest acceleration in healthcare inspires you, take a moment to discover See the full list for free.

With shares reaching new highs alongside upgraded guidance, the key question now is whether ALK-Abelló still offers value at current levels or if the market has already accounted for its future growth.Most Popular Narrative: 19% Overvalued

ALK-Abelló’s last close of DKK 233.2 is well above the most widely followed narrative fair value estimate of DKK 196. This suggests the stock is running ahead of consensus assumptions at this point. Behind this valuation is a detailed view of upcoming catalysts and growth plans that could justify future upside or expose overenthusiasm if results disappoint.

Initial market uptake of the neffy nasal adrenaline spray, with further launches planned in additional European markets and regulatory reviews ongoing in Canada, positions ALK-Abelló to capitalize on growing consumer preference for non-invasive and convenient therapies, likely driving incremental revenue and market share gains in coming years.

Want to know which industry shifts, bold revenue bets, and margin targets underpin this narrative’s high price? The full story includes assumptions about blockbuster products, cross-market expansion, and future profit multiples that rival industry leaders. Discover what’s really driving this high-stakes valuation call.

Result: Fair Value of DKK 196 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if ALK-Abelló’s key launches stumble or market access challenges persist, expected growth and margins could disappoint investors.

Find out about the key risks to this ALK-Abelló narrative.

Another View: Discounted Cash Flow Model

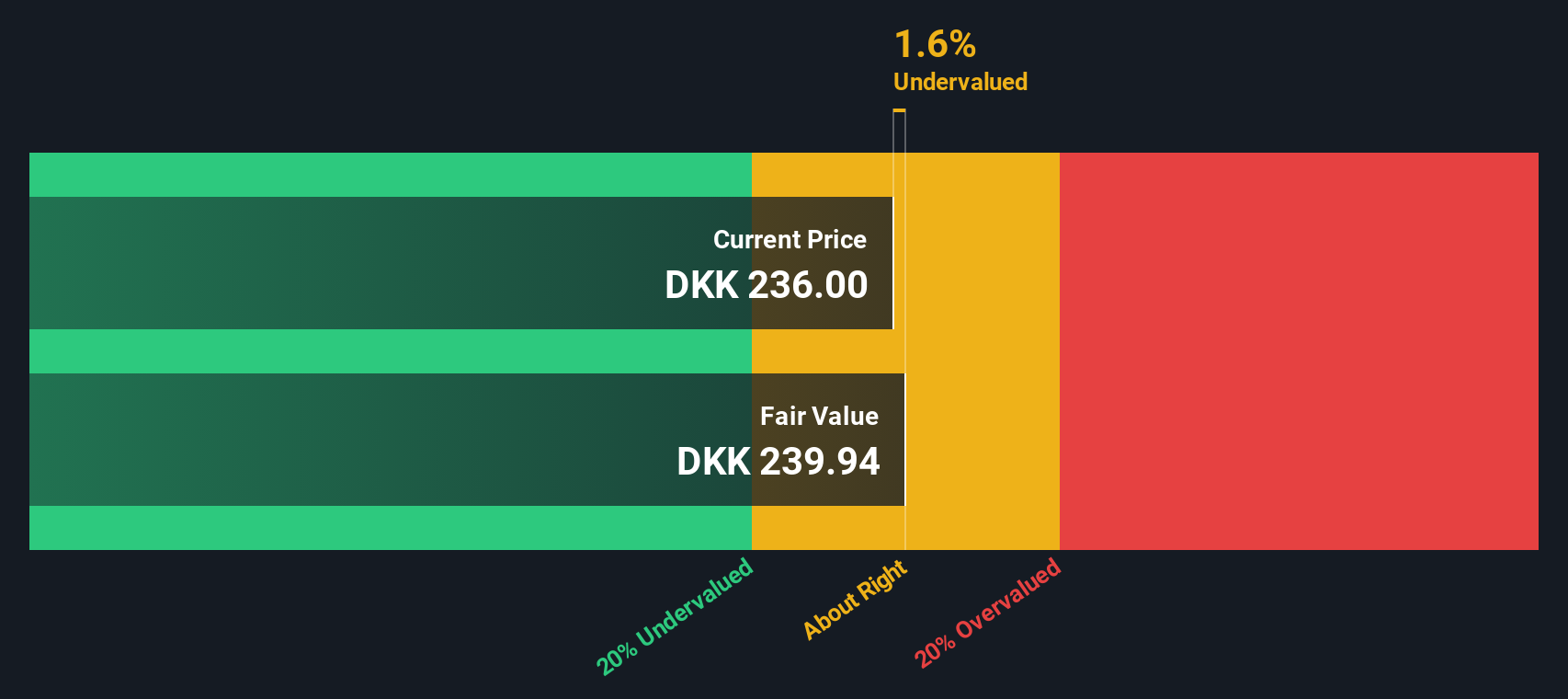

Looking through the lens of the SWS DCF model, ALK-Abelló appears to be trading at around 2.8% below its fair value estimate of DKK 239.94. While earnings multiples indicate it is pricey compared to peers, this cash flow-based view suggests the stock may actually be fairly valued. Does this method reveal hidden value or just a different kind of risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ALK-Abelló for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 898 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ALK-Abelló Narrative

If you think a different story is emerging or want to try your own hand at analysis, you can easily build your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding ALK-Abelló.

Looking for more investment ideas?

Don’t let potential winners pass you by. With the right tools, you can spot major opportunities others might overlook and stay ahead in the market.

- Capitalize on high yields by checking out these 15 dividend stocks with yields > 3%, which offers standout income potential and consistent growth.

- Uncover tomorrow’s tech leaders and seize trends early by searching through these 27 AI penny stocks, which highlights innovation in artificial intelligence.

- Boost your portfolio with value picks using these 898 undervalued stocks based on cash flows, focusing on strong cash flow fundamentals and attractive valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:ALK B

ALK-Abelló

Operates as an allergy solutions company in Europe, North America, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives