Stock Analysis

- Germany

- /

- Communications

- /

- XTRA:ADV

High Growth Tech Stocks in Germany for October 2024

Reviewed by Simply Wall St

As Germany's DAX index surged 4.03% amid hopes for interest rate cuts and China's new stimulus measures, the broader European market sentiment has been buoyed by these developments despite signs of slowing business activity. In this environment, high-growth tech stocks in Germany are gaining attention as investors look for companies with innovative solutions and strong growth potential that can thrive even amidst economic uncertainties.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Formycon | 32.50% | 30.70% | ★★★★★☆ |

| Ströer SE KGaA | 7.37% | 29.88% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| cyan | 28.13% | 71.37% | ★★★★★☆ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| medondo holding | 35.61% | 82.66% | ★★★★★☆ |

| Rubean | 55.25% | 67.67% | ★★★★★☆ |

| GK Software | 8.70% | 33.04% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Northern Data (DB:NB2)

Simply Wall St Growth Rating: ★★★★★☆

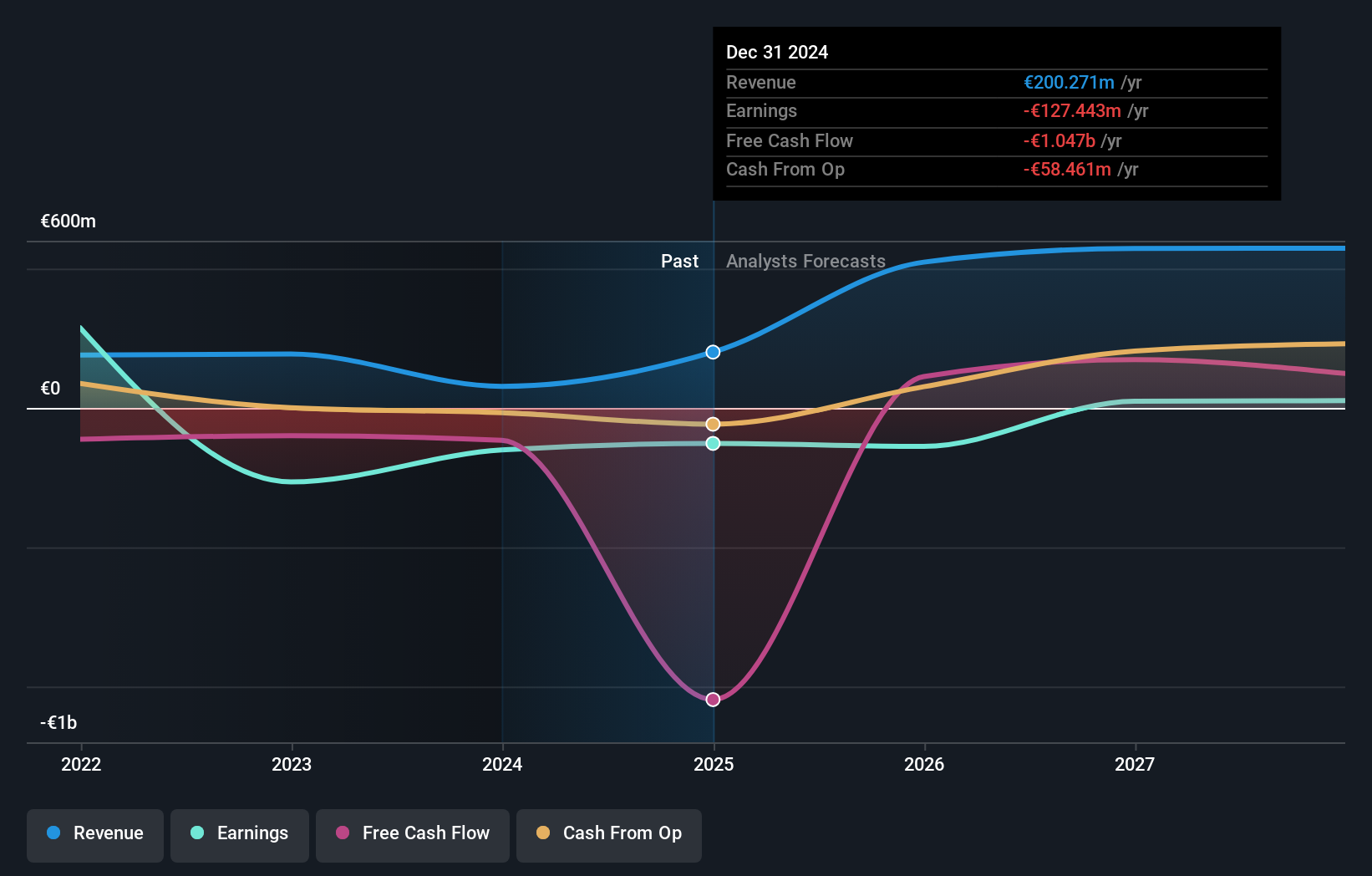

Overview: Northern Data AG provides high-performance computing infrastructure solutions to businesses and research institutions globally, with a market capitalization of €1.55 billion.

Operations: The company generates revenue primarily through Peak Mining (€156.13 million), Taiga Cloud (€22.13 million), and Ardent Data Centers (€31.46 million). The Consolidation segment shows a negative contribution of -€178.50 million, impacting overall financial performance.

Northern Data's recent inclusion in the S&P Global BMI Index underscores its growing prominence within the tech sector, notably after confirming its ambitious revenue target for 2024, aiming for a 200% increase to between €200 million and €240 million. This projection aligns with an expected annual revenue growth rate of 32.5%, significantly outpacing the German market's 5.4%. Moreover, amidst a challenging fiscal landscape marked by a substantial net loss in the previous year, Northern Data is poised for a robust recovery with earnings forecasted to surge by 68.2% annually. The company's strategic presentations at prominent investment conferences further highlight its active engagement with investors and stakeholders, reinforcing its trajectory towards profitability within three years despite recent shareholder dilution from a sizeable equity offering.

- Click to explore a detailed breakdown of our findings in Northern Data's health report.

Examine Northern Data's past performance report to understand how it has performed in the past.

Adtran Networks (XTRA:ADV)

Simply Wall St Growth Rating: ★★★★☆☆

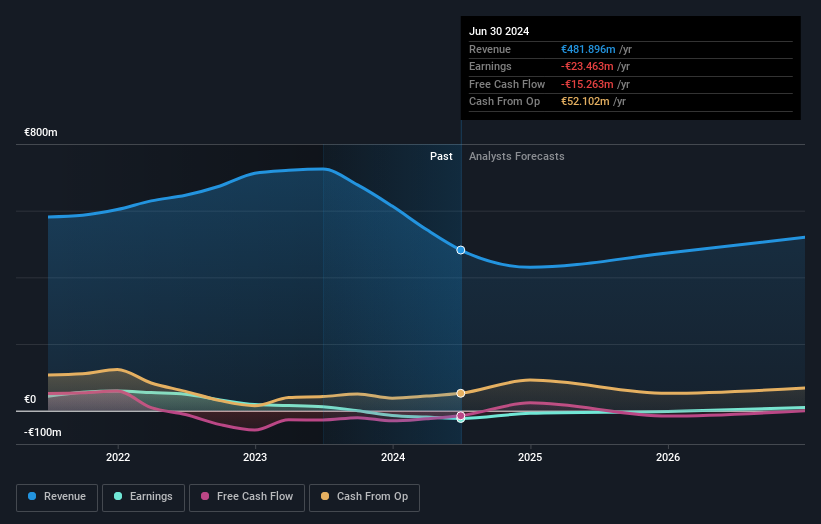

Overview: Adtran Networks SE focuses on developing, manufacturing, and selling optical and Ethernet-based networking solutions for telecommunications carriers and enterprises to facilitate data, storage, voice, and video services, with a market cap of approximately €1.01 billion.

Operations: Adtran Networks SE generates revenue primarily through its optical networking equipment, contributing €481.90 million. The company serves telecommunications carriers and enterprises by providing solutions that support data, storage, voice, and video services.

Adtran Networks SE, grappling with a challenging quarter, saw its sales dip to €108.17 million from €170.19 million year-over-year, reflecting broader sectoral pressures yet underscoring resilience in navigating market downturns. Despite a net loss of €0.826 million this quarter, the company is poised for recovery with expected revenue growth of 6.8% annually—outpacing Germany's average—and earnings projected to surge by 124.1%. This forecast aligns with Adtran's strategic focus on innovation and market adaptation, evidenced by significant R&D investments aimed at refining its tech offerings and enhancing competitive edge in the evolving digital landscape.

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SAP SE, along with its subsidiaries, delivers applications, technology, and services on a global scale and has a market capitalization of approximately €237.04 billion.

Operations: SAP SE generates revenue primarily from its Applications, Technology & Services segment, which amounts to €32.54 billion. The company's focus on providing comprehensive software solutions supports its operations across various industries globally.

Amidst a dynamic tech landscape, SAP stands out with its strategic partnerships and robust R&D commitment. Recently, SAP's alliance with BGSF Inc. to expand digital transformation services underscores its innovative edge, particularly in deploying SAP S/4HANA and cloud solutions. This move aligns with an impressive 9.6% annual revenue growth forecast, outpacing the German market's 5.4%. Furthermore, SAP's focus on R&D is evident as it channels significant investments into this area, fostering advancements that promise to keep it at the forefront of technological evolution and customer satisfaction in a competitive industry.

Key Takeaways

- Dive into all 43 of the German High Growth Tech and AI Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADV

Adtran Networks

Engages in the development, manufacture, and sale of optical and Ethernet-based networking solutions for telecommunications carriers and enterprises to deliver data, storage, voice, and video services.