- Germany

- /

- Trade Distributors

- /

- XTRA:BNR

Dinkelacker Leads Three Key German Dividend Stocks

Reviewed by Simply Wall St

Amid a backdrop of moderate gains in major European stock indexes, including a 1.32% rise in Germany's DAX, investors continue to navigate through an environment marked by political shifts and economic uncertainties. In such a climate, dividend stocks like Dinkelacker may offer a blend of stability and potential income, appealing to those looking for more conservative investment avenues in the current market scenario.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.29% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.61% | ★★★★★★ |

| Südzucker (XTRA:SZU) | 6.46% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.76% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.10% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.76% | ★★★★★☆ |

| MLP (XTRA:MLP) | 5.17% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 4.67% | ★★★★★☆ |

| Deutsche Telekom (XTRA:DTE) | 3.23% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.17% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Dinkelacker (BST:DWB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dinkelacker AG, with a market cap of €294.05 million, is engaged in the rental of real estate properties across Germany.

Operations: Dinkelacker AG generates its revenue through the leasing of real estate properties throughout Germany.

Dividend Yield: 3.2%

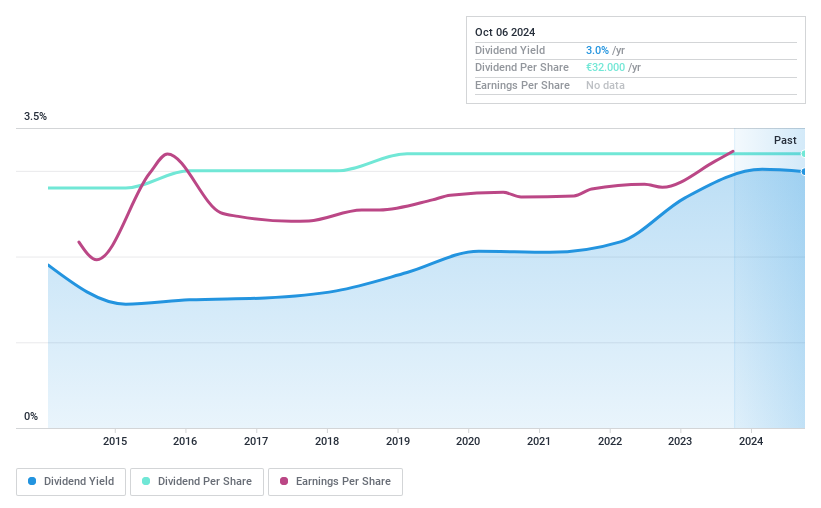

Dinkelacker AG, with a dividend yield of 3.17%, falls below the top-tier German dividend payers at 4.61%. Despite this, it has shown consistent dividend reliability over the past decade and has increased its dividends during this period. The company's payout ratio stands at 54.2%, indicating that dividends are well-covered by earnings. However, Dinkelacker carries a high level of debt and recent financials show a slight decline in net income from €5.38 million to €4.87 million year-over-year, alongside stable revenue figures around €12 million.

- Dive into the specifics of Dinkelacker here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Dinkelacker is trading beyond its estimated value.

Brenntag (XTRA:BNR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brenntag SE operates as a distributor of industrial and specialty chemicals and ingredients across regions including Germany, Europe, the Middle East, Africa, the Americas, and Asia Pacific, with a market capitalization of approximately €9.24 billion.

Operations: Brenntag SE's revenue is segmented across various geographical regions, with Brenntag Essentials - North America generating €4.28 billion, followed by Brenntag Essentials - Europe, Middle East & Africa (EMEA) at €3.34 billion, Brenntag Essentials - Asia Pacific (APAC) contributing €0.71 billion, and Brenntag Essentials - Latin America at €0.67 billion.

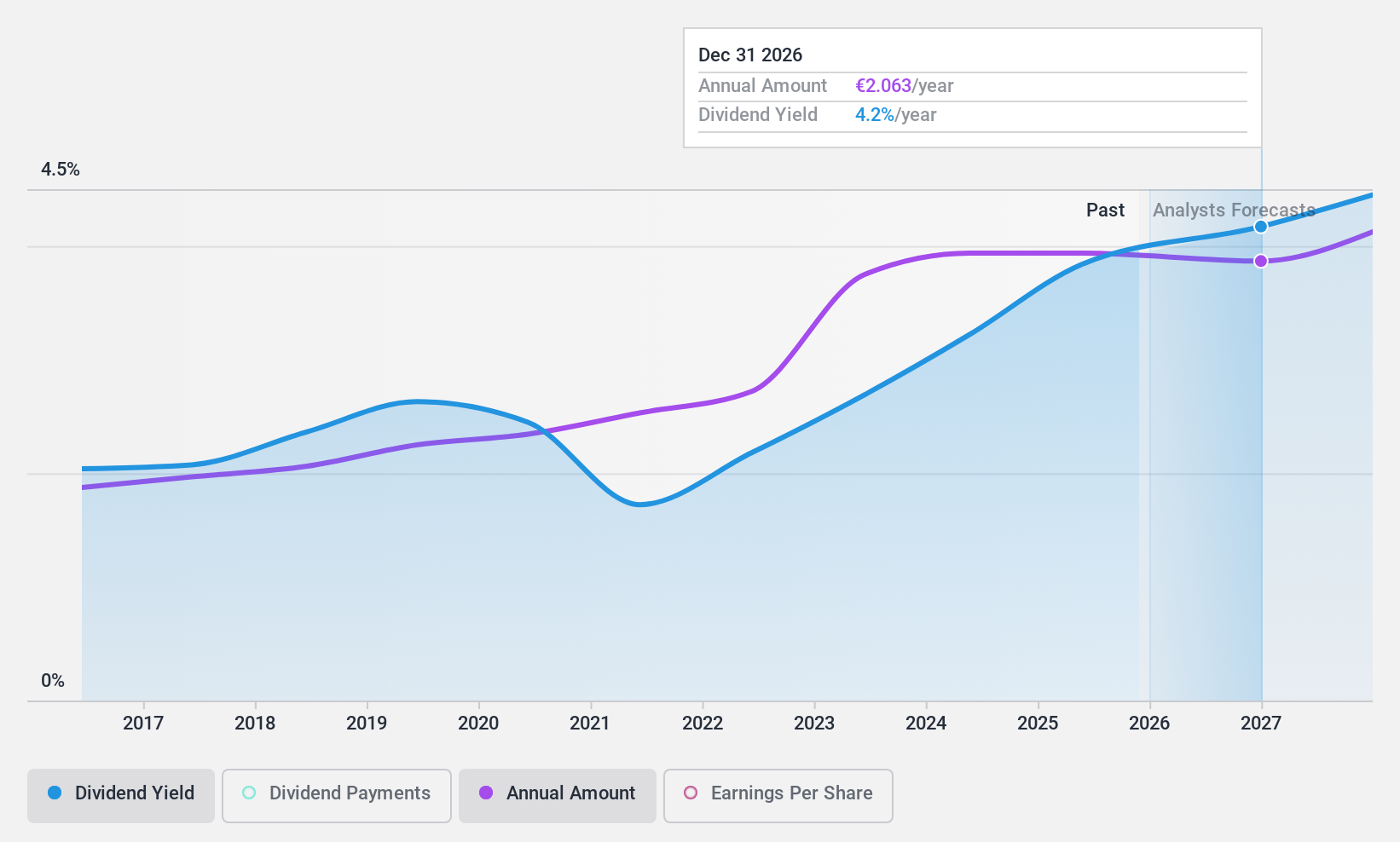

Dividend Yield: 3.3%

Brenntag SE offers a dividend yield of 3.28%, which is below the top 25% of German dividend stocks. Despite this, dividends have shown stability and growth over the last decade, supported by a conservative payout ratio of 48.9% and a cash payout ratio of 28.1%. The stock is currently perceived as undervalued, trading at 62.6% below estimated fair value with expected earnings growth of 9.32% per year, suggesting potential for price appreciation alongside reliable dividend payments.

- Take a closer look at Brenntag's potential here in our dividend report.

- According our valuation report, there's an indication that Brenntag's share price might be on the cheaper side.

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DATA MODUL Aktiengesellschaft, Produktion und Vertrieb von elektronischen Systemen operates in the development, manufacture, and distribution of flatbed displays, monitors, electronic subassemblies, and information systems globally with a market capitalization of approximately €104.37 million.

Operations: DATA MODUL Produktion und Vertrieb von elektronischen Systemen generates revenue primarily through two segments: €98.96 million from Systems and €175.39 million from Displays.

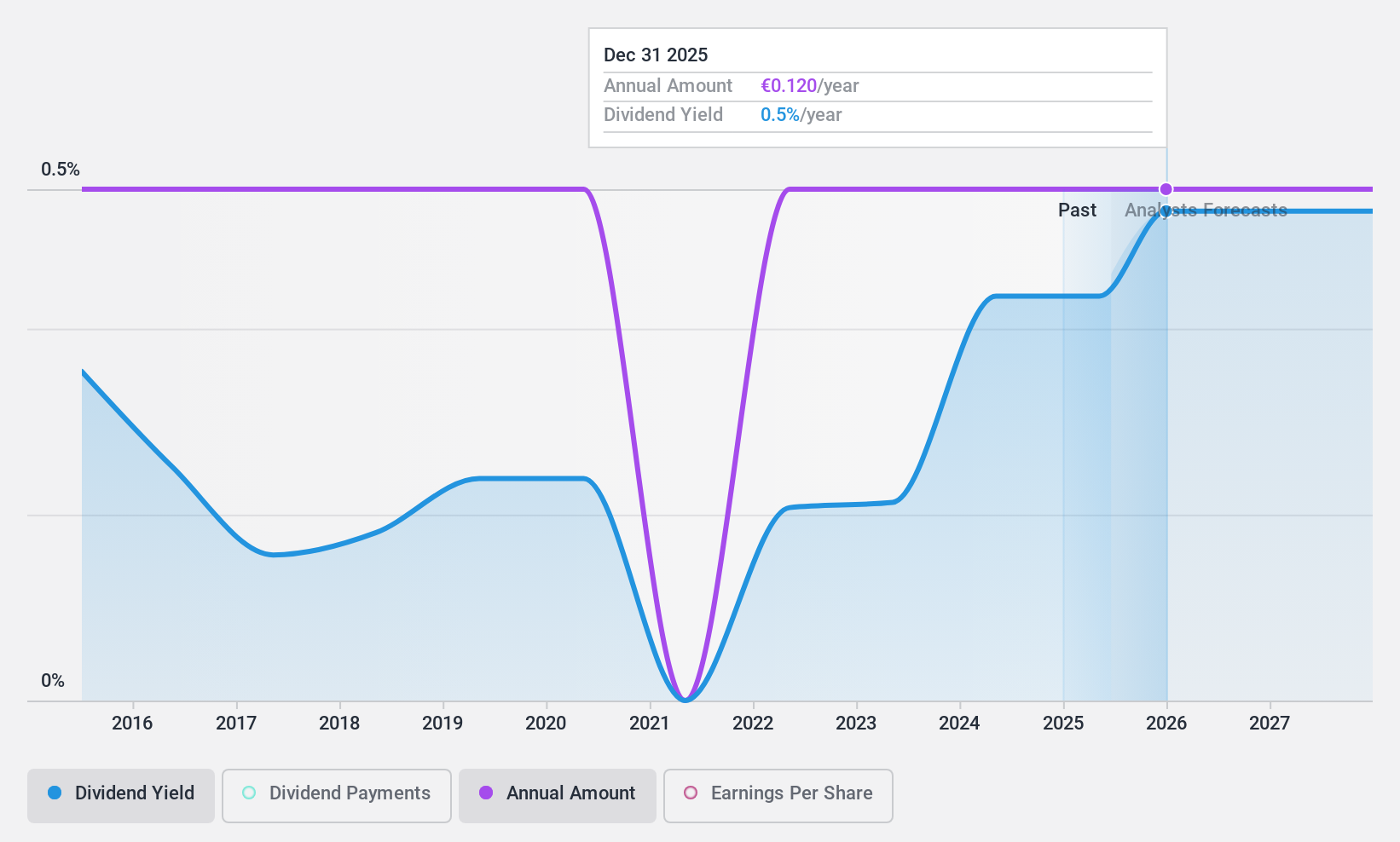

Dividend Yield: 6.8%

DATA MODUL exhibits a dividend yield of 6.76%, ranking it in the top quartile of German dividend payers. Despite its attractive yield, the company's dividend history has been marked by volatility and unreliability over the past decade. However, both earnings and cash flows sufficiently cover dividends, with payout ratios at 50.7% and 26.9% respectively, indicating a sustainable payment structure moving forward. Trading at a P/E ratio of 7.5x—well below the German market average—DATA MODUL also presents good value relative to its peers.

- Delve into the full analysis dividend report here for a deeper understanding of DATA MODUL Produktion und Vertrieb von elektronischen Systemen.

- Insights from our recent valuation report point to the potential undervaluation of DATA MODUL Produktion und Vertrieb von elektronischen Systemen shares in the market.

Summing It All Up

- Take a closer look at our Top Dividend Stocks list of 30 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brenntag might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BNR

Brenntag

Brenntag SE purchases and supplies various industrial and specialty chemicals, and ingredients in Germany, Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Excellent balance sheet established dividend payer.