- Germany

- /

- Renewable Energy

- /

- XTRA:HRPK

European Penny Stocks To Watch: AFYREN SAS Leads The Pack

Reviewed by Simply Wall St

The European market has recently experienced a downturn, with the pan-European STOXX Europe 600 Index ending 1.24% lower amid concerns over valuations in artificial intelligence-related stocks. In such fluctuating conditions, investors often turn to smaller or newer companies that might offer unique growth opportunities at lower price points. Penny stocks, despite their old-fashioned name, can still hold significant potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.656 | €1.27B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.06 | €15.75M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €2.05 | €28.33M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €217.46M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.58 | €404.8M | ✅ 4 ⚠️ 1 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.96 | €77.47M | ✅ 2 ⚠️ 4 View Analysis > |

| High (ENXTPA:HCO) | €4.00 | €78.25M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.03 | €280.59M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.878 | €29.4M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 280 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

AFYREN SAS (ENXTPA:ALAFY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AFYREN SAS specializes in producing biobased products as alternatives to petroleum-based molecules in France, with a market cap of €65.28 million.

Operations: The company generates its revenue of €2.70 million from the Chemicals segment.

Market Cap: €65.28M

AFYREN SAS, with a market cap of €65.28 million, operates in the biobased products sector and reported half-year sales of €1.2 million for 2025, down from €1.36 million the previous year. The company remains unprofitable with a net loss of €6.92 million and is not expected to achieve profitability in the next three years despite revenue growth forecasts of 72.51% annually. AFYREN has a cash runway exceeding three years based on current free cash flow, supported by short-term assets that surpass both its short- and long-term liabilities significantly more than its debt levels have reduced over time.

- Click to explore a detailed breakdown of our findings in AFYREN SAS' financial health report.

- Evaluate AFYREN SAS' prospects by accessing our earnings growth report.

Cellectis (ENXTPA:ALCLS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cellectis S.A. is a clinical-stage biotechnology company focused on developing gene-editing products, including allogeneic chimeric antigen receptor T-cell candidates for immuno-oncology and gene therapy candidates for various therapeutic areas, with a market cap of €232.16 million.

Operations: Cellectis S.A. has not reported any specific revenue segments.

Market Cap: €232.16M

Cellectis S.A., a clinical-stage biotech company, reported significant revenue growth with Q3 2025 earnings showing sales of US$35.17 million, more than doubling from the previous year. Despite this progress, the company remains unprofitable and is not expected to achieve profitability in the near term. Cellectis has a strong cash position with short-term assets exceeding liabilities and no debt burden, providing financial stability for its ongoing R&D efforts. Recent presentations at key conferences highlight advancements in its gene-editing therapies, although legal challenges regarding patent infringement could pose risks to future operations.

- Dive into the specifics of Cellectis here with our thorough balance sheet health report.

- Gain insights into Cellectis' future direction by reviewing our growth report.

7C Solarparken (XTRA:HRPK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 7C Solarparken AG owns and operates photovoltaic farms in Germany and Belgium, with a market cap of €138.27 million.

Operations: The company generates revenue primarily through the sale of electricity, amounting to €67.63 million.

Market Cap: €138.27M

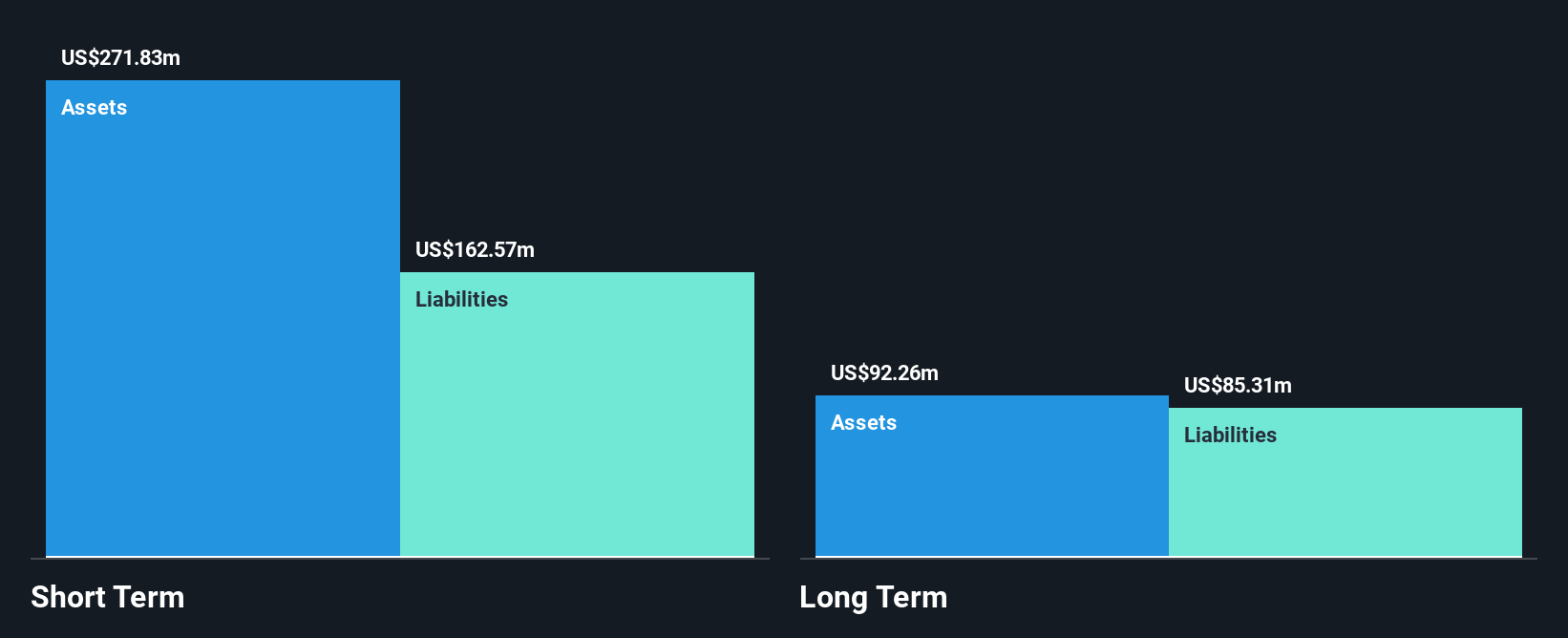

7C Solarparken AG, with a market cap of €138.27 million, operates photovoltaic farms in Germany and Belgium. The company reported half-year sales of €35.9 million, up from €31.55 million the previous year, yet faced a net loss of €3.88 million compared to a prior net income. Despite unprofitability and being dropped from the S&P Global BMI Index, its interest payments are well covered by EBIT (4.1x), and short-term assets exceed short-term liabilities (€114.2M vs €49.2M). However, high debt levels (net debt to equity ratio at 42.1%) remain a concern for investors considering penny stocks in Europe.

- Take a closer look at 7C Solarparken's potential here in our financial health report.

- Explore 7C Solarparken's analyst forecasts in our growth report.

Make It Happen

- Explore the 280 names from our European Penny Stocks screener here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HRPK

Undervalued with adequate balance sheet.

Market Insights

Community Narratives