3 German Stocks That Might Be Trading At Discounts Up To 48.8%

Reviewed by Simply Wall St

The German market has faced significant volatility recently, with the DAX index tumbling by 4.11% amid global economic concerns and weak U.S. data sparking worries about growth. Amidst this uncertainty, investors may find opportunities in stocks that appear undervalued relative to their intrinsic value. Identifying such stocks often involves looking for companies with strong fundamentals that are temporarily out of favor or mispriced due to broader market conditions. In this article, we will explore three German stocks that might be trading at discounts of up to 48.8%.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Kontron (XTRA:SANT) | €16.66 | €33.09 | 49.6% |

| Bertrandt (XTRA:BDT) | €24.50 | €42.50 | 42.3% |

| Gerresheimer (XTRA:GXI) | €98.20 | €191.83 | 48.8% |

| M1 Kliniken (XTRA:M12) | €13.65 | €23.69 | 42.4% |

| ecotel communication ag (XTRA:E4C) | €12.70 | €22.25 | 42.9% |

| Verbio (XTRA:VBK) | €16.10 | €29.50 | 45.4% |

| R. STAHL (XTRA:RSL2) | €17.90 | €33.14 | 46% |

| MTU Aero Engines (XTRA:MTX) | €258.50 | €445.17 | 41.9% |

| Vectron Systems (XTRA:V3S) | €10.80 | €17.68 | 38.9% |

| Basler (XTRA:BSL) | €9.75 | €16.48 | 40.8% |

Let's dive into some prime choices out of the screener.

RENK Group (DB:R3NK)

Overview: RENK Group AG, with a market cap of €2.49 billion, specializes in the design, engineering, production, testing, and servicing of customized drive systems both in Germany and internationally.

Operations: The company's revenue segments include €315.72 million from the M&I Segment, €552.71 million from the VMS Segment, and €113.58 million from the Slide Bearings Segment.

Estimated Discount To Fair Value: 37.9%

RENK Group AG appears undervalued based on cash flows, trading at €25.16, significantly below the estimated fair value of €40.48. Despite slower revenue growth (9.4% per year) compared to high-growth benchmarks, it's faster than the German market average (5.2%). Earnings are forecast to grow substantially at 33.6% annually over the next three years, outpacing market expectations and reflecting strong future profitability prospects despite current debt coverage issues by operating cash flow.

- Our growth report here indicates RENK Group may be poised for an improving outlook.

- Click here to discover the nuances of RENK Group with our detailed financial health report.

Basler (XTRA:BSL)

Overview: Basler Aktiengesellschaft develops, manufactures, and sells digital cameras for professional users both in Germany and internationally, with a market cap of €299.68 million.

Operations: Basler generates €190.30 million in revenue from its camera segment.

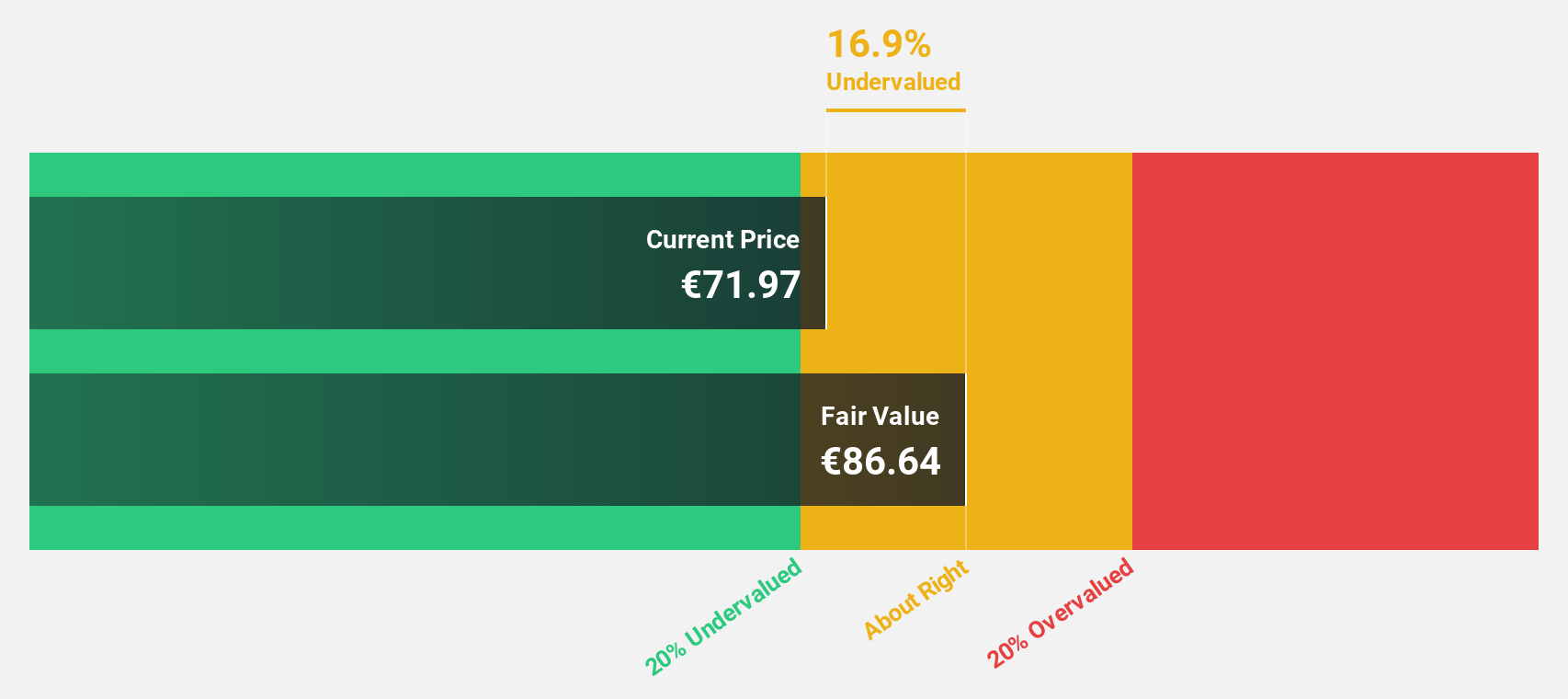

Estimated Discount To Fair Value: 40.8%

Basler Aktiengesellschaft is trading at €9.75, significantly below its estimated fair value of €16.48, making it highly undervalued based on discounted cash flow analysis. Despite a modest revenue growth forecast of 13.2% annually—above the German market average of 5.2%—earnings are expected to grow substantially at 84.03% per year over the next three years, reflecting strong future profitability prospects despite a low return on equity forecast (9.2%).

- Our comprehensive growth report raises the possibility that Basler is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Basler.

Gerresheimer (XTRA:GXI)

Overview: Gerresheimer AG, with a market cap of €3.38 billion, manufactures and sells medicine packaging, drug delivery devices, and solutions in Germany and internationally.

Operations: The company's revenue segments include Plastics & Devices (€1.11 billion), Advanced Technologies (€6.21 million), and Primary Packaging Glass (€892.01 million).

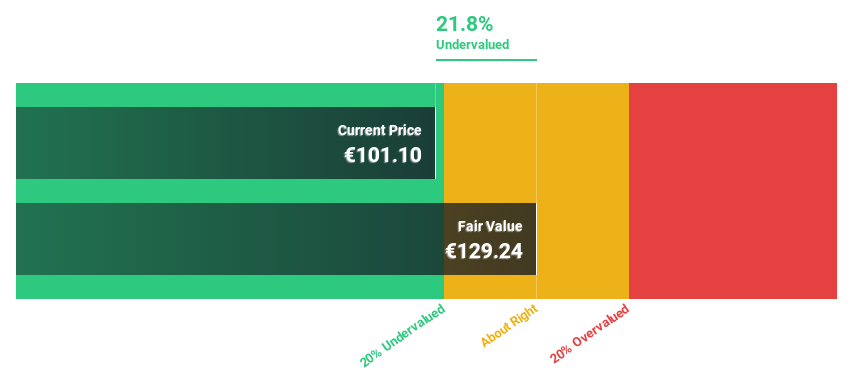

Estimated Discount To Fair Value: 48.8%

Gerresheimer AG is trading at €98.2, significantly below its estimated fair value of €191.83, indicating it is highly undervalued based on discounted cash flow analysis. Despite a high level of debt, earnings are forecast to grow 22.23% per year over the next three years, outpacing the German market's growth rate. Recent earnings reports show steady revenue growth but a slight decline in net income and basic earnings per share compared to the previous year.

- Insights from our recent growth report point to a promising forecast for Gerresheimer's business outlook.

- Click to explore a detailed breakdown of our findings in Gerresheimer's balance sheet health report.

Taking Advantage

- Gain an insight into the universe of 19 Undervalued German Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:R3NK

RENK Group

Engages in the design, engineering, production, testing, and servicing of customized drive systems in Germany and internationally.

High growth potential and fair value.