Gabriel Holding's (CPH:GABR) earnings trajectory could turn positive as the stock surges 12% this past week

Gabriel Holding A/S (CPH:GABR) shareholders should be happy to see the share price up 29% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been disappointing. The share price has failed to impress anyone , down a sizable 62% during that time. So we're not so sure if the recent bounce should be celebrated. We'd err towards caution given the long term under-performance.

On a more encouraging note the company has added kr.53m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Gabriel Holding became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

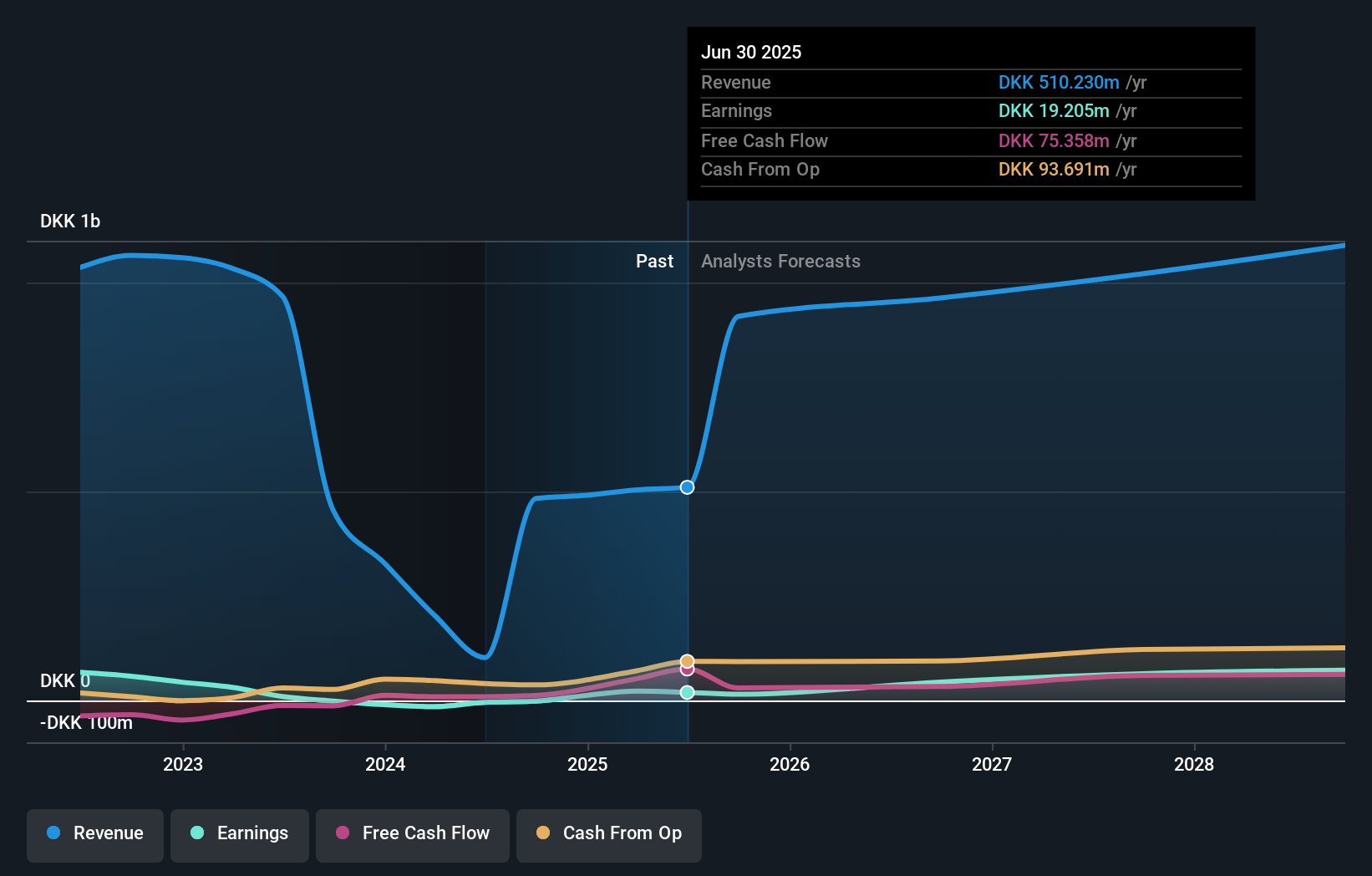

It could be that the revenue decline of 14% per year is viewed as evidence that Gabriel Holding is shrinking. This has probably encouraged some shareholders to sell down the stock.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Gabriel Holding has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Gabriel Holding will earn in the future (free profit forecasts).

A Different Perspective

We're pleased to report that Gabriel Holding shareholders have received a total shareholder return of 22% over one year. That certainly beats the loss of about 10% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Gabriel Holding (1 is a bit unpleasant!) that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Danish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:GABR

Gabriel Holding

Develops, manufactures, and sells upholstery fabrics, components, upholstered surfaces, and related products and services in Denmark, other European Countries, the United States, Mexico, Asia, and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives