- Denmark

- /

- Consumer Services

- /

- CPSE:SHAPE

After Leaping 27% Shape Robotics A/S (CPH:SHAPE) Shares Are Not Flying Under The Radar

Shape Robotics A/S (CPH:SHAPE) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 28% in the last twelve months.

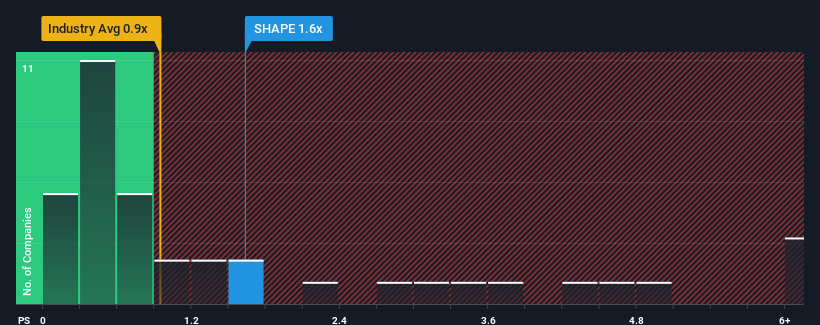

After such a large jump in price, you could be forgiven for thinking Shape Robotics is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.6x, considering almost half the companies in Denmark's Consumer Services industry have P/S ratios below 0.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Shape Robotics

What Does Shape Robotics' P/S Mean For Shareholders?

Shape Robotics certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shape Robotics will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Shape Robotics would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 74%. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 4.1%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Shape Robotics' P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What We Can Learn From Shape Robotics' P/S?

The large bounce in Shape Robotics' shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that Shape Robotics can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Shape Robotics (2 are significant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Shape Robotics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:SHAPE

Shape Robotics

An educational technology company, engages in the provision of intelligent classroom solutions, educational robots, software, and specific services primarily to educational institutions.

Moderate risk with questionable track record.

Similar Companies

Market Insights

Community Narratives