- Denmark

- /

- Hospitality

- /

- CPSE:TIV

Tivoli (CPSE:TIV) Margin Beat Reinforces Lofty Valuation Debate

Reviewed by Simply Wall St

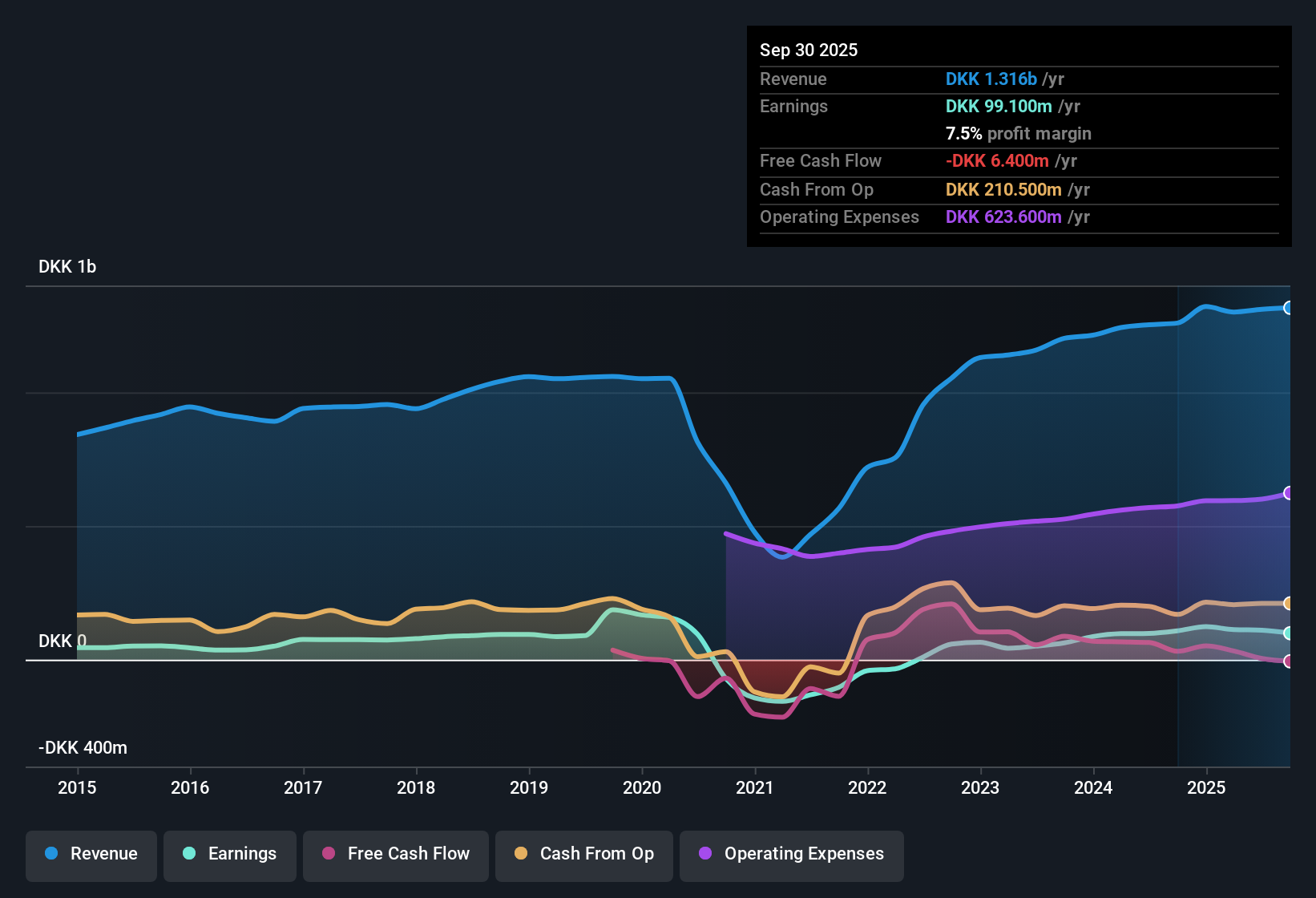

Tivoli (CPSE:TIV) posted net profit margins of 8.4%, topping last year's 7.8%. Average annual earnings growth has been impressive at 69.2% over five years, though the most recent figure, 12.2%, cools that pace. With consistently high-quality earnings supporting this track record, investors are left questioning the stock’s lofty 30.7x P/E ratio, which is well above both peer and industry norms, and a share price of DKK592 that sits far above its calculated fair value.

See our full analysis for Tivoli.Next up, we’ll put the latest earnings in context by weighing them against the major narratives shaping sentiment about Tivoli, with an eye toward where the numbers confirm or contradict the market’s story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Trend Outpaces Peers

- Tivoli's net profit margins reached 8.4%, staying above last year's 7.8% and outperforming many sector peers.

- Rapid margin expansion strongly supports the claim that Tivoli’s historic earnings durability stands out, especially given these factors:

- Even as recent annual earnings growth slowed to 12.2% from a long-term 69.2% average, margins have held up, showing management is converting sales into profit more efficiently than competitors.

- Compared with an industry average profit margin (not specified in the filing summary), Tivoli's current margin indicates a meaningful operational edge that would encourage bullish investors, especially in a competitive European hospitality environment.

Pace of Earnings Growth Normalizes

- The earnings growth rate fell to 12.2% over the past year, down from a 69.2% average over the last five years.

- What stands out is that, despite a dramatic deceleration from earlier rapid growth, Tivoli’s profit quality remains solid. This prompts questions about whether this lower but steadier expansion is a new normal or just a pause before future acceleration.

- Investors who previously paid up for high growth may need to recalibrate expectations, since the new pace suggests more incremental increases rather than the explosive gains of previous years.

- Although no dominant bear or bull narrative is available, this sharp shift from high double-digit to low double-digit earnings growth adds new context to how analysts and the market may view the stock’s upside from here.

Valuation Disconnect Sets a High Bar

- Tivoli trades at 30.7x P/E, above the peer average of 23x and the European hospitality group’s 17.2x, while its DKK592 share price is much higher than a DCF fair value of DKK89.38.

- This premium raises debate over whether Tivoli’s consistent margins and earnings history justify such a steep price, or if investors are overlooking valuation discipline.

- Consensus commentary would question whether the market is expecting another period of rapid growth to eventually close the fair value gap, or if it is pricing in brand or intangible strengths not reflected in basic valuation metrics.

- With no identified risks and profitability rewards highlighted, the absence of immediate red flags may embolden bulls. However, the extent to which price exceeds fundamentals sets a high hurdle for near-term upside.

Consensus watchers will be monitoring closely to see if Tivoli's premium valuation can hold up without a return to rapid growth. 📊 Read the full Tivoli Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Tivoli's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Tivoli’s valuation far exceeds both peers and fair value estimates. Recent earnings growth has slowed sharply, and there are no immediate signs of a coming rebound.

If you’re concerned about paying a premium for uncertain future growth, use these 833 undervalued stocks based on cash flows to discover attractively priced companies where strong fundamentals better support the share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tivoli might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:TIV

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives