Is Now The Time To Put Novozymes (CPH:NZYM B) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Novozymes (CPH:NZYM B), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Novozymes

How Quickly Is Novozymes Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Novozymes grew its EPS by 6.3% per year. This may not be setting the world alight, but it does show that EPS is on the upwards trend.

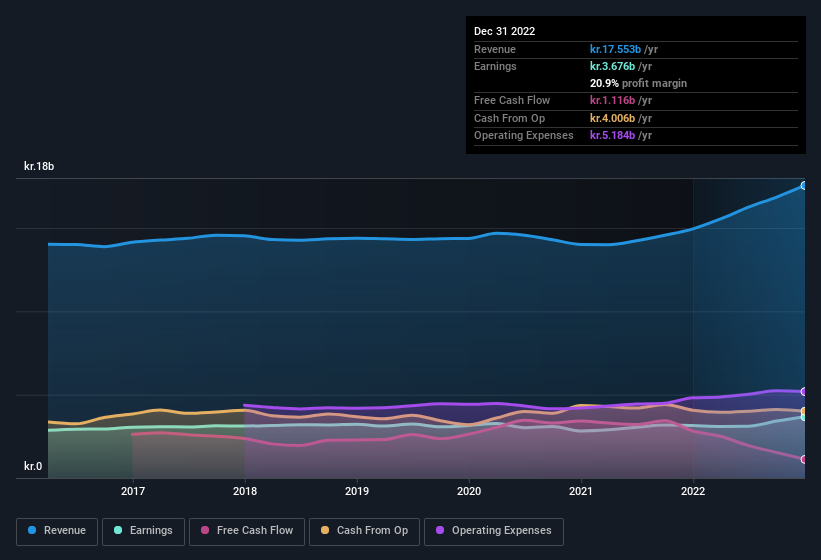

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Novozymes remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 17% to kr.18b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Novozymes' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Novozymes Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Shareholders in Novozymes will be more than happy to see insiders committing themselves to the company, spending kr.2.1m on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. It is also worth noting that it was company insider Jorgen Rasmussen who made the biggest single purchase, worth kr.1.0m, paying kr.347 per share.

It's reassuring that Novozymes insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. To be specific, the CEO is paid modestly when compared to company peers of the same size. Our analysis has discovered that the median total compensation for the CEOs of companies like Novozymes, with market caps over kr.56b, is about kr.27m.

Novozymes offered total compensation worth kr.24m to its CEO in the year to December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Novozymes Deserve A Spot On Your Watchlist?

As previously touched on, Novozymes is a growing business, which is encouraging. And that's not all. We've also seen insiders buying stock, and noted modest executive pay. All things considered, Novozymes is certainly displaying its merits and is worthy of taking research to the next step. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Novozymes , and understanding this should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, Novozymes isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Novonesis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:NSIS B

Novonesis

Produces and sells industrial enzymes, microorganisms, and probiotics in Denmark, rest of Europe, North America, Asia Pacific, the Middle East, Africa, Latin America, and internationally.

Excellent balance sheet low.