- Spain

- /

- Metals and Mining

- /

- BME:TUB

3 European Stocks Estimated To Be Up To 43.5% Below Intrinsic Value

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index recently ended 1.77% higher, buoyed by relief over the reopening of the U.S. federal government, cooling sentiment on artificial intelligence tempered market gains across Europe. In this context, identifying stocks that are potentially undervalued can be crucial for investors seeking opportunities in a market where economic indicators and investor sentiment are in flux.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN128.00 | PLN255.57 | 49.9% |

| STEICO (XTRA:ST5) | €20.20 | €40.18 | 49.7% |

| Mangata Holding (WSE:MGT) | PLN63.80 | PLN124.84 | 48.9% |

| Lingotes Especiales (BME:LGT) | €5.15 | €10.09 | 49% |

| KB Components (OM:KBC) | SEK41.20 | SEK81.10 | 49.2% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.392 | €0.78 | 49.9% |

| EcoUp Oyj (HLSE:ECOUP) | €1.36 | €2.66 | 48.9% |

| Bonesupport Holding (OM:BONEX) | SEK198.20 | SEK394.13 | 49.7% |

| Allcore (BIT:CORE) | €1.33 | €2.66 | 49.9% |

| Absolent Air Care Group (OM:ABSO) | SEK204.00 | SEK401.16 | 49.1% |

Let's review some notable picks from our screened stocks.

ACS Actividades de Construcción y Servicios (BME:ACS)

Overview: ACS Actividades de Construcción y Servicios is a Spanish multinational company engaged in construction, engineering, and infrastructure services with a market cap of approximately €20.01 billion.

Operations: The company's revenue is primarily derived from its segments, with Turner contributing €24.44 billion, Cimic providing €11.11 billion, Engineering and Construction generating €10.30 billion, and Infrastructure adding €241.67 million.

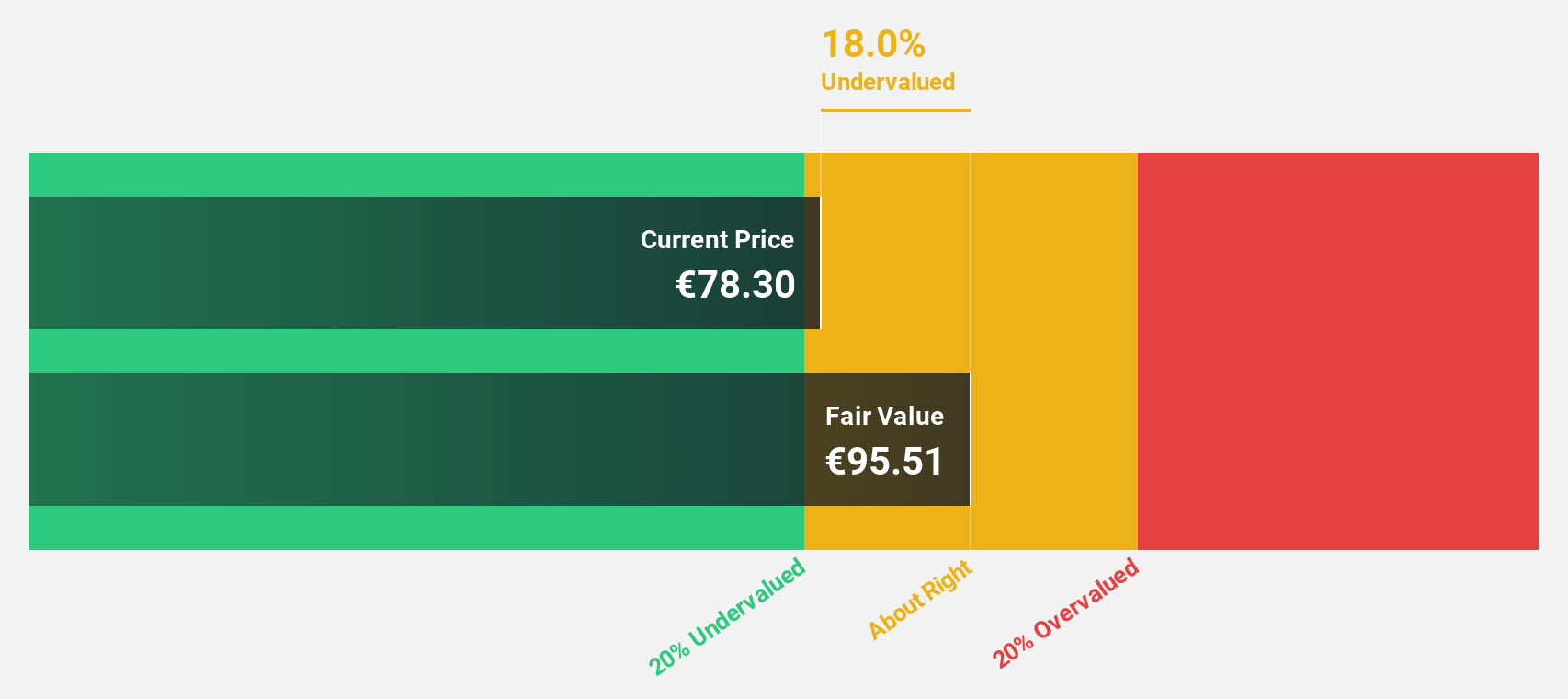

Estimated Discount To Fair Value: 18%

ACS Actividades de Construcción y Servicios is trading at €78.3, 18% below its estimated fair value of €95.51, suggesting it may be undervalued based on cash flows. Despite a less stable dividend track record and earnings impacted by large one-off items, ACS's earnings are forecast to grow faster than the Spanish market at 13.1% annually. Recent results show increased sales of €36.75 billion and net income growth to €655 million for the first nine months of 2025.

- Our earnings growth report unveils the potential for significant increases in ACS Actividades de Construcción y Servicios' future results.

- Take a closer look at ACS Actividades de Construcción y Servicios' balance sheet health here in our report.

Tubacex (BME:TUB)

Overview: Tubacex, S.A. and its subsidiaries manufacture and sell stainless steel and nickel tubes both in Spain and internationally, with a market cap of €418.18 million.

Operations: The company's revenue is primarily derived from Seamless Stainless Steel Pipes, generating €358.65 million, and Special Steels and Components, contributing €372.36 million.

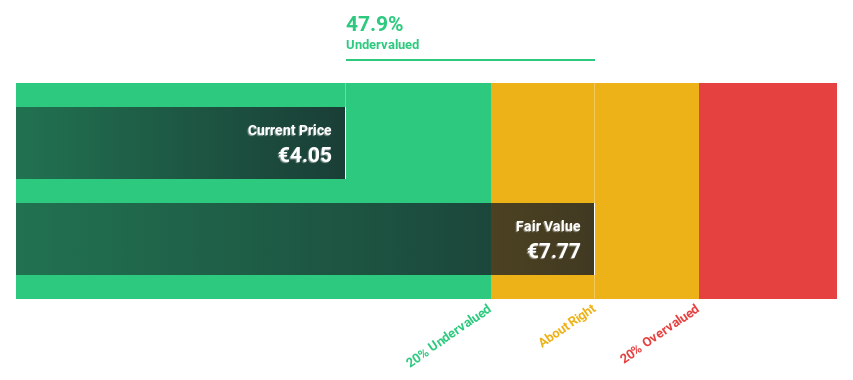

Estimated Discount To Fair Value: 43.5%

Tubacex is trading at €3.41, significantly below its estimated fair value of €6.03, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow substantially at 28.9% annually, outpacing the Spanish market's growth rate of 6.5%. Despite strong earnings growth and good relative value compared to peers, Tubacex faces challenges with interest payments not well covered by earnings and a dividend yield of 5.98% that isn't backed by free cash flows.

- Our expertly prepared growth report on Tubacex implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Tubacex.

Basler (XTRA:BSL)

Overview: Basler Aktiengesellschaft develops, manufactures, and sells digital cameras for professional users in Germany and internationally, with a market cap of €481.51 million.

Operations: The company's revenue segment includes the sale of cameras, generating €214.97 million.

Estimated Discount To Fair Value: 31.7%

Basler is trading at €15.66, below its estimated fair value of €22.92, highlighting potential undervaluation based on cash flows. The company recently became profitable, with earnings expected to grow significantly at 60.1% annually, outpacing the German market's growth rate of 16.8%. Despite a low forecasted return on equity of 12.5%, Basler's revenue is set to increase by 9.8% annually and has raised its sales forecast for fiscal year 2025 to between €220 million and €225 million.

- In light of our recent growth report, it seems possible that Basler's financial performance will exceed current levels.

- Navigate through the intricacies of Basler with our comprehensive financial health report here.

Make It Happen

- Explore the 201 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tubacex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:TUB

Tubacex

Engages in the manufacturing and sale of stainless steel and nickel tubes in Spain and internationally.

Very undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives