- Germany

- /

- Telecom Services and Carriers

- /

- XTRA:DTE

What Deutsche Telekom (XTRA:DTE)'s €1 Billion AI Cloud Alliance With Nvidia Could Mean for Shareholders

Reviewed by Sasha Jovanovic

- Nvidia Corporation and Deutsche Telekom announced in the past week a €1 billion partnership to develop an industrial AI cloud data center in Munich, with the project set to go live in early 2026 and SAP contributing software solutions.

- This collaboration aims to provide a secure and sovereign platform for enabling advanced AI applications across manufacturing, public services, and defense sectors throughout Europe.

- We’ll consider how Deutsche Telekom’s industrial AI alliance with Nvidia, focusing on sovereign European infrastructure, could reshape its investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Deutsche Telekom Investment Narrative Recap

To be a shareholder in Deutsche Telekom, you need to believe in the company's ability to unlock new value through digital transformation and leadership in European connectivity. The partnership with Nvidia for an industrial AI cloud establishes a key medium-term catalyst but does not remove the short-term risks around German broadband competition and pressured margins, which remain significant challenges to immediate earnings momentum.

Among Deutsche Telekom’s recent announcements, the collaboration with Comcast to bring advanced WiFi Mesh technology to Europe is most relevant in context, it supports growth through improved home connectivity, echoing the AI cloud’s aim of moving the business up the value chain, though it doesn’t shift the balance of demand-side risks in the near term.

In contrast, investors should be aware that aggressive price competition in Germany continues to weigh on customer volumes and could...

Read the full narrative on Deutsche Telekom (it's free!)

Deutsche Telekom's narrative projects €128.8 billion revenue and €11.8 billion earnings by 2028. This requires 2.2% yearly revenue growth and a €0.8 billion decrease in earnings from €12.6 billion today.

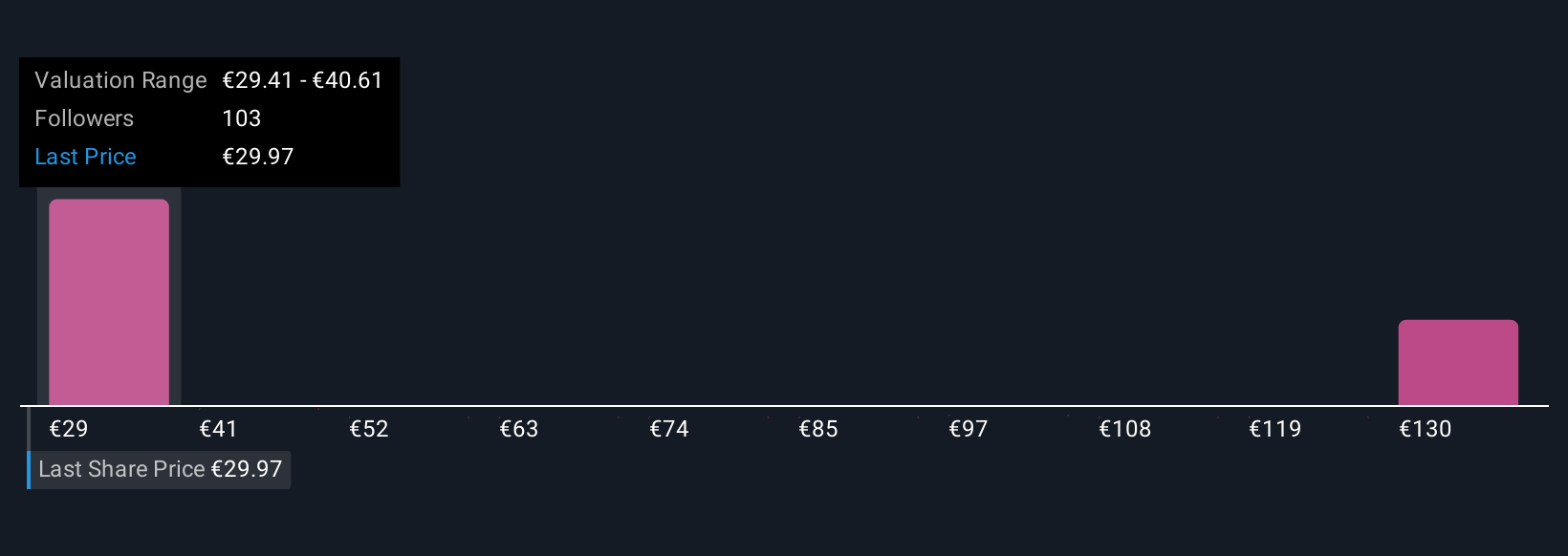

Uncover how Deutsche Telekom's forecasts yield a €38.07 fair value, a 44% upside to its current price.

Exploring Other Perspectives

Eight Community fair value estimates for Deutsche Telekom range widely from €33 to €109.44, reflecting divergent market opinions. While many see upside potential, risks from intense broadband competition continue to affect forecasts, so examine different viewpoints to better understand the company's margin pressures.

Explore 8 other fair value estimates on Deutsche Telekom - why the stock might be worth just €33.00!

Build Your Own Deutsche Telekom Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Deutsche Telekom research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Deutsche Telekom research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Deutsche Telekom's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DTE

Deutsche Telekom

Provides integrated telecommunication services worldwide.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives