- Germany

- /

- Entertainment

- /

- XTRA:EDL

3 German Dividend Stocks Yielding Up To 7.9%

Reviewed by Simply Wall St

As the German DAX index recently surged by over 4%, buoyed by hopes for interest rate cuts and China's new stimulus measures, investors are increasingly looking towards stable income opportunities in Europe's largest economy. In this context, dividend stocks stand out as a compelling option, offering potential steady returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Edel SE KGaA (XTRA:EDL) | 6.73% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.79% | ★★★★★★ |

| SAF-Holland (XTRA:SFQ) | 5.29% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.69% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.52% | ★★★★★☆ |

| Allianz (XTRA:ALV) | 4.73% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.24% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.39% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.23% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.66% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top German Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

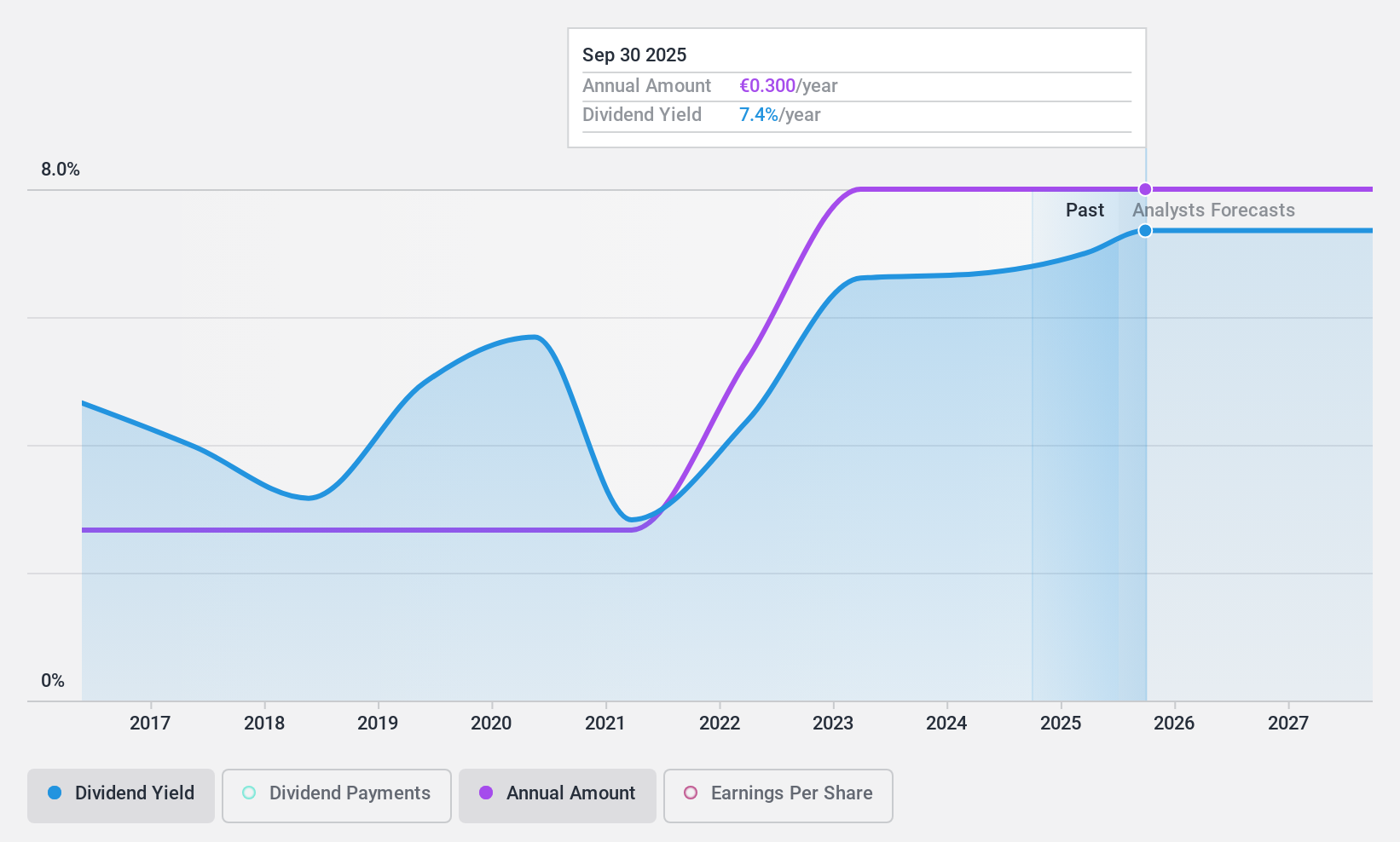

Edel SE KGaA (XTRA:EDL)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Edel SE & Co. KGaA, along with its subsidiaries, functions as an independent music company in Europe and has a market capitalization of €94.88 million.

Operations: Edel SE & Co. KGaA, through its subsidiaries, generates revenue by operating as an independent music company in Europe.

Dividend Yield: 6.7%

Edel SE KGaA offers a compelling dividend profile with a 6.73% yield, placing it in the top 25% of German dividend payers. Over the past decade, dividends have been stable and growing, supported by earnings and cash flows with payout ratios of 52.7% and 71%, respectively. Despite its high debt level, the company trades at a significant discount to estimated fair value, suggesting potential for capital appreciation alongside reliable income streams.

- Click here to discover the nuances of Edel SE KGaA with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Edel SE KGaA's current price could be quite moderate.

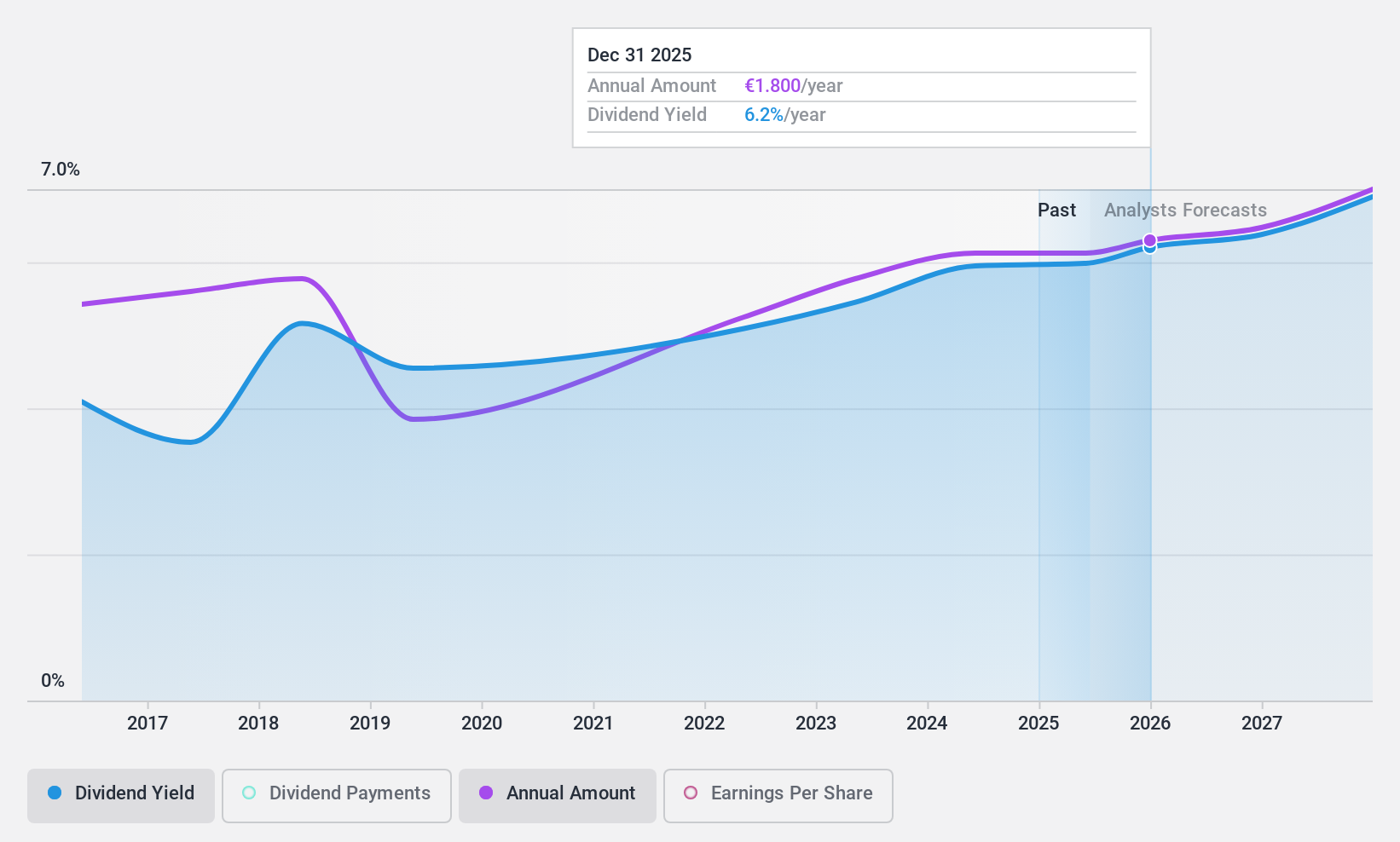

PWO (XTRA:PWO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PWO AG manufactures and sells lightweight construction aluminum sheet components made of steel for the mobility industry across Germany, Czechia, Canada, Mexico, Serbia, and China, with a market cap of €93.75 million.

Operations: PWO AG generates its revenue from the Auto Parts & Accessories segment, amounting to €564.29 million.

Dividend Yield: 5.8%

PWO AG's dividend yield of 5.83% ranks in the top 25% of German dividend payers, supported by a low payout ratio of 38% and a cash payout ratio of 19.5%, indicating strong coverage by earnings and cash flows. However, its dividends have been volatile over the past decade, lacking consistent growth. Recent earnings showed modest sales growth but declining net income, raising concerns about financial stability amid insufficient interest coverage by earnings.

- Click to explore a detailed breakdown of our findings in PWO's dividend report.

- In light of our recent valuation report, it seems possible that PWO is trading behind its estimated value.

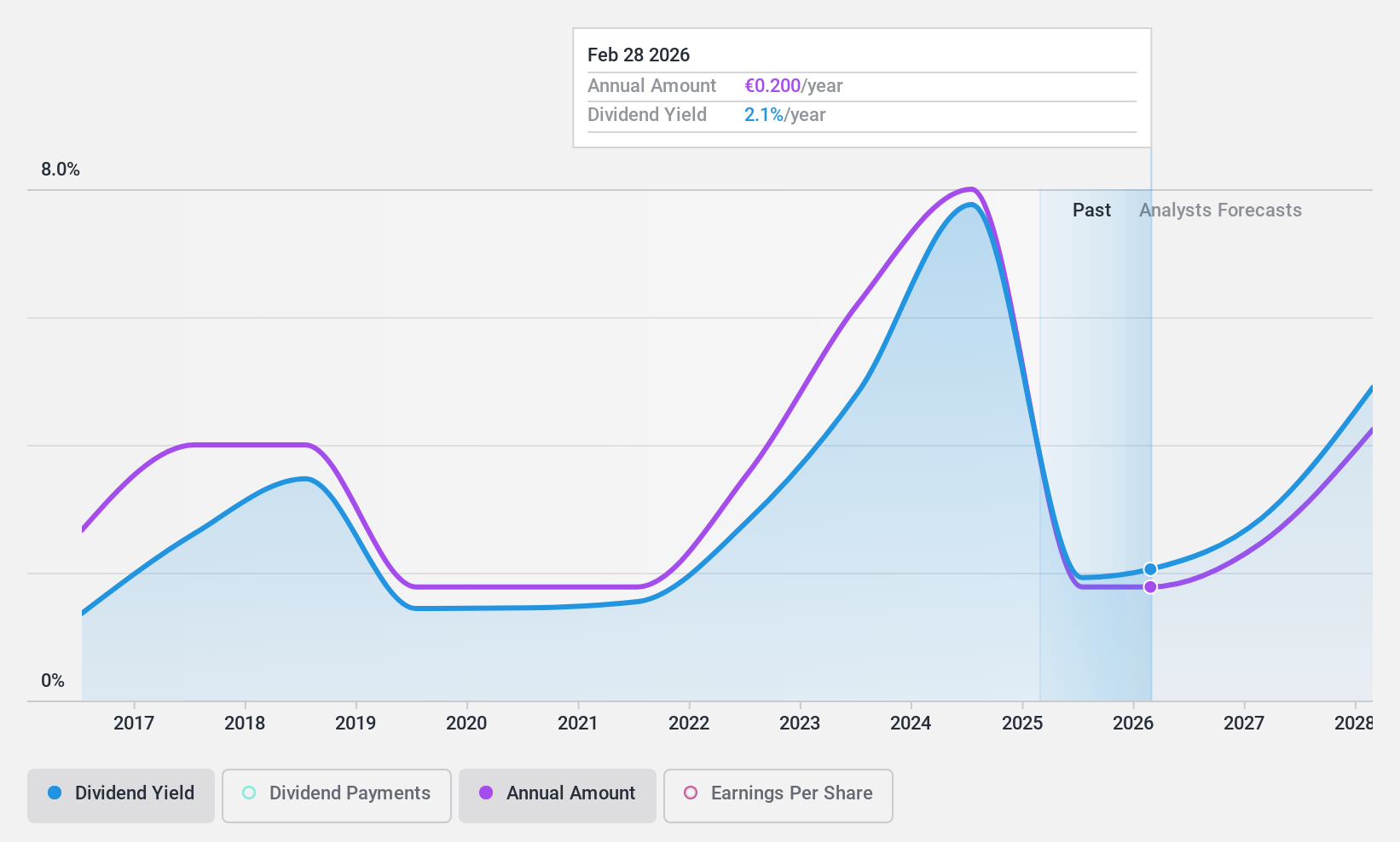

Südzucker (XTRA:SZU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Südzucker AG is a company that produces and sells sugar products across Germany, the rest of the European Union, the United Kingdom, the United States, and internationally with a market cap of approximately €2.30 billion.

Operations: Südzucker AG's revenue is derived from several segments, including Sugar (€4.59 billion), Special Products excluding Starch (€2.40 billion), Fruit (€1.58 billion), CropEnergies (€1.16 billion), and Starch (€1.12 billion).

Dividend Yield: 8%

Südzucker offers a dividend yield of 7.98%, placing it in the top 25% of German dividend payers, supported by a payout ratio of 39.4% and a cash payout ratio of 23.4%. Despite strong coverage, its dividends have been volatile over the past decade without consistent growth. Recent earnings showed sales at €2.55 billion but net income declined to €83 million, highlighting potential financial challenges as future earnings are forecasted to decline significantly.

- Get an in-depth perspective on Südzucker's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Südzucker shares in the market.

Where To Now?

- Unlock more gems! Our Top German Dividend Stocks screener has unearthed 31 more companies for you to explore.Click here to unveil our expertly curated list of 34 Top German Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edel SE KGaA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EDL

6 star dividend payer and undervalued.