- France

- /

- Professional Services

- /

- ENXTPA:ALFRE

European Penny Stock Highlights: Freelance.com And 2 Promising Picks

Reviewed by Simply Wall St

As the European markets navigate a complex landscape of mixed economic signals and monetary policy decisions, investors are keenly assessing opportunities across various sectors. Penny stocks, often associated with smaller or emerging companies, remain an intriguing segment for those seeking affordability coupled with growth potential. Despite the term's somewhat outdated connotation, these stocks can offer significant value when backed by strong financials; this article will explore several such stocks that stand out in today's market conditions.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.186 | €1.45B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.03 | €15.3M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €224.95M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.83 | €39.16M | ✅ 3 ⚠️ 3 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.484 | RON16.37M | ✅ 2 ⚠️ 4 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.20 | €10.15M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.415 | €390.22M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.02 | €279.21M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.89 | €30.01M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 332 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Freelance.com (ENXTPA:ALFRE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Freelance.com SA facilitates intermediation between companies and intellectual service providers across several countries, including France and Germany, with a market cap of €130.52 million.

Operations: The company generates revenue of €1.05 billion from its Business Services segment.

Market Cap: €130.52M

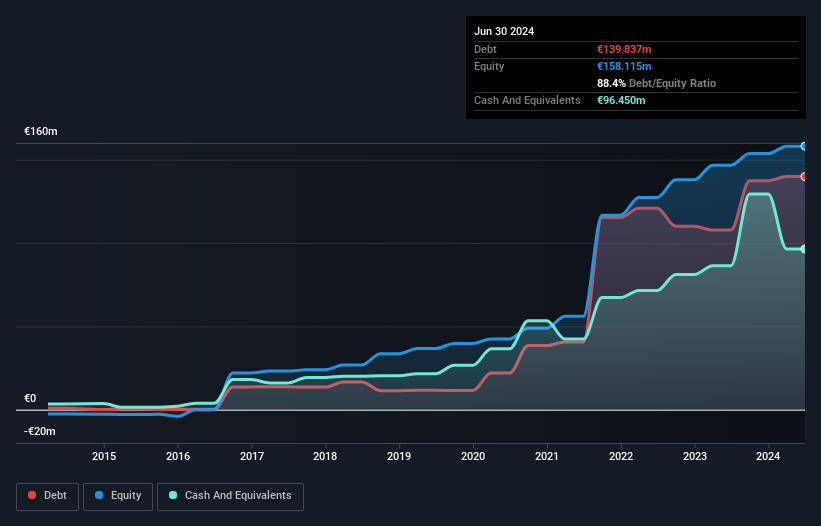

Freelance.com SA, with a market cap of €130.52 million and revenue of €1.05 billion, shows promising growth potential in the penny stock arena. Its earnings have grown significantly over the past five years, with a recent acceleration to 23.9% last year, outpacing industry averages. The company trades at good value compared to peers and is 74.2% below estimated fair value. While its net profit margin remains modest at 1.7%, Freelance.com maintains satisfactory debt levels and strong asset coverage for liabilities, though its operating cash flow does not fully cover debt obligations yet.

- Click here to discover the nuances of Freelance.com with our detailed analytical financial health report.

- Gain insights into Freelance.com's future direction by reviewing our growth report.

Cherry (XTRA:C3RY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cherry SE, along with its subsidiaries, manufactures and sells computer input devices in Germany with a market cap of €15.44 million.

Operations: The company generates revenue primarily from its Gaming & Office Peripherals segment at €71.07 million and Digital Health & Solutions segment at €27.27 million, with an additional contribution of €12.40 million from Components.

Market Cap: €15.44M

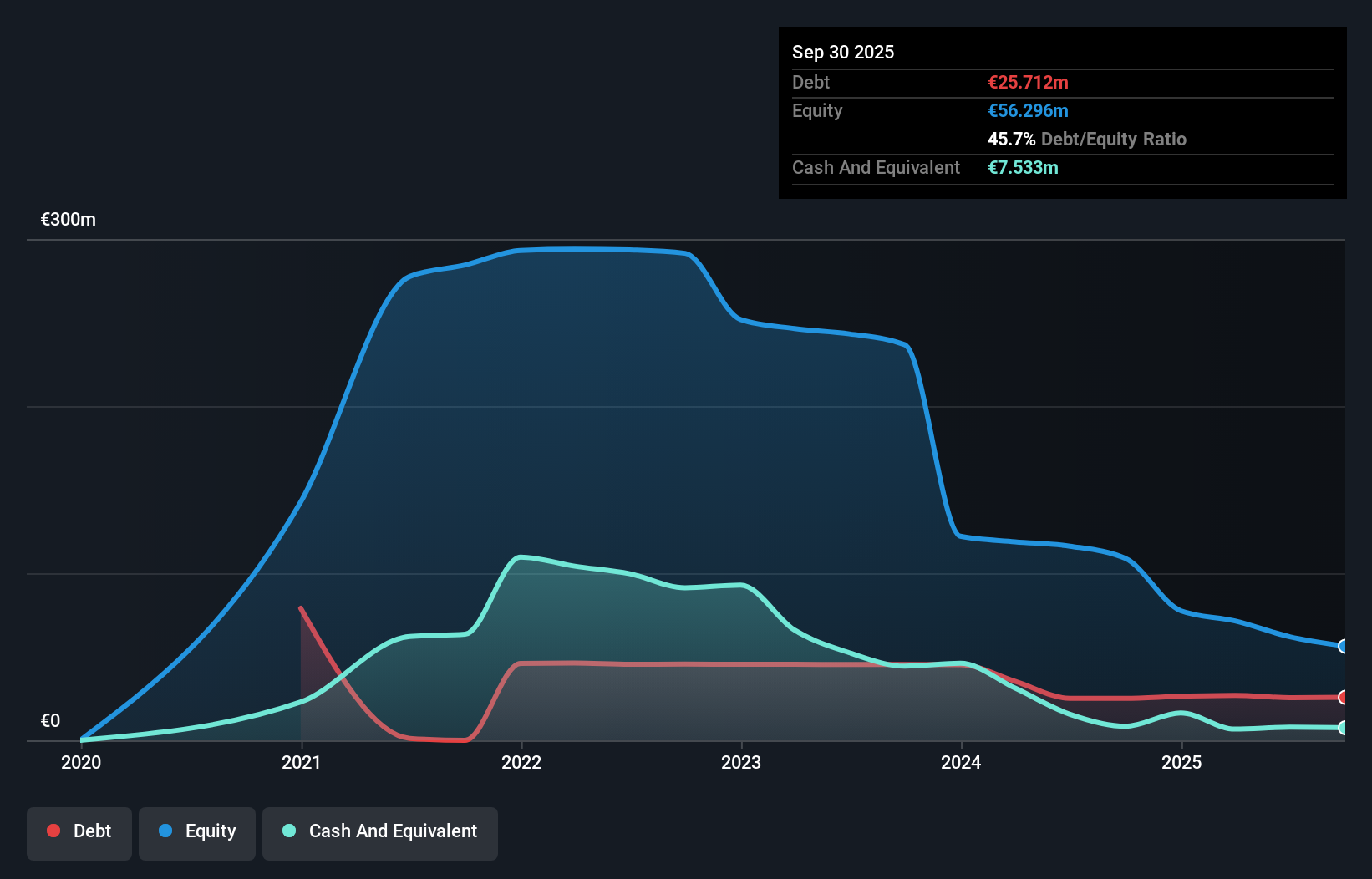

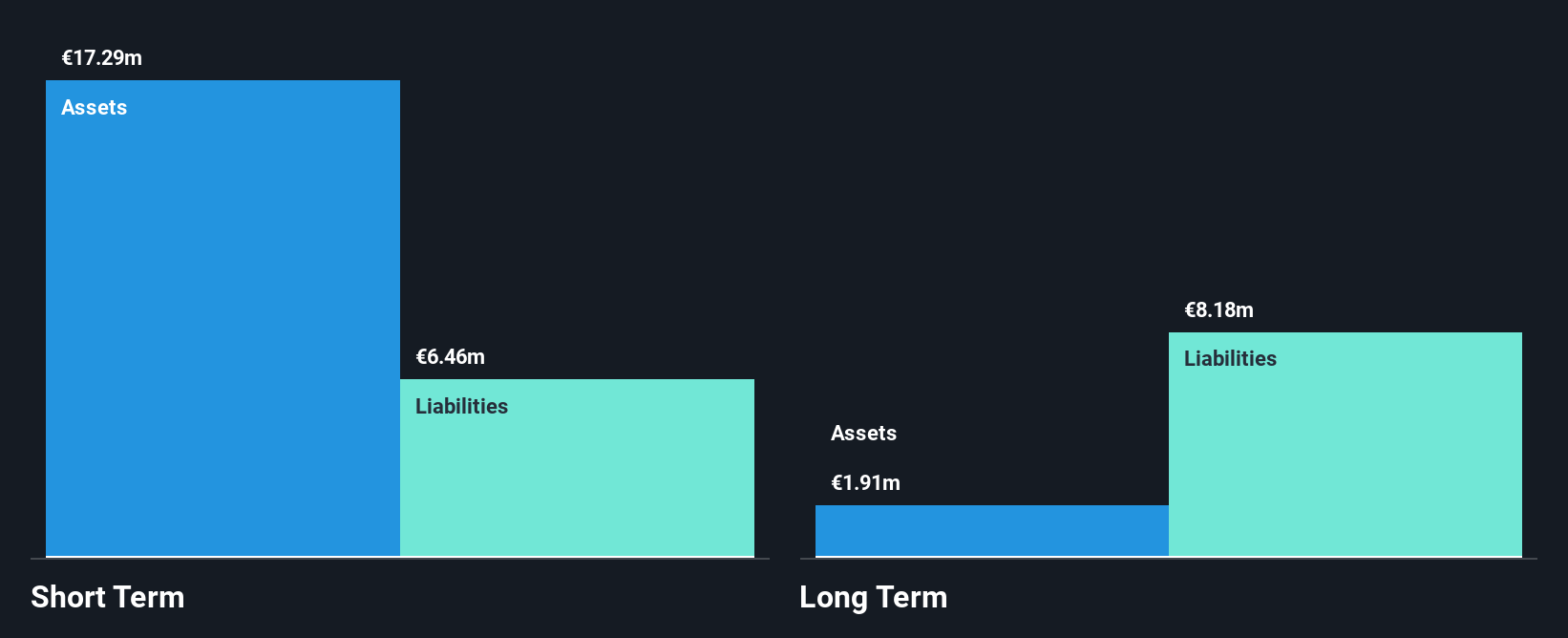

Cherry SE, with a market cap of €15.44 million, operates in the computer input device sector but remains unprofitable and is not expected to achieve profitability in the near term. The company has experienced volatility in its share price recently and faces challenges with a limited cash runway under one year. Despite these hurdles, Cherry's short-term assets exceed both its short-term and long-term liabilities, indicating some financial stability. Recent executive changes include Jurjen Jongma as CFO, potentially strengthening financial oversight. Additionally, Cherry's TI Messenger approval marks progress in digital health solutions, offering secure communication for healthcare professionals.

- Jump into the full analysis health report here for a deeper understanding of Cherry.

- Understand Cherry's earnings outlook by examining our growth report.

Exasol (XTRA:EXL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Exasol AG develops databases for analytics and data warehousing across Germany, Austria, Switzerland, Great Britain, North America, and internationally, with a market cap of €86.40 million.

Operations: Exasol's revenue is primarily generated from the Germany, Austria, and Switzerland (DACH) region with €28.07 million, followed by North America at €7.72 million, Great Britain with €2.01 million, and the Rest of Europe and Rest of World contributing €3.83 million.

Market Cap: €86.4M

Exasol AG, with a market cap of €86.40 million, has transitioned to profitability in the past year, enhancing its investment appeal. The company reported half-year sales of €21.47 million and a net income of €1.37 million, marking an improvement from the previous year's loss. Exasol operates debt-free and maintains high-quality earnings with strong short-term assets exceeding liabilities. Its return on equity is notably high at 30.9%, reflecting efficient management practices. Despite trading below estimated fair value, Exasol's revenue growth is concentrated in the DACH region, with forecasts indicating continued earnings growth at 28.25% annually.

- Click here and access our complete financial health analysis report to understand the dynamics of Exasol.

- Review our growth performance report to gain insights into Exasol's future.

Next Steps

- Unlock more gems! Our European Penny Stocks screener has unearthed 329 more companies for you to explore.Click here to unveil our expertly curated list of 332 European Penny Stocks.

- Ready For A Different Approach? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALFRE

Freelance.com

Provides intermediation between companies and intellectual service providers in France, Germany, Morocco, Luxembourg, Switzerland, and Singapore.

Undervalued with solid track record.

Market Insights

Community Narratives