- Spain

- /

- Commercial Services

- /

- BME:CASH

Prosegur Cash And 2 European Stocks That Could Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

Amid renewed concerns over inflated AI stock valuations and receding expectations for a U.S. interest rate cut, European markets have seen a downturn, with major indices like the STOXX Europe 600 Index ending lower. In such an environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors looking to navigate these challenging market conditions effectively.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vimi Fasteners (BIT:VIM) | €1.07 | €2.12 | 49.4% |

| Talgo (BME:TLGO) | €2.705 | €5.35 | 49.4% |

| STEICO (XTRA:ST5) | €20.10 | €40.10 | 49.9% |

| Roche Bobois (ENXTPA:RBO) | €34.80 | €69.37 | 49.8% |

| Micro Systemation (OM:MSAB B) | SEK64.60 | SEK127.66 | 49.4% |

| HMS Bergbau (XTRA:HMU) | €52.00 | €103.88 | 49.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.392 | €0.78 | 49.9% |

| EcoUp Oyj (HLSE:ECOUP) | €1.32 | €2.64 | 50% |

| Delivery Hero (XTRA:DHER) | €16.02 | €31.79 | 49.6% |

| Daldrup & Söhne (XTRA:4DS) | €16.05 | €31.48 | 49% |

Below we spotlight a couple of our favorites from our exclusive screener.

Prosegur Cash (BME:CASH)

Overview: Prosegur Cash, S.A. offers integrated cash cycle management solutions and payment automation for various sectors including retail and financial institutions across Europe, LATAM, and internationally, with a market cap of €1.02 billion.

Operations: Prosegur Cash generates revenue by providing cash cycle management and payment automation services to sectors such as retail, financial institutions, government agencies, and more across Europe, LATAM, and globally.

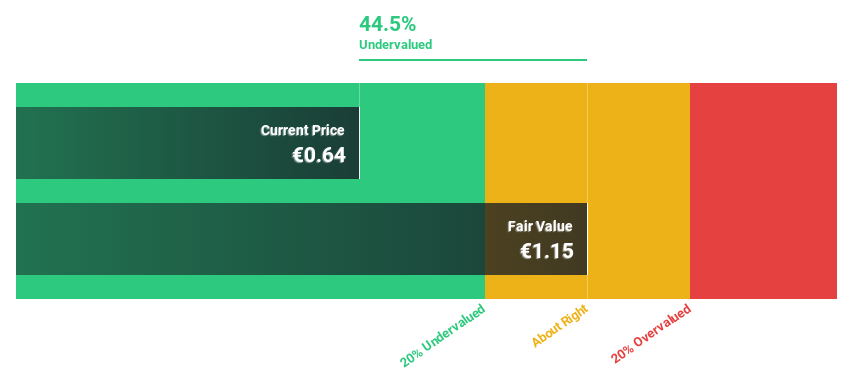

Estimated Discount To Fair Value: 33%

Prosegur Cash appears undervalued based on cash flows, trading 33% below its fair value estimate of €1.04 per share. Despite a strong earnings growth forecast of 15.66% annually, the company's debt is not adequately covered by operating cash flow, posing a potential risk. Revenue growth is modestly above the Spanish market average, and analysts agree on a potential price increase of 27.3%. However, its dividend yield of 5.82% lacks coverage by earnings.

- Our comprehensive growth report raises the possibility that Prosegur Cash is poised for substantial financial growth.

- Navigate through the intricacies of Prosegur Cash with our comprehensive financial health report here.

Sanoma Oyj (HLSE:SANOMA)

Overview: Sanoma Oyj is a media and learning company operating in Finland, the Netherlands, Poland, Spain, Belgium, and internationally with a market cap of €1.67 billion.

Operations: The company's revenue is primarily derived from its Learning segment, which generates €754 million, and its Media Finland segment, contributing €564.30 million.

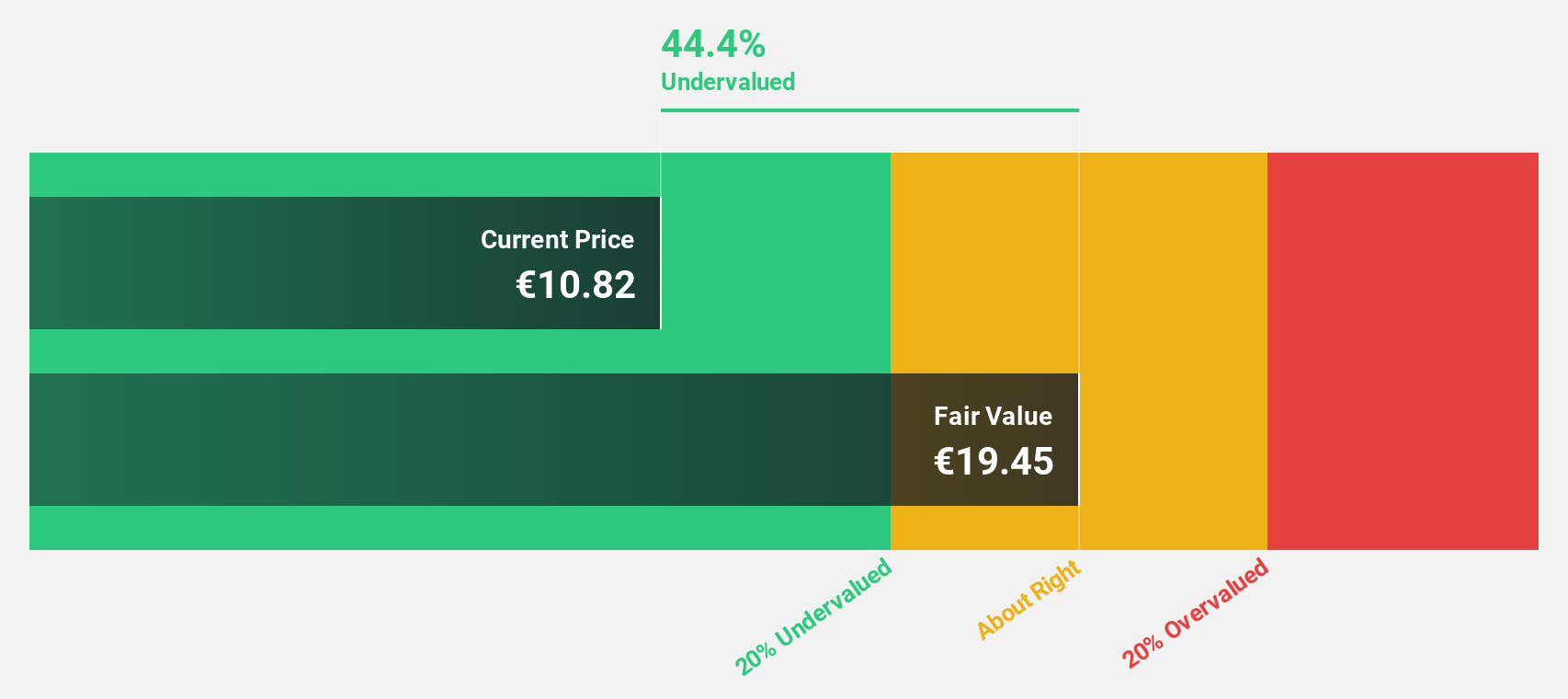

Estimated Discount To Fair Value: 44.8%

Sanoma Oyj is trading significantly below its estimated fair value of €18.58 per share, with a current price of €10.26, indicating potential undervaluation based on cash flows. Despite a high debt level and declining profit margins (from 2% to 0.9%), earnings are forecast to grow substantially at 60.2% annually, outpacing the Finnish market's growth rate of 16.9%. Recent guidance suggests operational EBIT will be at the higher end of expectations for 2025 (€180-190 million).

- Our growth report here indicates Sanoma Oyj may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Sanoma Oyj.

Nemetschek (XTRA:NEM)

Overview: Nemetschek SE offers software solutions for architecture, engineering, construction, operation, and media industries globally and has a market cap of €10.36 billion.

Operations: Nemetschek SE's revenue is derived from its software solutions across four primary segments: Build (€453.38 million), Media (€121.29 million), Design (€534.37 million), and Manage (€51.07 million).

Estimated Discount To Fair Value: 21.2%

Nemetschek is trading at €89.7, significantly below its estimated fair value of €113.83, suggesting undervaluation based on cash flows. The company reported strong third-quarter results with revenue increasing to €295.08 million and net income rising to €55.26 million year-over-year. Earnings are projected to grow 18.6% annually, outpacing the German market's 16.7% growth rate, while revenue growth is forecasted at 12.5%. Analysts agree on a potential price increase of 37.9%.

- Our expertly prepared growth report on Nemetschek implies its future financial outlook may be stronger than recent results.

- Take a closer look at Nemetschek's balance sheet health here in our report.

Where To Now?

- Click through to start exploring the rest of the 196 Undervalued European Stocks Based On Cash Flows now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CASH

Prosegur Cash

Provides integrated cash cycle management solutions and automating payments in retail establishments and ATM management for financial institutions, retail establishments, business, government agencies, central banks, mints, and jewellery stores in Europe, LATAM, and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives