- Denmark

- /

- Medical Equipment

- /

- CPSE:DEMANT

European Stocks That Could Be Trading At A Discount Of Up To 49%

Reviewed by Simply Wall St

As European markets face a pullback amid concerns over artificial intelligence stock valuations, major indices like the STOXX Europe 600 and Germany's DAX have seen declines. In this environment of cautious sentiment, identifying undervalued stocks can provide opportunities for investors seeking potential value plays.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vinext (BIT:VNXT) | €3.38 | €6.57 | 48.5% |

| Truecaller (OM:TRUE B) | SEK25.80 | SEK50.46 | 48.9% |

| STEICO (XTRA:ST5) | €19.88 | €39.56 | 49.7% |

| Rusta (OM:RUSTA) | SEK65.20 | SEK126.83 | 48.6% |

| Roche Bobois (ENXTPA:RBO) | €34.80 | €69.34 | 49.8% |

| Nordisk Bergteknik (OM:NORB B) | SEK13.65 | SEK27.10 | 49.6% |

| NEUCA (WSE:NEU) | PLN790.00 | PLN1553.92 | 49.2% |

| eDreams ODIGEO (BME:EDR) | €7.20 | €14.30 | 49.6% |

| Demant (CPSE:DEMANT) | DKK228.20 | DKK447.14 | 49% |

| Allcore (BIT:CORE) | €1.34 | €2.66 | 49.7% |

We'll examine a selection from our screener results.

I.CO.P.. Società Benefit (BIT:ICOP)

Overview: I.CO.P. S.p.A. Società Benefit offers construction and special engineering services to both public and private clients in Italy and internationally, with a market cap of €562.48 million.

Operations: The company's revenue segment includes heavy construction services, generating €155.27 million.

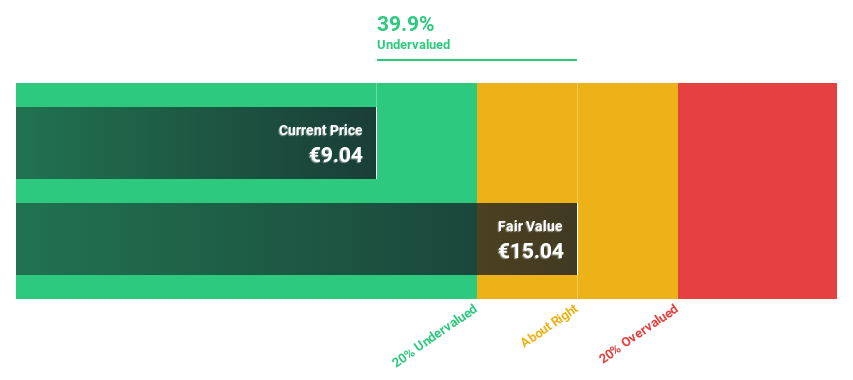

Estimated Discount To Fair Value: 27.9%

I.CO.P. Società Benefit appears undervalued based on cash flows, trading at €17.7, significantly below its estimated fair value of €24.55. Despite high volatility in share price and debt not well covered by operating cash flow, the company reported substantial revenue growth from €78.6 million to €160.07 million year-over-year for the first half of 2025, with net income rising to €10.77 million. Revenue and earnings are forecasted to grow robustly above market averages in Italy.

- Insights from our recent growth report point to a promising forecast for I.CO.P.. Società Benefit's business outlook.

- Click here to discover the nuances of I.CO.P.. Società Benefit with our detailed financial health report.

Acerinox (BME:ACX)

Overview: Acerinox, S.A. is a global manufacturer and marketer of stainless steel products, operating in Spain, the United States, Africa, Asia, and Europe with a market cap of approximately €2.81 billion.

Operations: The company's revenue is primarily derived from its Stainless Steel Business, which contributes €4.17 billion, and High Performance Alloys segment, accounting for €1.67 billion.

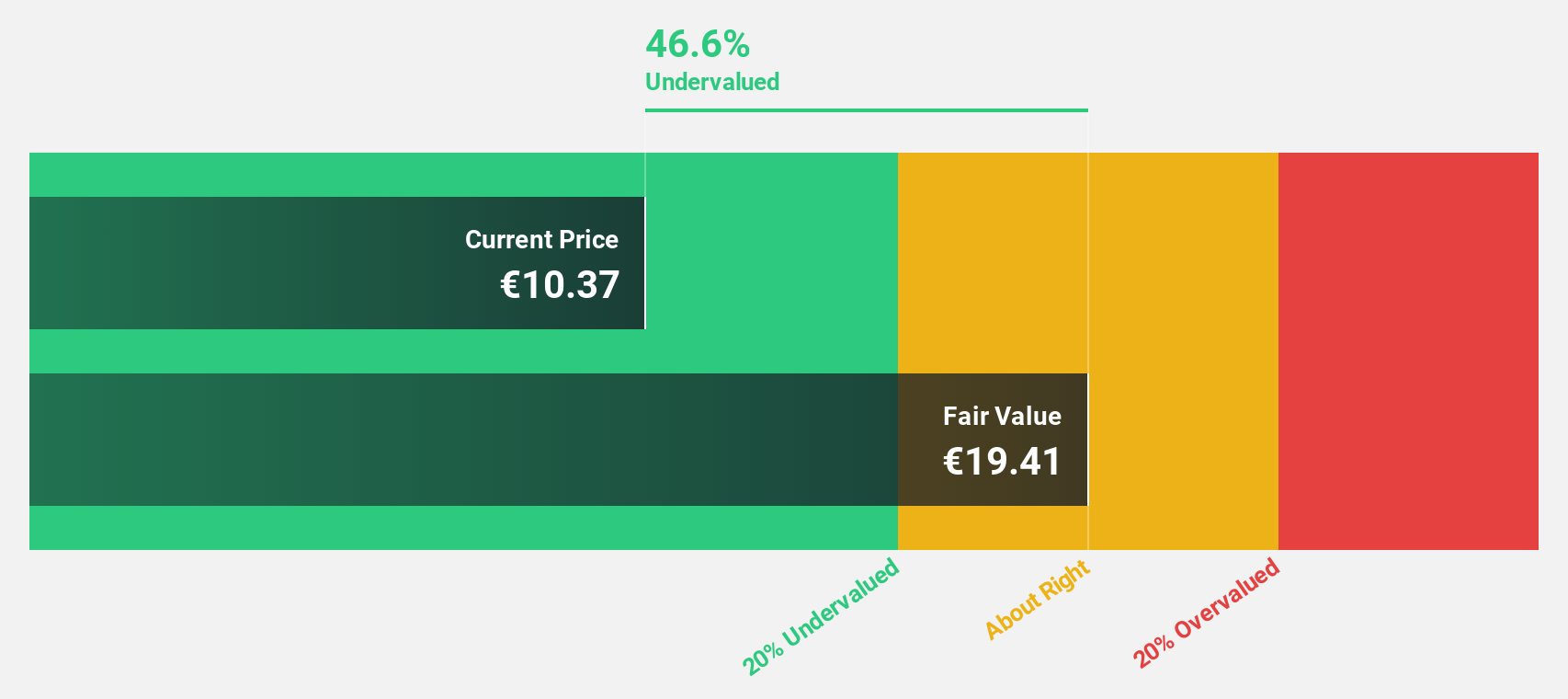

Estimated Discount To Fair Value: 26%

Acerinox is trading at €11.26, well below its estimated fair value of €15.23, suggesting undervaluation based on cash flows. Despite a challenging third quarter with net income dropping to €25 million from €48 million year-over-year, revenue for the nine months increased to €4.47 billion from €4.09 billion previously. The company's earnings are forecasted to grow significantly above the Spanish market average, although dividend sustainability and interest coverage remain concerns.

- Our growth report here indicates Acerinox may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Acerinox's balance sheet health report.

Demant (CPSE:DEMANT)

Overview: Demant A/S is a hearing healthcare company operating in Europe, North America, Asia, the Pacific region, and internationally with a market cap of DKK48.61 billion.

Operations: The company's revenue is primarily derived from its Hearing Healthcare segment, which generated DKK22.59 billion.

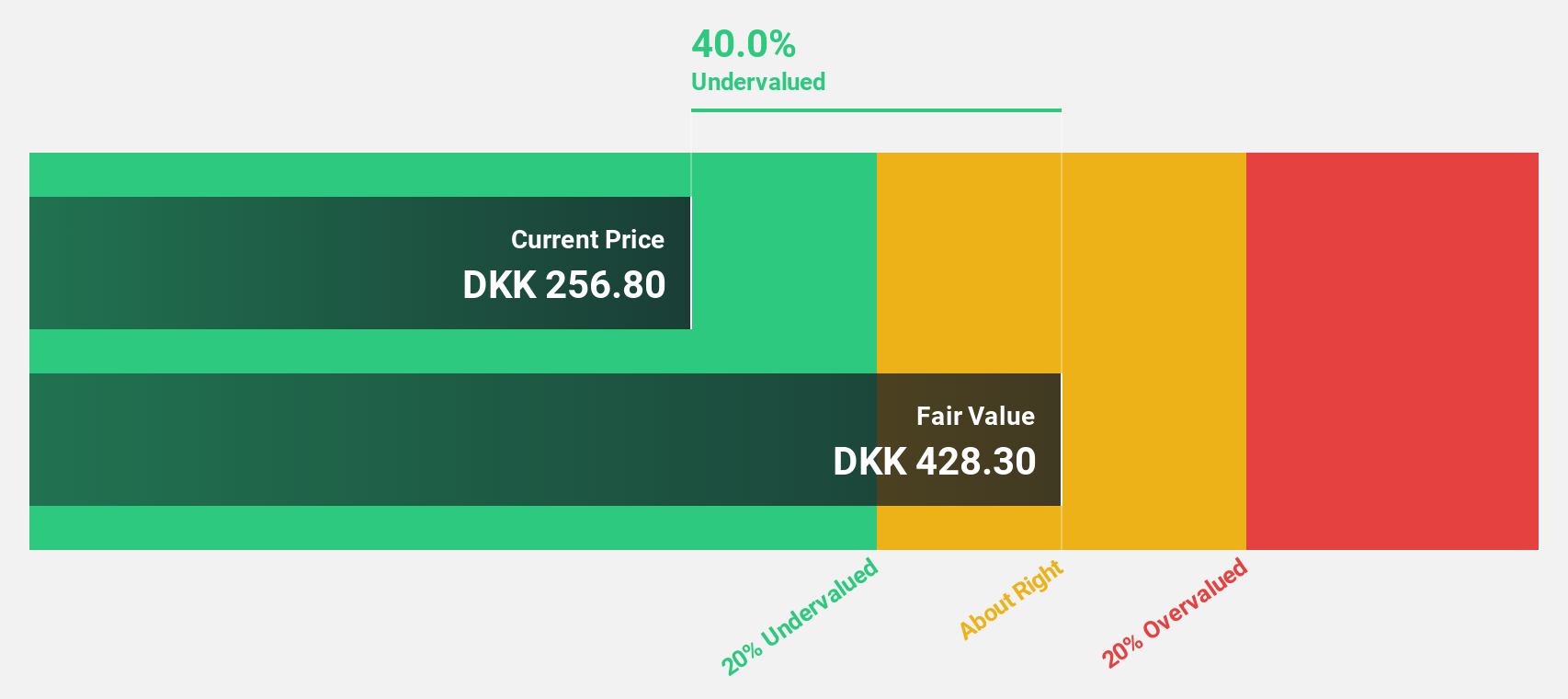

Estimated Discount To Fair Value: 49%

Demant is trading at DKK 228.2, significantly below its estimated fair value of DKK 447.14, reflecting undervaluation based on cash flows. Earnings are projected to grow faster than the Danish market average, though recent guidance suggests earnings will be at the lower end of expectations with EBIT between DKK 3.9-4.3 billion. Despite a high debt level and leadership changes, Demant's revenue growth outlook remains robust compared to peers and industry standards.

- The analysis detailed in our Demant growth report hints at robust future financial performance.

- Take a closer look at Demant's balance sheet health here in our report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 194 companies within our Undervalued European Stocks Based On Cash Flows screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:DEMANT

Demant

Operates as a hearing healthcare company in Europe, North America, Asia, Pacific region, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives