- Germany

- /

- Other Utilities

- /

- XTRA:MVV1

Top German Dividend Stocks To Watch In September 2024

Reviewed by Simply Wall St

As European inflation nears the central bank's target, Germany's DAX index has reached new heights, reflecting a positive sentiment in the market. With this backdrop, it's an opportune moment to explore dividend stocks that can offer stability and income potential. In times of economic optimism and market peaks, dividend stocks are particularly appealing due to their ability to provide consistent returns through regular payouts.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 4.91% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.72% | ★★★★★★ |

| MLP (XTRA:MLP) | 5.17% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.69% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 4.90% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.50% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.69% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.38% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.78% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.33% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top German Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) develops, manufactures, and distributes flatbed displays, monitors, electronic subassemblies, and information systems both in Germany and internationally with a market cap of €91.68 million.

Operations: DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) generates revenue from two main segments: €96.65 million from Systems and €161.99 million from Displays.

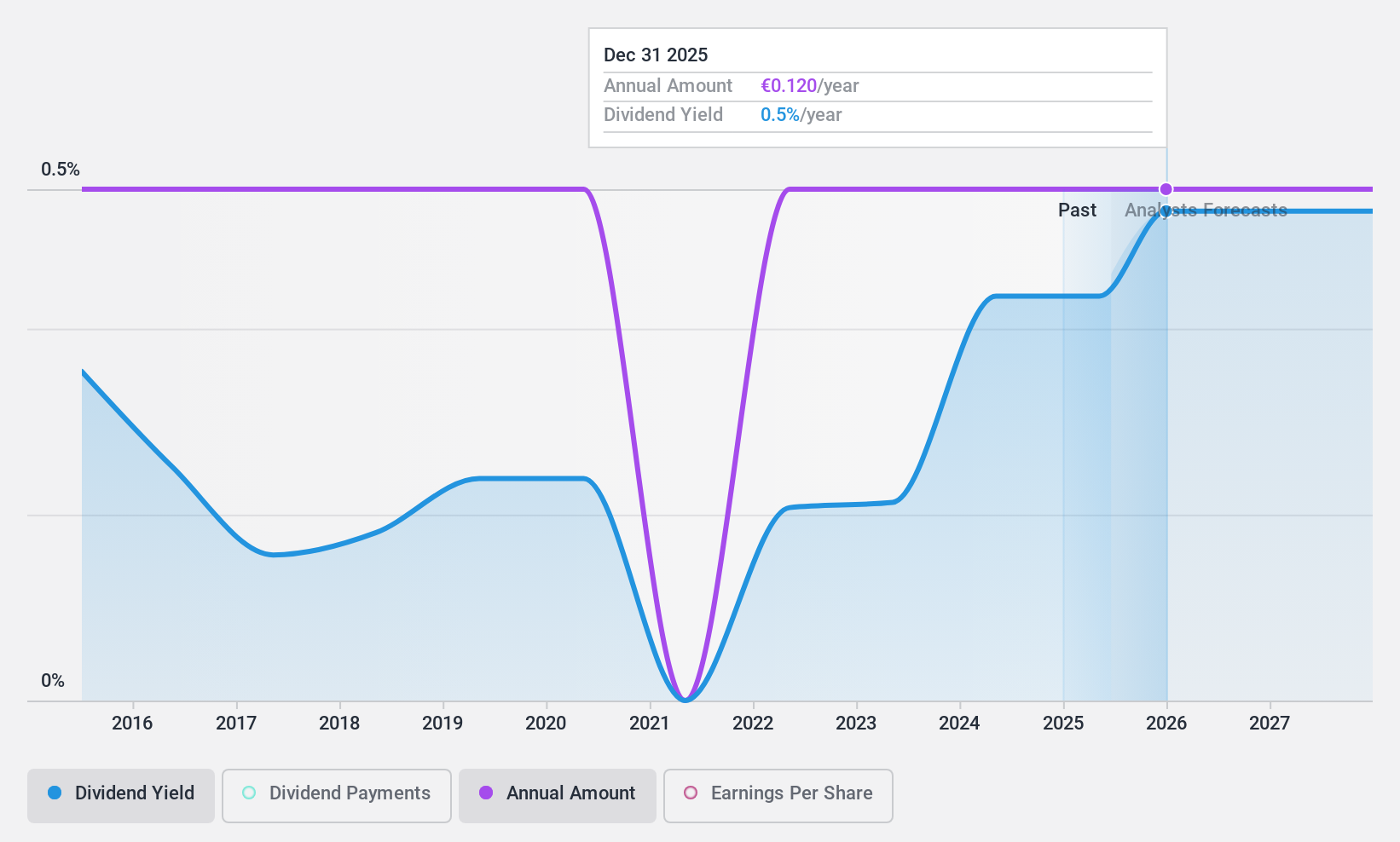

Dividend Yield: 7.7%

DATA MODUL Produktion und Vertrieb von elektronischen Systemen has a mixed dividend profile. While its dividends have been volatile and unreliable over the past decade, they are well-covered by both earnings (64% payout ratio) and cash flows (19.5% cash payout ratio). Despite a recent decline in net income and sales, the company's dividend yield of 7.69% is among the top 25% in Germany, supported by a low Price-to-Earnings ratio of 8.3x compared to the market's 17x.

- Click here and access our complete dividend analysis report to understand the dynamics of DATA MODUL Produktion und Vertrieb von elektronischen Systemen.

- In light of our recent valuation report, it seems possible that DATA MODUL Produktion und Vertrieb von elektronischen Systemen is trading beyond its estimated value.

MVV Energie (XTRA:MVV1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MVV Energie AG, with a market cap of €2.00 billion, operates in Germany providing electricity, heat, gas, water, and waste treatment and disposal services through its subsidiaries.

Operations: MVV Energie AG's revenue segments include electricity, heat, gas, water, and waste treatment and disposal products.

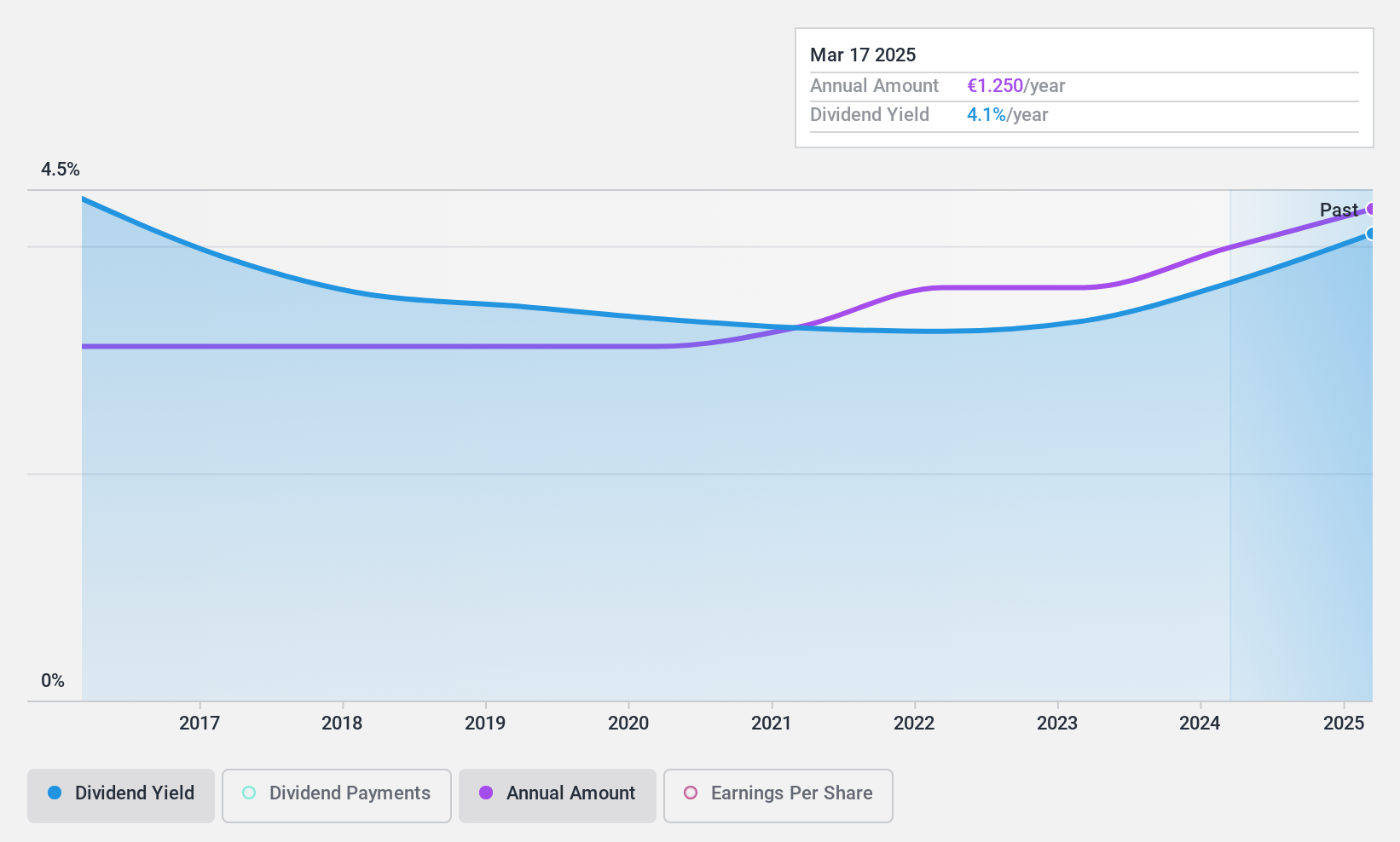

Dividend Yield: 3.8%

MVV Energie offers a stable and reliable dividend, with payments consistently increasing over the past decade. The dividends are well-covered by earnings (47.1% payout ratio) and cash flows (59.9% cash payout ratio), despite recent financial challenges such as declining net income and profit margins. Trading at 12.9% below its estimated fair value, MVV Energie's current yield of 3.78% is lower than the top 25% of German dividend payers but remains attractive for long-term investors seeking stability.

- Navigate through the intricacies of MVV Energie with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of MVV Energie shares in the market.

Schloss Wachenheim (XTRA:SWA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Schloss Wachenheim AG, with a market cap of €121.18 million, produces and distributes sparkling and semi-sparkling wine products in Europe and internationally.

Operations: Schloss Wachenheim AG generates €441.16 million in revenue from its alcoholic beverages segment.

Dividend Yield: 3.9%

Schloss Wachenheim's dividend yield of 3.92% is lower than the top 25% of German dividend payers but has been stable and growing over the past decade. However, its dividends are not well-covered by free cash flows, with a high cash payout ratio of 113.1%. Despite this, the payout ratio from earnings stands at a reasonable 54.2%. The stock trades at good value compared to peers and industry, currently priced 16% below its estimated fair value.

- Dive into the specifics of Schloss Wachenheim here with our thorough dividend report.

- The valuation report we've compiled suggests that Schloss Wachenheim's current price could be quite moderate.

Summing It All Up

- Click here to access our complete index of 32 Top German Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MVV1

MVV Energie

Provides electricity, heat, gas, water, and waste treatment and disposal products primarily in Germany.

Excellent balance sheet established dividend payer.