- Germany

- /

- Telecom Services and Carriers

- /

- XTRA:DTE

Deutsche Telekom (XTRA:DTE) Reports Q1 Sales Growth to €30 Billion

Reviewed by Simply Wall St

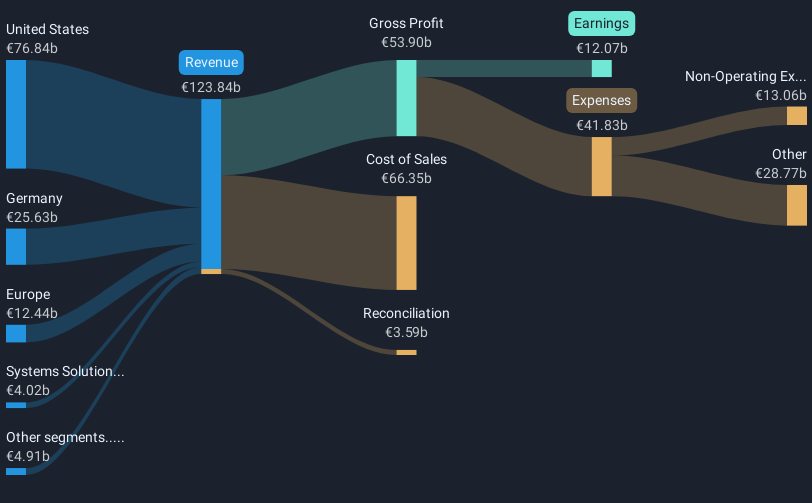

Deutsche Telekom (XTRA:DTE) recently released its earnings report for the first quarter of 2025, showing significant growth in sales and net income compared to the previous year. This announcement coincided with a 3% increase in its stock price over the past month, aligning with broader market movements where the S&P 500 gained 5% over the same period. The company's improvement in financial performance, as evidenced by increased earnings per share, undoubtedly supported its stock's momentum. However, the broader positive market environment, boosted by news of reduced tariffs between the U.S. and China, provided additional impetus to the company's share price performance.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent earnings report from Deutsche Telekom highlights substantial growth in sales and net income, potentially reinforcing the narrative of strengthened operational efficiencies through its fiber and AI initiatives. The 3% increase in Deutsche Telekom's stock price over the past month, while modest compared to the S&P 500's 5% gain, reflects underlying confidence in the company's strategic directions, such as its expanded T-Mobile US stake and emphasis on AI and ESG efforts. However, intense competition and market volatility, particularly in the German fixed-line sector, present ongoing challenges that could affect revenue and earnings forecasts.

Over a five-year period, Deutsche Telekom has achieved a total return, including share price and dividends, of approximately 197.62%. This performance surpasses the German telecom industry's one-year return of 38.7%, showcasing the company's resilience and growth amidst broader industry shifts. Analysts forecast a revenue growth of 2.5% annually over the next three years, while also predicting some pressure on profit margins due to external factors such as inflation and exchange rate fluctuations.

Currently, Deutsche Telekom trades at a share price of €31.6, which is approximately 16.1% below the consensus price target of €37.67. The fair value estimation reflects analyst expectations regarding future earnings growth and profit margins. As the company continues to leverage its assets and strategic initiatives, its alignment with these forecasts will be crucial in determining whether the current share price can bridge this gap to the analyst price target.

Click to explore a detailed breakdown of our findings in Deutsche Telekom's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DTE

Deutsche Telekom

Provides integrated telecommunication services worldwide.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives