- Germany

- /

- Renewable Energy

- /

- XTRA:ECV

Encavis AG's (ETR:ECV) Earnings Haven't Escaped The Attention Of Investors

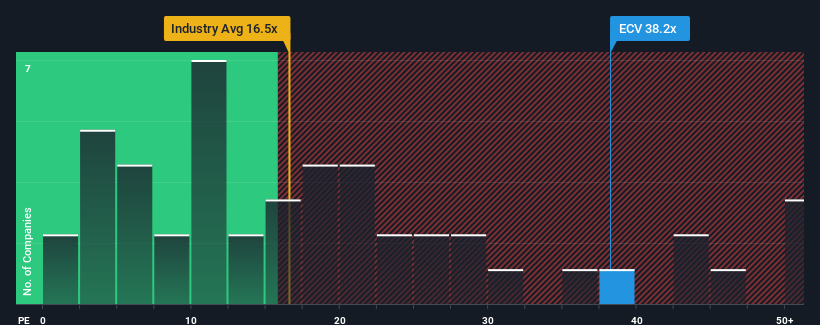

When close to half the companies in Germany have price-to-earnings ratios (or "P/E's") below 16x, you may consider Encavis AG (ETR:ECV) as a stock to avoid entirely with its 38.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings that are retreating more than the market's of late, Encavis has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Encavis

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Encavis' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 828% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 27% during the coming year according to the eleven analysts following the company. With the market only predicted to deliver 9.5%, the company is positioned for a stronger earnings result.

With this information, we can see why Encavis is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Encavis' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 3 warning signs for Encavis (1 shouldn't be ignored!) that you need to take into consideration.

If you're unsure about the strength of Encavis' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Encavis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:ECV

Encavis

An independent power producer, acquires and operates solar and onshore wind parks in Germany, Italy, Spain, France, Denmark, the Netherlands, the United Kingdom, Finland, Sweden, Ireland, and Lithuania.

Moderate growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives