As of July 2024, the German market has experienced notable volatility, with the DAX index declining by 3.07% amid escalating U.S.-China trade tensions and mixed signals from economic indicators across Europe. In such a fluctuating environment, dividend stocks can offer investors potential stability and steady income streams, making them an attractive option to consider.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.26% | ★★★★★★ |

| MLP (XTRA:MLP) | 5.21% | ★★★★★☆ |

| INDUS Holding (XTRA:INH) | 5.19% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.71% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.25% | ★★★★★☆ |

| Südzucker (XTRA:SZU) | 7.50% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.41% | ★★★★★☆ |

| Deutsche Telekom (XTRA:DTE) | 3.17% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.38% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.15% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top German Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Brenntag (XTRA:BNR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brenntag SE is a global distributor of industrial and specialty chemicals and ingredients, operating across regions including Germany, Europe, the Middle East, Africa, the Americas, and Asia Pacific, with a market capitalization of approximately €9.45 billion.

Operations: Brenntag SE generates revenue through its Brenntag Essentials segment across various regions, with €4.28 billion from North America, €3.34 billion from Europe, the Middle East & Africa (EMEA), €708 million from Asia Pacific (APAC), and €670.20 million from Latin America.

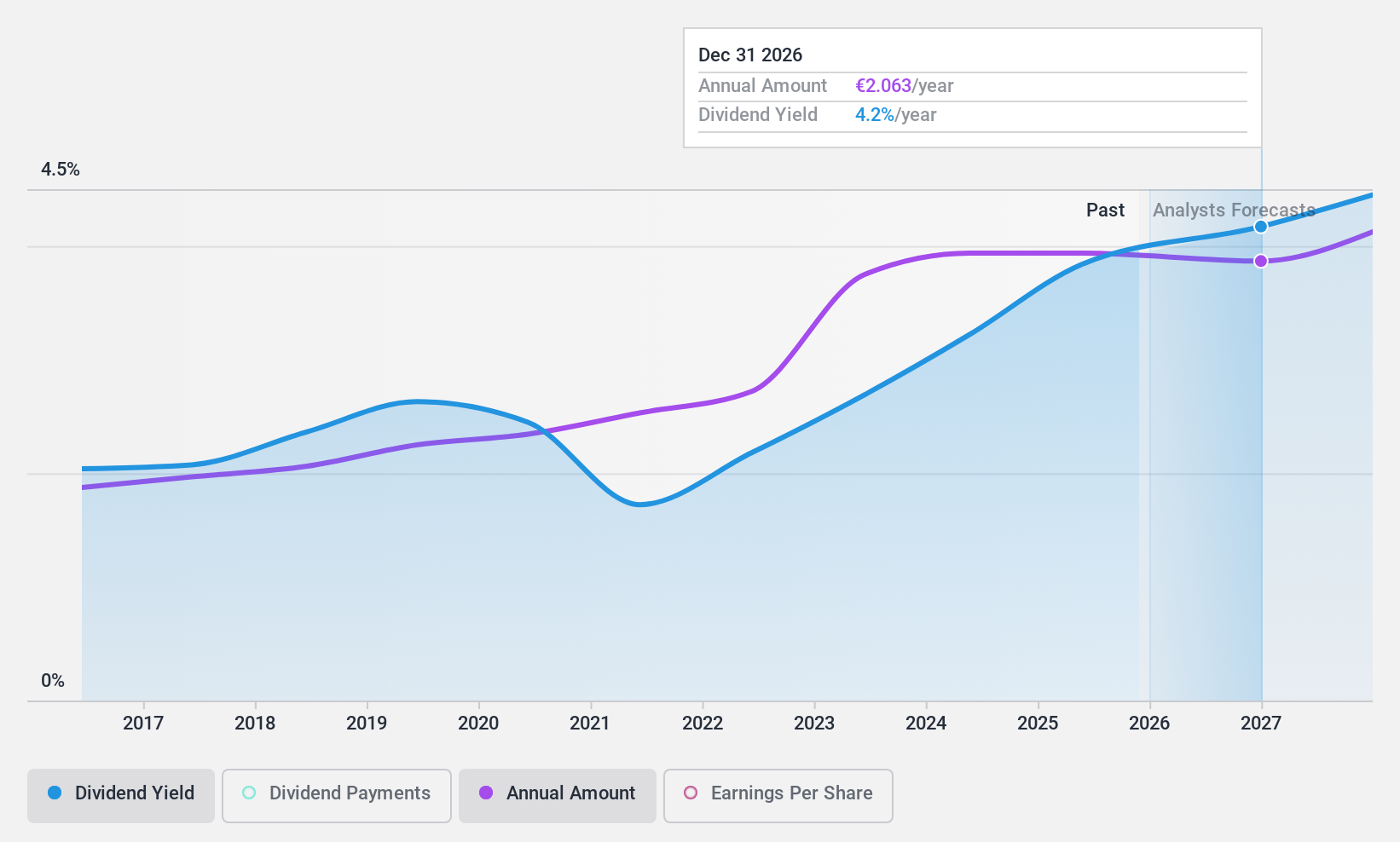

Dividend Yield: 3.2%

Brenntag SE has demonstrated a consistent dividend reliability over the past decade, with its payouts well-supported by both earnings and cash flows, holding payout ratios at 48.9% and 28.1% respectively. Despite a lower yield of 3.21% compared to some German market leaders, the dividends are stable and have shown growth. Recent corporate activities include significant share buybacks totaling €750 million and consistent cash dividends paid out in May 2024, underscoring ongoing shareholder returns amid fluctuating quarterly earnings from €4.53 billion to €4 billion year-over-year with a decline in net income from €215.9 million to €141.4 million.

- Take a closer look at Brenntag's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Brenntag shares in the market.

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DATA MODUL Aktiengesellschaft, Produktion und Vertrieb von elektronischen Systemen is a company based in Germany that specializes in the development, manufacture, and distribution of flatbed displays, monitors, electronic subassemblies, and information systems globally, with a market capitalization of approximately €95.21 million.

Operations: DATA MODUL generates revenue primarily through two segments: €98.96 million from systems and €175.39 million from displays.

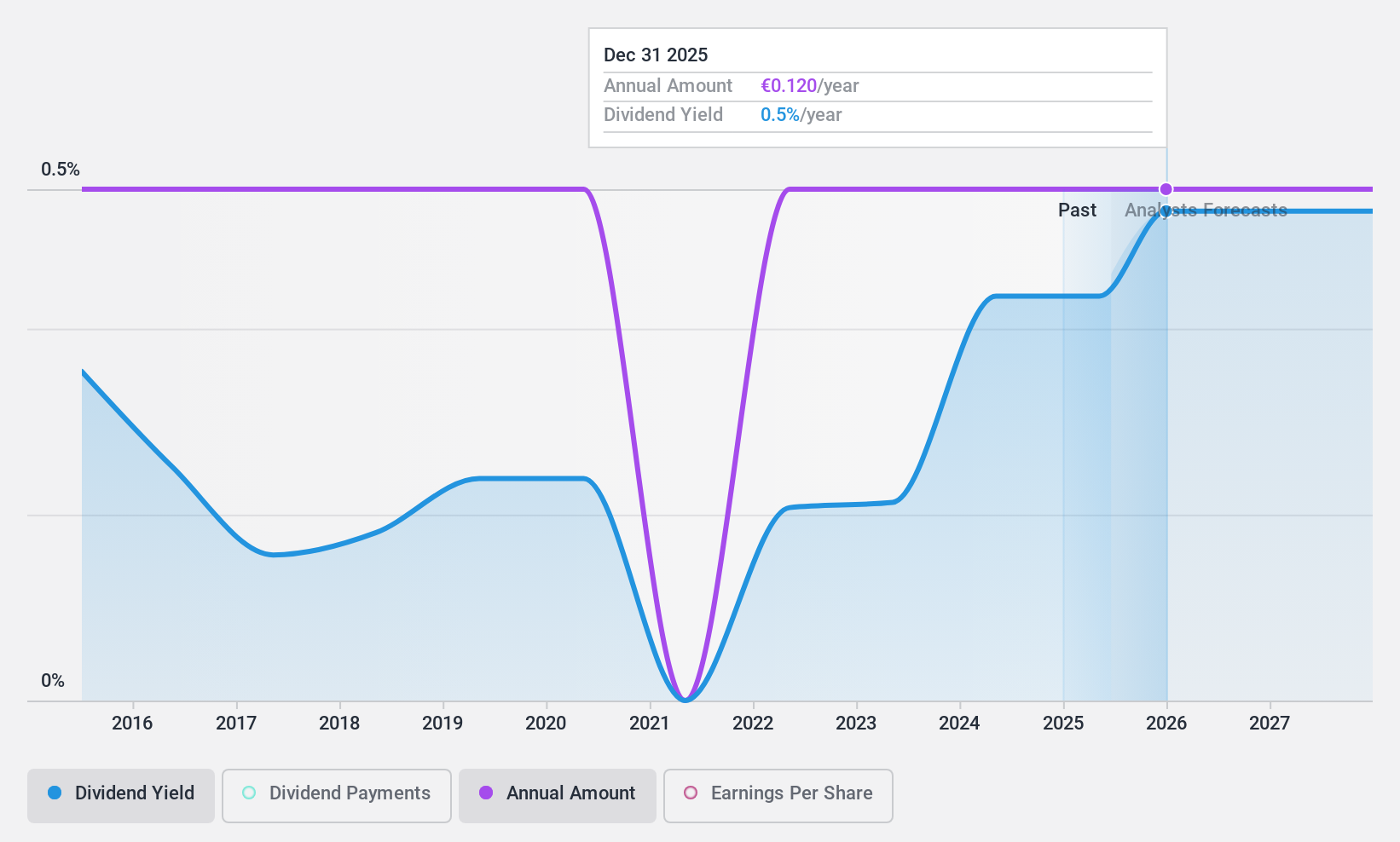

Dividend Yield: 7.4%

DATA MODUL's recent financial performance shows a decrease in sales and net income, with Q1 sales dropping to €63.53 million from €72.41 million and net income to €2.74 million from €3.31 million year-over-year. Despite a historically unstable dividend track record and volatility in payments, the dividends are supported by a reasonable payout ratio of 50.7% and a low cash payout ratio of 26.9%. Additionally, its price-to-earnings ratio at 6.8x is attractively below the German market average of 17.8x, suggesting good value relative to peers.

- Click to explore a detailed breakdown of our findings in DATA MODUL Produktion und Vertrieb von elektronischen Systemen's dividend report.

- Our expertly prepared valuation report DATA MODUL Produktion und Vertrieb von elektronischen Systemen implies its share price may be lower than expected.

PWO (XTRA:PWO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PWO AG specializes in producing lightweight construction components from aluminum and steel for the mobility industry, operating across Germany, Czechia, Canada, Mexico, Serbia, and China, with a market capitalization of approximately €91.88 million.

Operations: PWO AG generates €562.18 million in revenue from its auto parts and accessories segment.

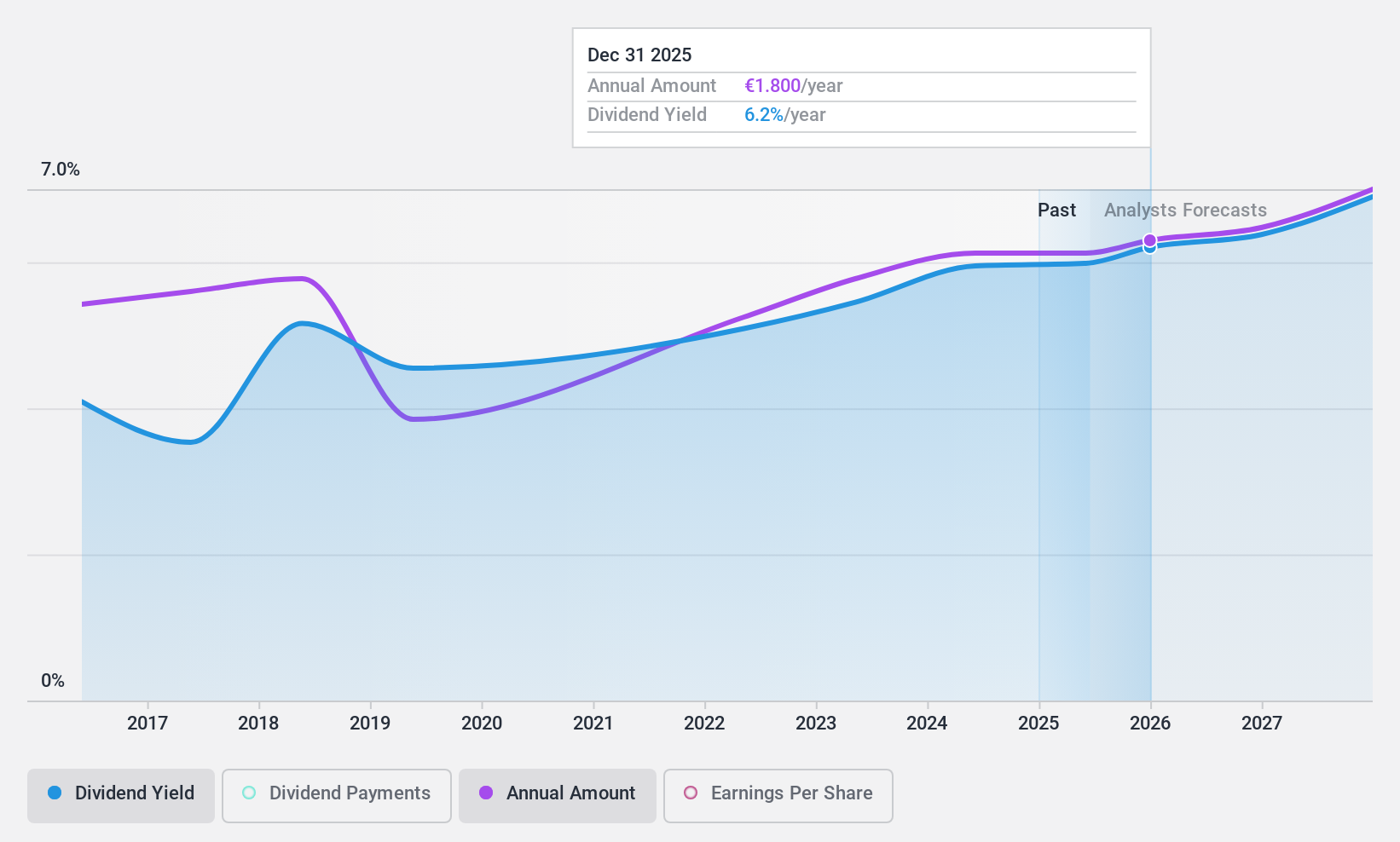

Dividend Yield: 6%

PWO reported a slight increase in Q1 2024 sales to €146.87 million and net income to €3.32 million, with earnings per share rising to €1.06. Despite a high dividend yield of 5.95%, PWO's dividend history shows instability over the past decade, including significant annual fluctuations exceeding 20%. However, dividends are well-supported by earnings and cash flows, with payout ratios at 33.3% and 23% respectively, indicating sustainability under current conditions but caution due to past volatility remains advisable.

- Click here to discover the nuances of PWO with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that PWO is trading behind its estimated value.

Key Takeaways

- Unlock more gems! Our Top German Dividend Stocks screener has unearthed 27 more companies for you to explore.Click here to unveil our expertly curated list of 30 Top German Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DAM

DATA MODUL Produktion und Vertrieb von elektronischen Systemen

Engages in the development, manufacture, and distribution of flatbed displays, monitors, electronic subassemblies, and information systems in Germany and internationally.

Flawless balance sheet established dividend payer.