Is Lufthansa’s 28.4% Rally in 2025 Backed By Its True Value?

Reviewed by Bailey Pemberton

- Wondering if Deutsche Lufthansa is a bargain or a bubble? You are not alone. This is the perfect time to check if the current share price matches its true worth.

- The stock has gained a solid 28.4% since the start of the year, showing 8.6% growth in just the last month and is up a notable 34.5% over the past year.

- Lufthansa has benefited from industry-wide optimism as travel demand rebounds across Europe. Recent headlines highlight renewed route expansions and positive updates from government travel policy changes, which have given the stock an extra lift.

- The company scores a strong 5 out of 6 on our undervaluation checks. This raises the question: how do different valuation methods compare, and is there an even more insightful approach you may want to see at the end of this article?

Find out why Deutsche Lufthansa's 34.5% return over the last year is lagging behind its peers.

Approach 1: Deutsche Lufthansa Discounted Cash Flow (DCF) Analysis

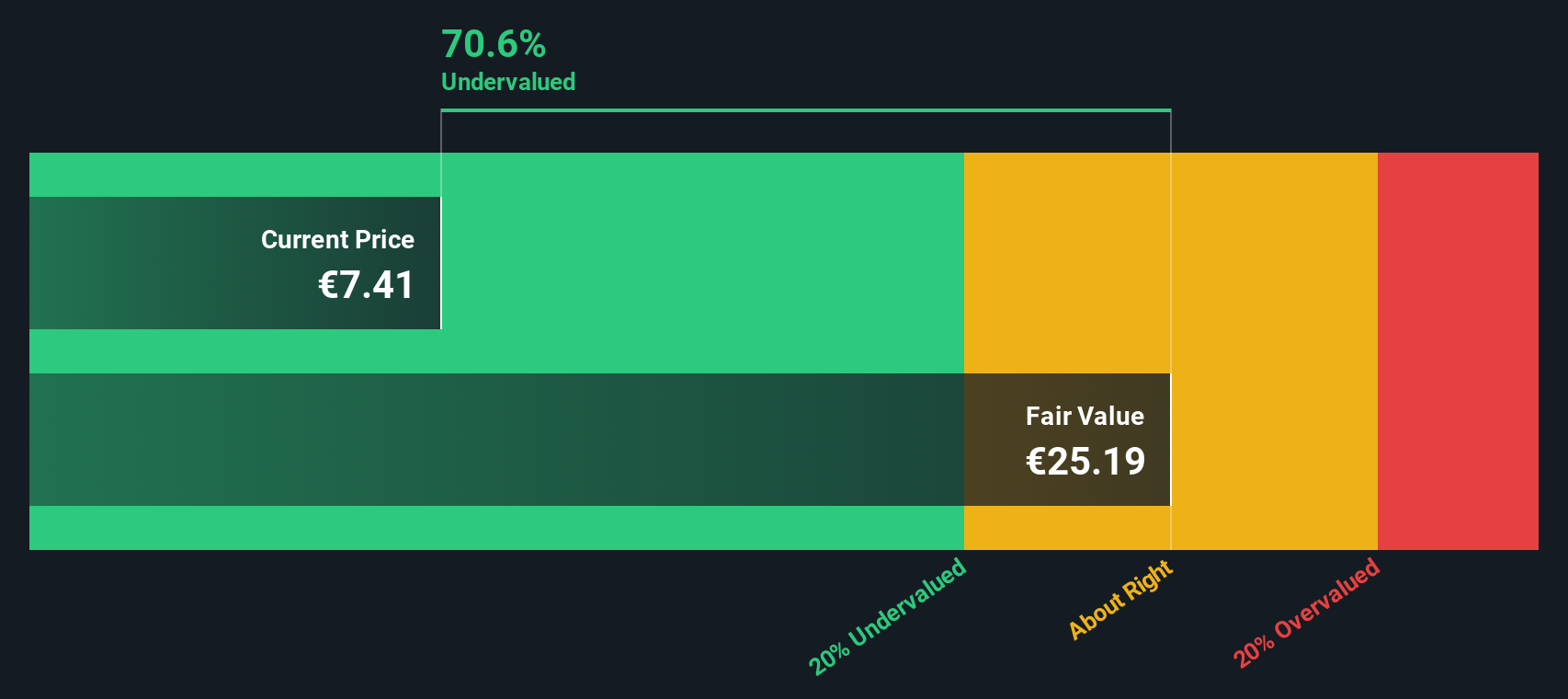

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and then discounting them back to today’s value to reflect risk and time. For Deutsche Lufthansa, this approach begins with the latest Free Cash Flow, which stands at €626 Million for the last twelve months. Analysts forecast robust growth, with cash flow projected to reach €2.28 Billion by 2029. Direct analyst estimates are available for the next five years, and projections beyond that are extrapolated by Simply Wall St to provide a fuller long-term view.

Based on these detailed cash flow forecasts, the DCF model arrives at an intrinsic value of €27.33 per share. With this value sitting 71.1% above the current share price, the implication is clear: the stock appears to be significantly undervalued at today’s market price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Deutsche Lufthansa is undervalued by 71.1%. Track this in your watchlist or portfolio, or discover 898 more undervalued stocks based on cash flows.

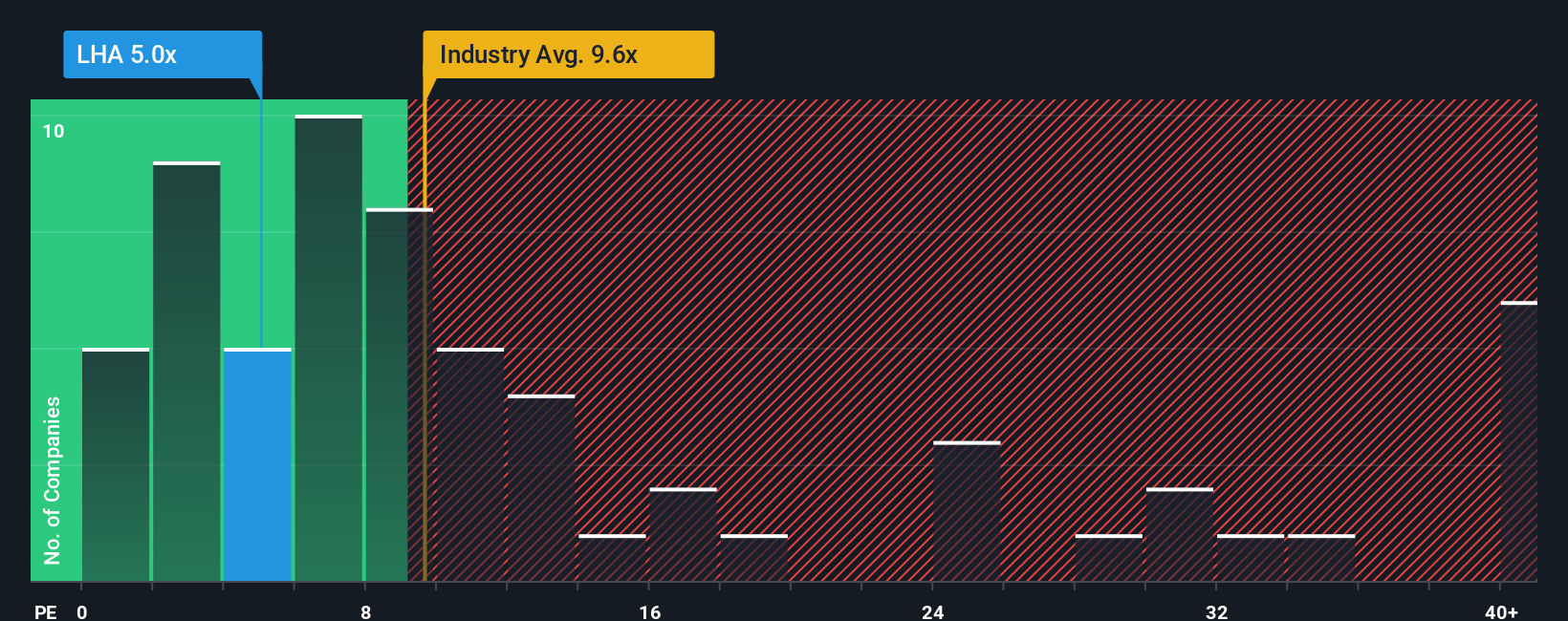

Approach 2: Deutsche Lufthansa Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular way to value profitable companies like Deutsche Lufthansa because it ties the share price directly to the company’s bottom line. Investors often use the PE ratio to gauge how much they are paying for each euro of current earnings, making it especially useful for companies with steady profits.

Of course, what makes a “fair” PE ratio varies. Faster-growing companies can often support higher PE ratios because their earnings are expected to expand. On the other hand, heightened risks or market uncertainty may justify lower multiples. That is why simply comparing the PE ratio without context can be misleading.

Currently, Deutsche Lufthansa trades at just 5.8x PE, which is notably lower than the airlines industry average of 8.9x and its peer average of 10.4x. This suggests the market is pricing Lufthansa below its competitors, despite the positive momentum in travel demand and earnings recovery.

Simply Wall St’s Fair Ratio for Deutsche Lufthansa is 12.9x. Unlike traditional benchmarks, the Fair Ratio takes into account not just industry comparisons but also the company’s growth prospects, profit margins, size, and risk profile. This provides a more tailored and rigorous estimate of what a reasonable multiple should be for Lufthansa at this point in time.

With the current 5.8x PE well below the fair value multiple of 12.9x, this methodology also points to the stock being undervalued by the market right now.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1416 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Deutsche Lufthansa Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives, a powerful method that goes beyond the numbers and puts your viewpoint front and center.

A Narrative is simply your story for a company, combining what you believe about its future revenue, earnings, and margins into a personalized financial forecast and fair value estimate. Rather than relying solely on generic ratios or analyst forecasts, Narratives help you articulate your unique outlook, connecting real business changes and industry trends to what you think moves the share price.

This approach links Deutsche Lufthansa’s business story to its likely financial future and fair value, giving investors a tool that is as dynamic as the market itself. Narratives are accessible on the Simply Wall St Community page and are already being used by millions of investors worldwide to guide their decisions. They allow you to track how your fair value compares to the current price. Since they update automatically with news and results, you will always be working with the most up-to-date snapshot.

For example, some investors may see Lufthansa as poised for a strong rebound and assign a fair value near €12.0, while others, wary of industry challenges and rising costs, might opt for a far lower target like €5.0. Your Narrative helps you decide when to buy, hold, or sell based on your personal expectations and the latest information.

Do you think there's more to the story for Deutsche Lufthansa? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:LHA

Deutsche Lufthansa

Operates as an aviation company in Germany and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives