SAP Stock Dips 12% After AI and Cloud Expansion News — Is There Still Value?

Reviewed by Bailey Pemberton

- Ever wondered if SAP is a hidden value gem or if the run-up in its stock has made it too pricey for new investors?

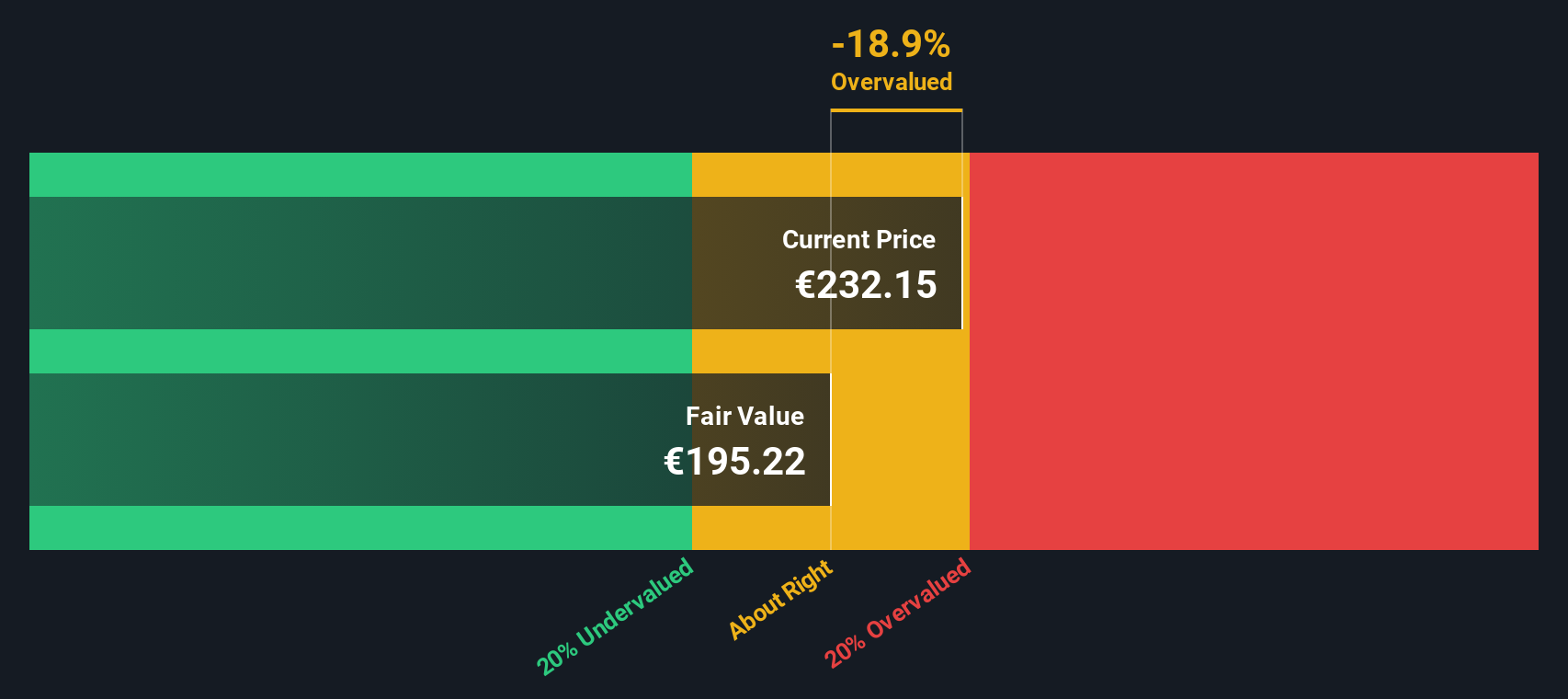

- SAP's shares have had quite a ride, with a three-year return of 106.5% and five-year gains of 119.7%. However, recent momentum has cooled down, with a 12.2% dip over the past month and a year-to-date decline of 14.1%.

- Recent headlines have put the spotlight on SAP's expansion into artificial intelligence partnerships and cloud offerings. This has fueled fresh debate about its growth potential and competitive positioning. The market seems to be adjusting to these updates, as investors reassess both risks and opportunities following these high-profile announcements.

- Right now, SAP scores a 3 out of 6 on our valuation checks, pointing to a market that sees both strengths and limits in the current price. We will break down how analysts typically value SAP and explain an even smarter way to assess whether now is the right time to buy, so stay tuned for that at the end.

Approach 1: SAP Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating a company's future cash flows and then discounting those amounts back to today using an appropriate rate. This gives an intrinsic value that reflects what those future earnings are worth in current terms.

SAP's most recent twelve-month Free Cash Flow sits at approximately €6.4 billion. Analyst forecasts expect robust annual growth, with Free Cash Flow projected to reach €11.3 billion by 2027 and extrapolated to €16.9 billion by 2035. While analysts provide estimates up to five years out, further projections are generated using Simply Wall St’s models to give a fuller long-term picture.

Based on these forecasts and the 2 Stage Free Cash Flow to Equity approach, SAP’s intrinsic value works out to €253.50 per share. With the current share price trading at a 19.2% discount to this estimate, DCF suggests SAP is undervalued by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SAP is undervalued by 19.2%. Track this in your watchlist or portfolio, or discover 924 more undervalued stocks based on cash flows.

Approach 2: SAP Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is one of the most popular valuation tools for assessing profitable companies like SAP. This metric helps investors understand how much the market is willing to pay today for each euro of SAP’s earnings. It is especially useful when a company has strong and consistent profitability.

Generally, higher growth expectations or lower risk justify a higher PE ratio, while slower growth or higher uncertainty pull it down. The “right” PE also depends on market sentiment and how SAP compares to its rivals and broader industry trends.

SAP currently trades at a PE ratio of 33.7x. For context, the average PE for the Software industry is 27.0x, and SAP’s direct peers average about 30.5x. This indicates that investors are willing to pay a premium for SAP, likely due to its solid earnings profile and future prospects.

Simply Wall St's proprietary “Fair Ratio” provides a more tailored benchmark, taking into account SAP’s earnings growth, risk profile, margins, industry, and market cap. Unlike simple peer or industry comparisons, the Fair Ratio approach paints a more complete picture by analyzing factors unique to SAP and its competitive landscape.

For SAP, the Fair Ratio comes in at 39.6x. Since SAP’s current PE is below this fair value benchmark, this suggests that, despite a premium over the industry, the stock may actually be trading at an attractive valuation after accounting for all relevant fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1435 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SAP Narrative

Earlier we mentioned there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story and set of assumptions about a company. For SAP, that means turning your views on future revenue, earnings, and margins into a tailored financial forecast and fair value estimate.

Rather than relying solely on analyst targets or standard metrics, Narratives help you tie SAP’s latest developments to numbers that reflect your own convictions. They make valuation more dynamic by updating as new information, like earnings or news, arrives, so you always have a clear, current view of whether SAP’s price looks attractive compared to your fair value.

Narratives are easy to use and fully accessible on Simply Wall St’s Community page, and are already relied upon by millions of investors. With Narratives, you can see at a glance where your forecast stands. For example, one investor believes SAP’s fair value is as high as €345, while another estimates it as low as €192. You can then decide how the price compares to what you think the company is really worth.

Do you think there's more to the story for SAP? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAP

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success