Stock Analysis

- Denmark

- /

- Energy Services

- /

- CPSE:DRLCO

Is Drilling Company of 1972 (CPH:DRLCO) Using Debt In A Risky Way?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, The Drilling Company of 1972 A/S (CPH:DRLCO) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Drilling Company of 1972

What Is Drilling Company of 1972's Net Debt?

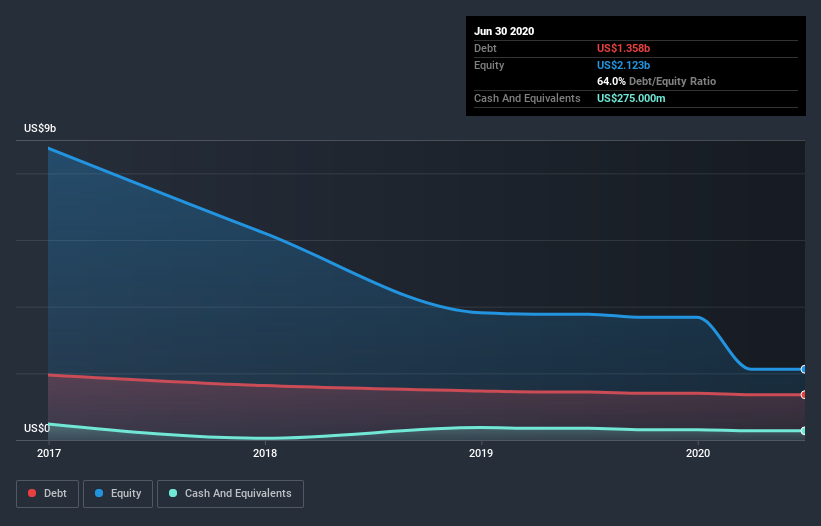

As you can see below, Drilling Company of 1972 had US$1.35b of debt at June 2020, down from US$1.44b a year prior. However, because it has a cash reserve of US$275.0m, its net debt is less, at about US$1.08b.

How Healthy Is Drilling Company of 1972's Balance Sheet?

We can see from the most recent balance sheet that Drilling Company of 1972 had liabilities of US$544.0m falling due within a year, and liabilities of US$1.28b due beyond that. Offsetting this, it had US$275.0m in cash and US$318.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$1.23b.

This deficit is considerable relative to its market capitalization of US$1.27b, so it does suggest shareholders should keep an eye on Drilling Company of 1972's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Drilling Company of 1972 can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Drilling Company of 1972 had a loss before interest and tax, and actually shrunk its revenue by 9.7%, to US$1.2b. We would much prefer see growth.

Caveat Emptor

Over the last twelve months Drilling Company of 1972 produced an earnings before interest and tax (EBIT) loss. Indeed, it lost US$20m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. We would feel better if it turned its trailing twelve month loss of US$1.6b into a profit. So in short it's a really risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with Drilling Company of 1972 .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Drilling Company of 1972, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Drilling Company of 1972 is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:DRLCO

Drilling Company of 1972

The Drilling Company of 1972 A/S provides offshore drilling rig services to oil and gas companies worldwide.

Reasonable growth potential with mediocre balance sheet.