- Denmark

- /

- Healthtech

- /

- CPSE:NNIT

NNIT A/S (CPH:NNIT) Might Not Be As Mispriced As It Looks After Plunging 27%

NNIT A/S (CPH:NNIT) shares have had a horrible month, losing 27% after a relatively good period beforehand. Longer-term, the stock has been solid despite a difficult 30 days, gaining 16% in the last year.

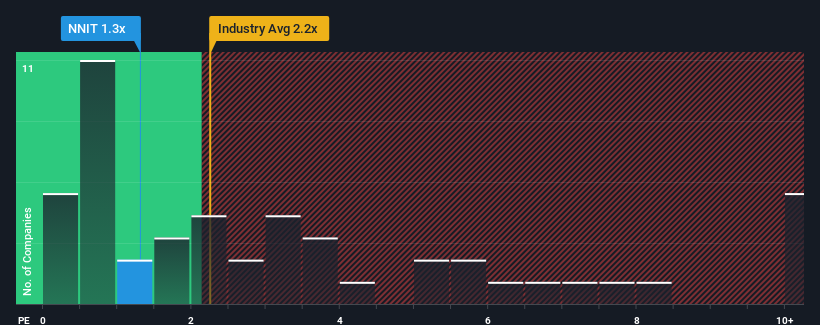

Even after such a large drop in price, NNIT may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.3x, considering almost half of all companies in the Healthcare Services industry in Denmark have P/S ratios greater than 2.2x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for NNIT

What Does NNIT's Recent Performance Look Like?

There hasn't been much to differentiate NNIT's and the industry's revenue growth lately. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. Those who are bullish on NNIT will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on NNIT.How Is NNIT's Revenue Growth Trending?

NNIT's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. However, this wasn't enough as the latest three year period has seen an unpleasant 36% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 8.6% during the coming year according to the dual analysts following the company. With the industry predicted to deliver 8.2% growth , the company is positioned for a comparable revenue result.

With this information, we find it odd that NNIT is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From NNIT's P/S?

NNIT's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like the P/S figures for NNIT remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for NNIT (1 is a bit concerning!) that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if NNIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:NNIT

NNIT

Provides information technology solutions for life sciences, public, and private sectors in Denmark, Europe, the United States, and Asia.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives