- Germany

- /

- Telecom Services and Carriers

- /

- XTRA:DTE

Does the Recent 8% Slide Make Deutsche Telekom a Bargain in 2025?

Reviewed by Bailey Pemberton

- Wondering if Deutsche Telekom is a bargain right now? If you care about getting value for your money, it is smart to dig deeper into how this stock stacks up.

- The share price has dipped by 8.2% over the last week and is down 8.7% year-to-date, but has delivered an impressive 112.9% total return over the last five years.

- Recent headlines highlight ongoing expansion in their 5G network and strategic moves to strengthen their position in European telecom. Both of these factors are fueling long-term optimism despite short-term volatility. These developments have caught investor attention and are helping to shape the current debate around the company’s prospects.

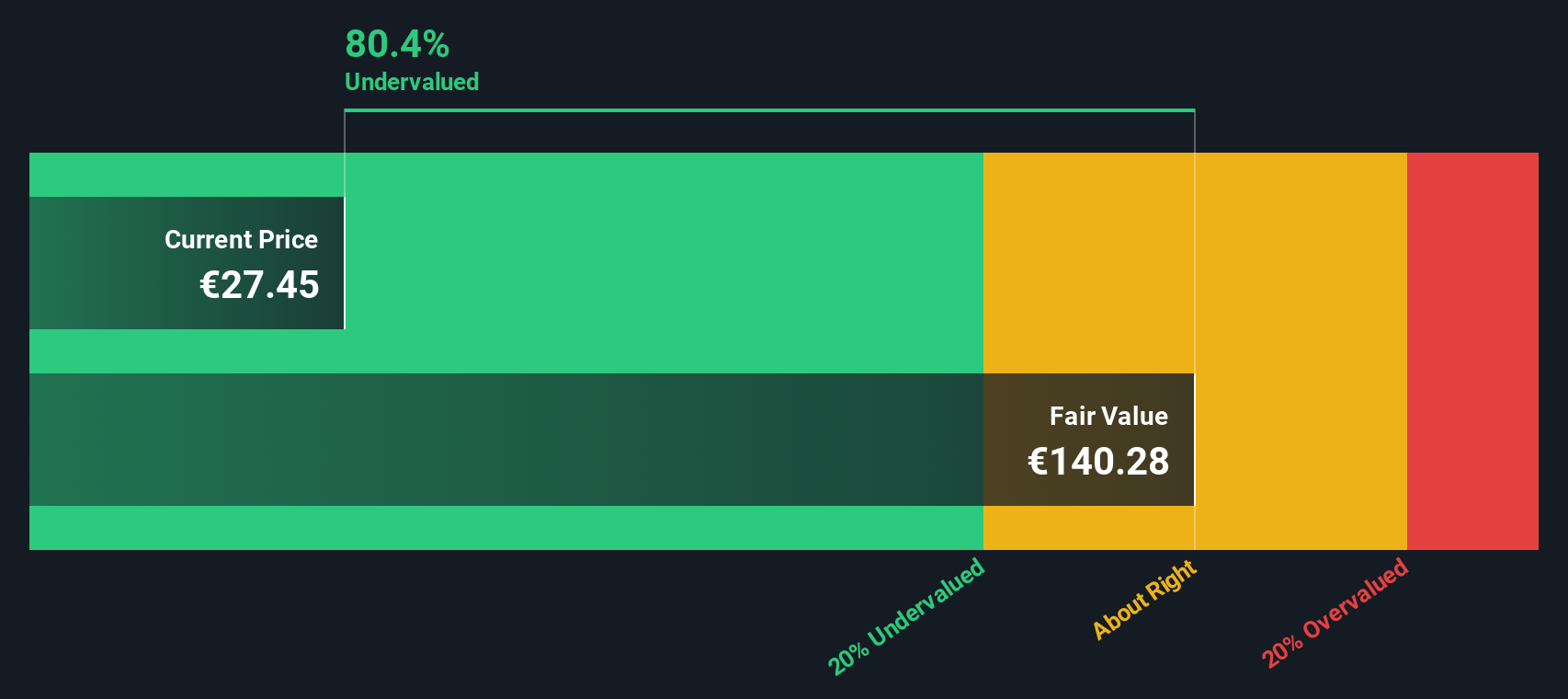

- By our checks, Deutsche Telekom earns a valuation score of 6 out of 6, marking it as undervalued across all the metrics we track. Next up, we will compare the main approaches to valuation, but make sure to read to the end for a smarter way to connect the numbers to the real story.

Approach 1: Deutsche Telekom Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) method estimates a company's true worth by projecting its future free cash flows and then discounting those amounts back to today's value. This helps investors understand whether a stock's current price reflects its long-term earning potential.

For Deutsche Telekom, the most recent twelve months show Free Cash Flow of €21.8 Billion. Analysts estimate that by 2029, annual Free Cash Flow could reach €23.6 Billion, with further extrapolations reaching as high as €27.9 Billion by 2035. The company's ability to generate and grow such substantial cash flows strengthens the case for its long-term value, even as projections become less certain as they extend further into the future.

This DCF analysis sets Deutsche Telekom's intrinsic value at €114.18 per share. With the current market price trading at a 76.7% discount to this estimated fair value, the model strongly suggests that the stock is significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Deutsche Telekom is undervalued by 76.7%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: Deutsche Telekom Price vs Earnings

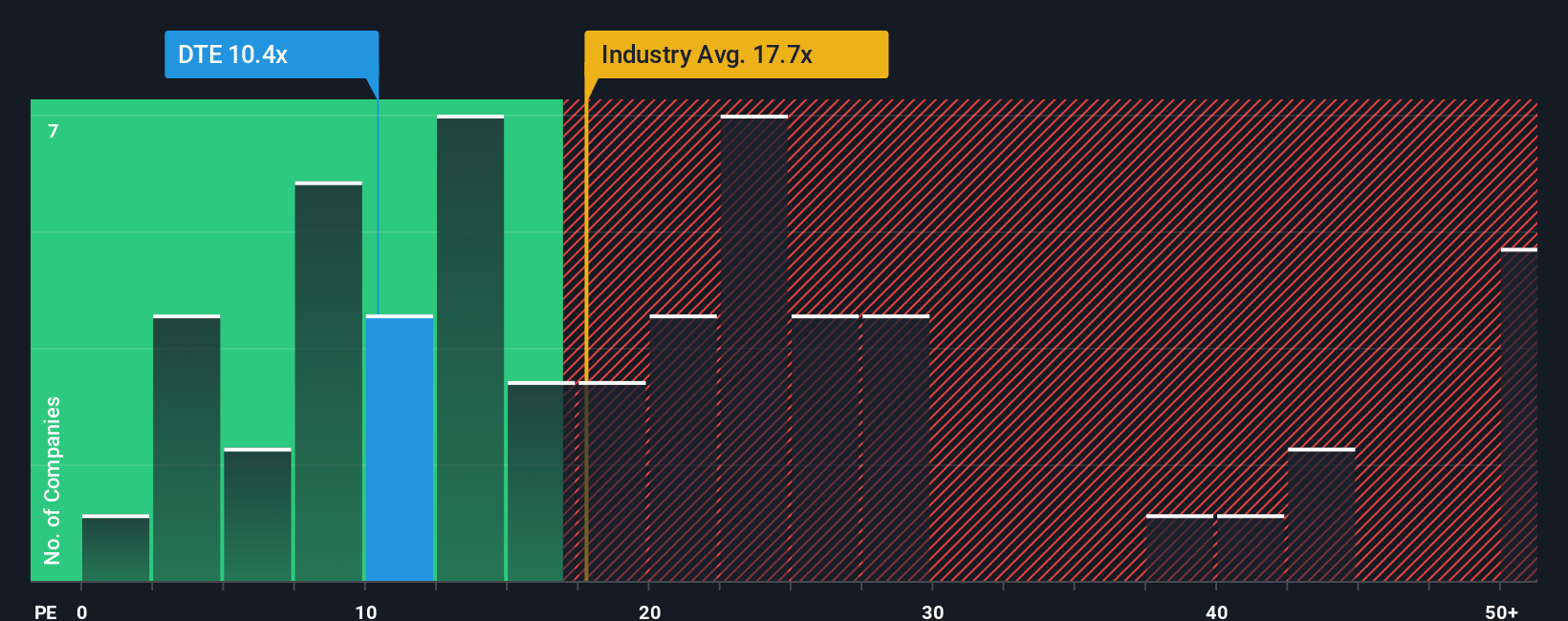

For profitable companies like Deutsche Telekom, the Price-to-Earnings (PE) ratio is often the go-to valuation tool. This metric tells you how much investors are willing to pay now for each euro of company earnings. It provides a direct signal of market sentiment about future prospects and risk.

The “right” PE ratio for a company depends on factors such as expected growth and potential risks. Fast-growing, stable companies with solid market positions usually command higher PE ratios. Companies with less profit growth or higher risk are typically assigned lower PE ratios by the market.

Deutsche Telekom is currently trading at a PE ratio of 10.07x. In comparison, the telecom industry average is 16.25x and the average among its peers is 19.02x, making Deutsche Telekom look comparatively inexpensive. For a more tailored perspective, Simply Wall St's proprietary "Fair Ratio" offers a deeper analysis by considering Deutsche Telekom’s unique growth outlook, profit margins, risk profile, industry characteristics, and market capitalization. For Deutsche Telekom, the Fair Ratio is calculated at 20.76x, significantly higher than its current level.

The Fair Ratio helps eliminate noise from peer and industry comparisons, giving a more nuanced view based on the company's distinct fundamentals. With Deutsche Telekom's actual PE nearly half the Fair Ratio, evidence points strongly to the stock being undervalued at its current price.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Deutsche Telekom Narrative

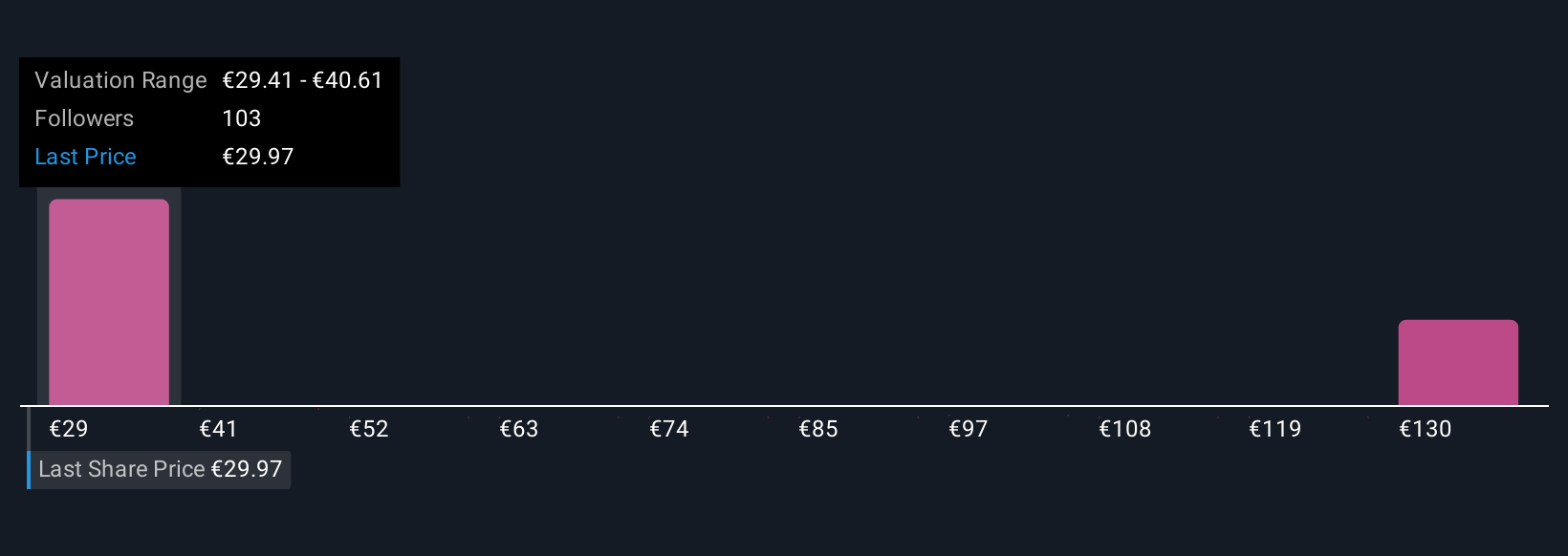

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your personalized story or perspective about a company, connecting your view of the business, such as where you think Deutsche Telekom is headed, what risks or opportunities will impact it, and what numbers to expect, to your financial forecast and estimate of fair value.

Unlike traditional ratios and models, Narratives bridge the gap between the company’s real-world story and the numbers, helping you put a fair value on Deutsche Telekom that truly reflects your expectations for future growth, earnings, and margins. They are simple to create and share on Simply Wall St's Community page, an easy-to-use tool relied on by millions of investors to make smarter decisions together.

With Narratives, you can compare your own fair value estimate to the current market price and decide whether now is the time to buy, hold, or sell. As soon as key news or earnings are released, Narratives update dynamically, making sure your story and fair value stay relevant. For example, some investors see Deutsche Telekom’s digital transformation and U.S. growth as strong positives, placing fair value as high as €43.5, while others worry about margin pressure and competition, resulting in targets as low as €31.0. Narratives allow both perspectives to be captured, compared, and tracked over time for better decision making.

Do you think there's more to the story for Deutsche Telekom? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DTE

Deutsche Telekom

Provides integrated telecommunication services worldwide.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives