- Denmark

- /

- Medical Equipment

- /

- CPSE:COLO B

Coloplast's (CPSE:COLO B) Modest Dividend Hike: A Clue to Management's Confidence or Cost Pressures?

Reviewed by Sasha Jovanovic

- Coloplast recently reported earnings for the fourth quarter and full year ended September 30, 2025, with annual sales rising to DKK 27.87 billion but net income falling to DKK 3.64 billion compared to the prior year; in addition, the Board recommended a year-end dividend of DKK 18 per share, bringing the full-year dividend to DKK 23 per share, up from DKK 22 last year.

- Alongside a modest dividend increase, the company issued new earnings guidance targeting around 7% organic revenue and EBIT growth for the 2025-2026 fiscal year, suggesting management's confidence in future operational improvements despite the annual profit decline.

- With Coloplast's updated guidance for 7% organic revenue growth, we'll explore its implications for the company's previously established investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Coloplast Investment Narrative Recap

To be a Coloplast shareholder, you need to believe in the company’s ability to drive steady, long-term growth by capitalizing on aging demographics and advances in chronic and acute care solutions. The recent earnings report, showing higher sales but lower profits, does not materially shift the outlook for the short-term catalyst of Chronic Care innovation, nor does it significantly alter the biggest risk currently facing Coloplast, the threat of U.S. competitive bidding set to impact pricing from 2027. The most relevant recent announcement is management’s FY 2025-2026 guidance for 7% organic revenue and EBIT growth. This guidance reiterates the company’s focus on operational improvements, supporting the ongoing reorganization and the push to accelerate R&D in Chronic Care, both seen as fundamental to delivering long-term value even amid margin pressures and regulatory risks. But against management’s optimism, investors should be aware that the risk from U.S. pricing pressures is becoming...

Read the full narrative on Coloplast (it's free!)

Coloplast's outlook anticipates DKK34.4 billion in revenue and DKK7.3 billion in earnings by 2028. This implies a 7.3% annual revenue growth and a DKK3.2 billion increase in earnings from the current DKK4.1 billion.

Uncover how Coloplast's forecasts yield a DKK686.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

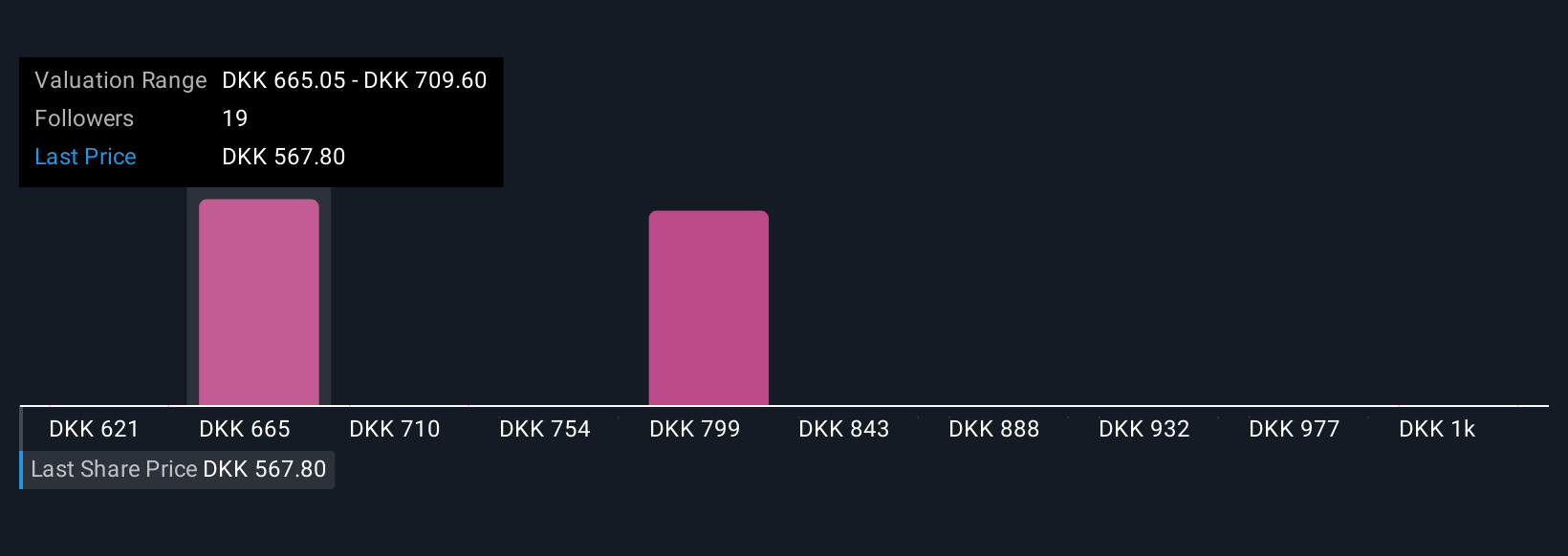

Five Simply Wall St Community members estimate Coloplast’s fair value between DKK 620.50 and DKK 1,065.99. While opinions differ, attention is building around the timing and possible impact of upcoming U.S. policy changes on future group earnings.

Explore 5 other fair value estimates on Coloplast - why the stock might be worth just DKK620.50!

Build Your Own Coloplast Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coloplast research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Coloplast research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coloplast's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:COLO B

Coloplast

Engages in the development and sale of intimate healthcare products and services in Denmark, the United States, the United Kingdom, France, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives