Lån & Spar Bank (CPSE:LASP) Net Profit Margin Falls, Challenging Bullish Growth Narratives

Reviewed by Simply Wall St

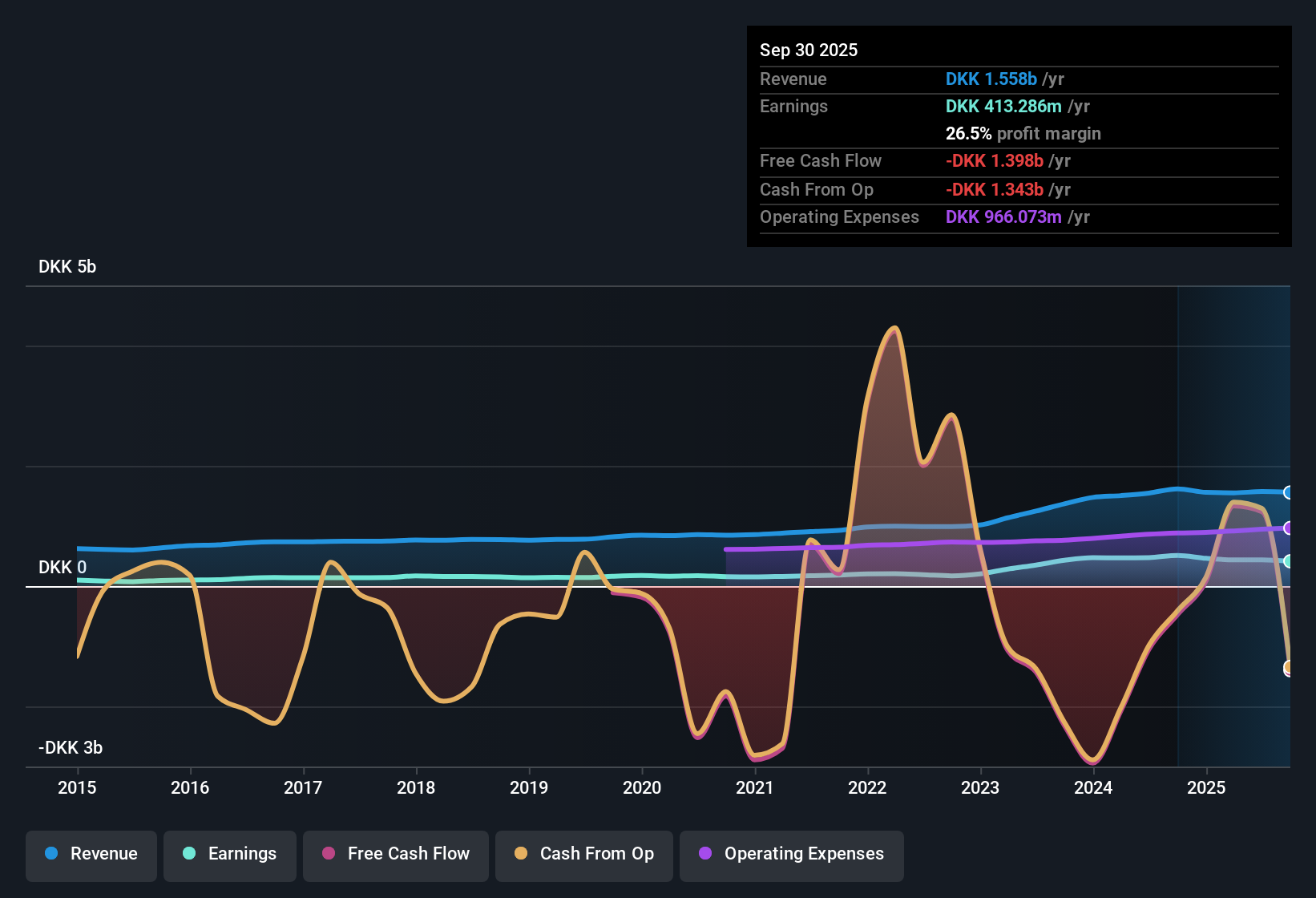

Lån & Spar Bank (CPSE:LASP) posted an average annual profit growth of 25.4% over the past five years, but its momentum has cooled, with the latest net profit margin dropping to 26.5% from 31.5% a year ago. Shares are trading at 9.7 times earnings, slightly below the European Banks industry average of 10.1x, and well under a discounted cash flow fair value estimate of DKK 2,486.09 compared to the market price of DKK 1,160. A track record of strong historical profits, attractive valuation, and a solid dividend offer reasons for optimism, even as investors take note of declining recent margins and growth.

See our full analysis for Lån & Spar Bank.Next up, we’ll see how this batch of numbers measures up against the most widely held market narratives about Lån & Spar Bank. Some expectations will hold up, while others might be upended.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Weakens After Years of High Growth

- Lån & Spar Bank’s net profit margin slid to 26.5% after maintaining a robust 25.4% annual profit growth over five years. This shift underlines a move from breakneck expansion to more modest profitability.

- Rather than reinforcing the idea that strong multi-year growth always guarantees continued performance, the latest results highlight how quickly momentum can slow, even for banks with a track record of high past quality.

- While the margin remains healthy, its decline suggests that previous bullish arguments about unstoppable earnings compounding may need to be revisited, as recent quarters have not sustained that pace.

- Where bulls would expect ongoing rapid progress, current numbers push investors to consider whether the high growth phase might be giving way to a more mature and less explosive trajectory.

Share Price Sits Well Below DCF Fair Value

- Shares trade at DKK 1,160, which is substantially discounted relative to a DCF fair value of DKK 2,486.09. This gap stands out even when compared to industry and peer averages.

- The prevailing market view points to a company that looks attractive to value-focused investors, with market price lagging far behind what cash flow analysis suggests is justified.

- This valuation disconnect creates tension with cautious voices, who might see the current price as a reflection of slowing growth or margin pressure. Yet, the fair value calculation supports the idea that the longer-term potential could be underappreciated.

- Although profit margins have narrowed, the scale of undervaluation implied by DCF measures indicates an opportunity for those willing to look past the immediate slowdown.

Dividend Appeal Amid Margin Compression

- The company’s dividend is described as attractive in recent reports, signaling that management maintains a focus on shareholder returns despite the pressure on profit margins.

- The prevailing market view sees the steady dividend as a potential anchor for investors seeking income, mitigating short-term earnings volatility.

- Even as net profit margins narrow, a reliable payout can keep income-oriented holders interested with the prospect of ongoing yield.

- For investors worried about near-term growth, the dividend offers a practical reason to stay invested and wait for underlying profitability to stabilize or recover.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Lån & Spar Bank's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

After years of rapid profit growth, Lån & Spar Bank now faces slowing momentum and compressed margins. This challenges its ability to maintain steady earnings expansion.

If you value more predictable performance, check out stable growth stocks screener (2082 results) to discover companies that deliver reliable results even as market conditions shift.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:LASP

Lån & Spar Bank

Provides various banking products and services in Denmark.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives