- Germany

- /

- Auto Components

- /

- XTRA:PWO

3 German Dividend Stocks Yielding Up To 6.2%

Reviewed by Simply Wall St

Amid recent rate cuts by the European Central Bank and a notable rise in Germany's DAX index, investors are increasingly turning their attention to dividend stocks as a stable source of income. In this environment, selecting stocks with strong fundamentals and attractive yields can be particularly rewarding, especially when market conditions are favorable for income-generating investments.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| All for One Group (XTRA:A1OS) | 3.22% | ★★★★★☆ |

| MLP (XTRA:MLP) | 5.41% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 5.27% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.69% | ★★★★★☆ |

| Allianz (XTRA:ALV) | 4.82% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.34% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.75% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.23% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.33% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.78% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top German Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

PWO (XTRA:PWO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PWO AG manufactures and sells lightweight aluminum sheet components made of steel for the mobility industry across Germany, Czechia, Canada, Mexico, Serbia, and China with a market cap of €95.63 million.

Operations: PWO AG's revenue from Auto Parts & Accessories amounts to €564.29 million.

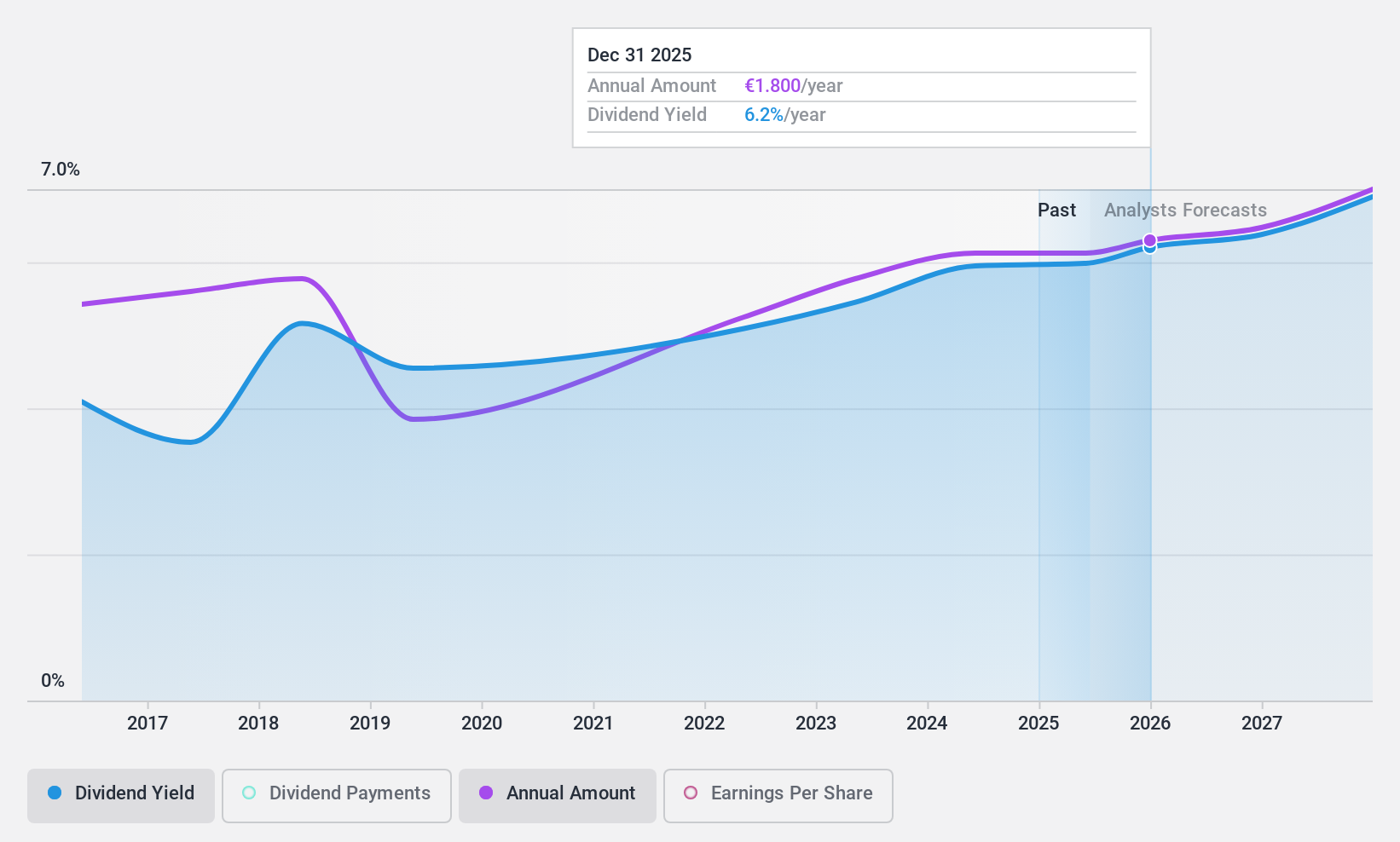

Dividend Yield: 5.7%

PWO's recent earnings report showed a slight increase in sales but a decline in net income, with EUR 3.4 million for Q2 2024 compared to EUR 5.4 million a year ago. Despite this, PWO offers an attractive dividend yield of 5.72%, well-covered by both earnings (38% payout ratio) and cash flows (19.5% cash payout ratio). However, the dividend has been volatile over the past decade, raising concerns about its reliability for long-term investors.

- Click here and access our complete dividend analysis report to understand the dynamics of PWO.

- Our comprehensive valuation report raises the possibility that PWO is priced lower than what may be justified by its financials.

Sixt (XTRA:SIX2)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sixt SE, with a market cap of €2.76 billion, offers global mobility services to private and business customers through a network of corporate and franchise stations.

Operations: Sixt SE generates revenue from various regions, including €1.49 billion in Europe, €1.22 billion in Germany, and €1.21 billion in North America.

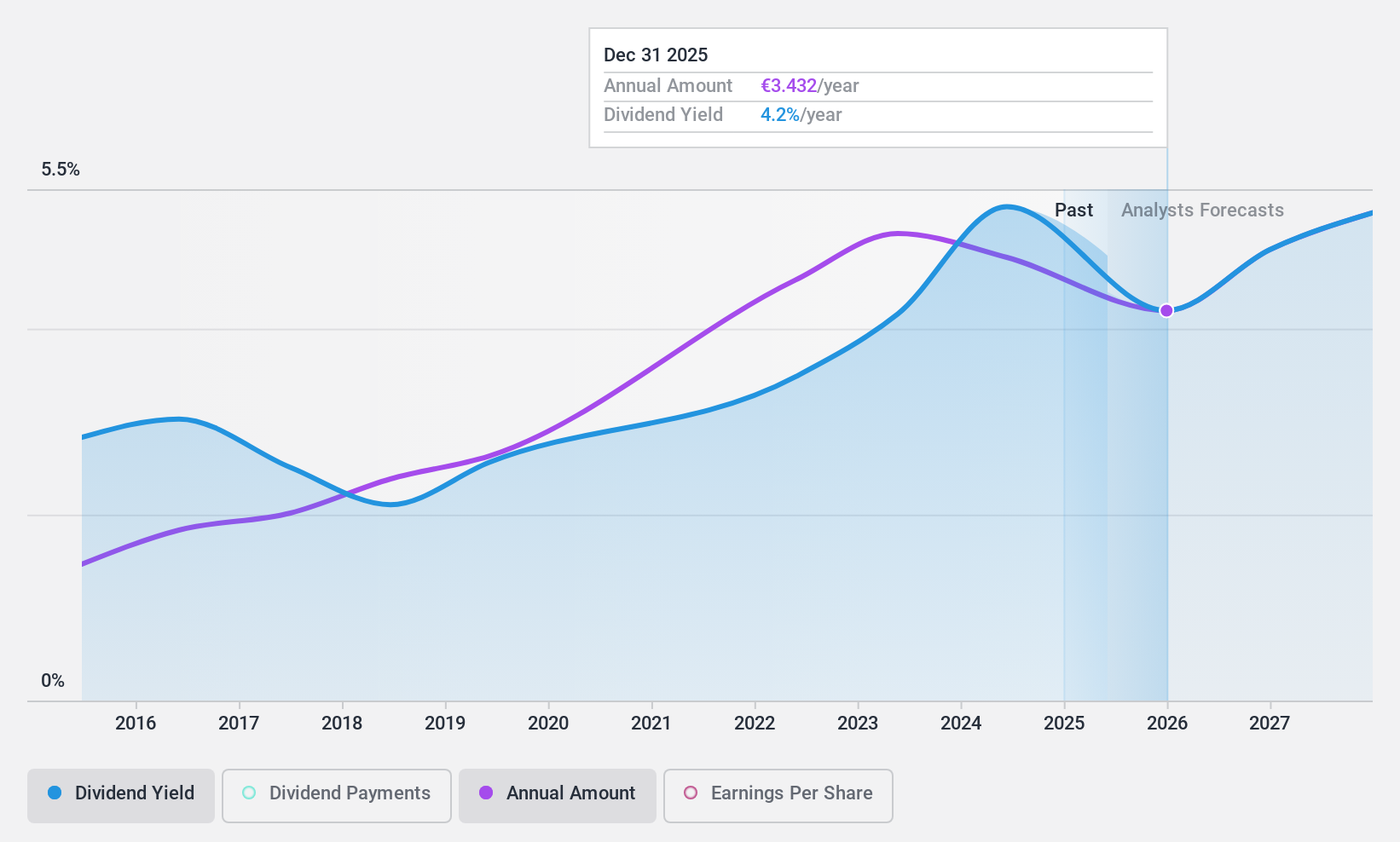

Dividend Yield: 6.3%

Sixt SE's recent earnings report revealed a rise in revenue to €1.01 billion for Q2 2024, but net income dropped to €48.29 million from €96.57 million a year ago. Despite its attractive dividend yield of 6.26%, the dividend payments have been volatile and are not well covered by free cash flows, raising sustainability concerns. However, Sixt's P/E ratio of 12.1x indicates good relative value compared to the German market average of 16.2x.

- Take a closer look at Sixt's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Sixt shares in the market.

WashTec (XTRA:WSU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WashTec AG provides car wash solutions across Germany, Europe, North America, and the Asia Pacific with a market cap of €492.47 million.

Operations: WashTec AG's revenue segments include €91.10 million from North America and €393.04 million from Segment Adjustment.

Dividend Yield: 6%

WashTec AG's recent earnings report showed a decline in sales to €119.41 million for Q2 2024, down from €127.08 million the previous year, but net income increased to €7.55 million from €6.17 million. Despite a high dividend yield of 5.98%, the dividend is not well covered by earnings due to a payout ratio exceeding 100%. The company's dividends have been volatile over the past decade, raising concerns about their reliability and sustainability.

- Click here to discover the nuances of WashTec with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, WashTec's share price might be too pessimistic.

Seize The Opportunity

- Gain an insight into the universe of 32 Top German Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PWO

PWO

Engages in the manufacture and sale of light weight construction aluminum sheet components made of steel for mobility industry in Germany, Czechia, Canada, Mexico, Serbia, and China.

Good value with proven track record and pays a dividend.