As the German market experiences a notable upswing, with the DAX surging 4.03% amid hopes for interest rate cuts and China's stimulus measures lifting sentiment, investors are increasingly focusing on dividend stocks as a potential source of steady returns in uncertain economic times. In this context, Siemens and two other prominent companies on the German exchange stand out for their robust dividend yields, offering potential stability and income in an evolving market landscape.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Edel SE KGaA (XTRA:EDL) | 6.76% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.76% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.81% | ★★★★★★ |

| SAF-Holland (XTRA:SFQ) | 5.29% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.69% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.46% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.34% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.36% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.28% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.64% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top German Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

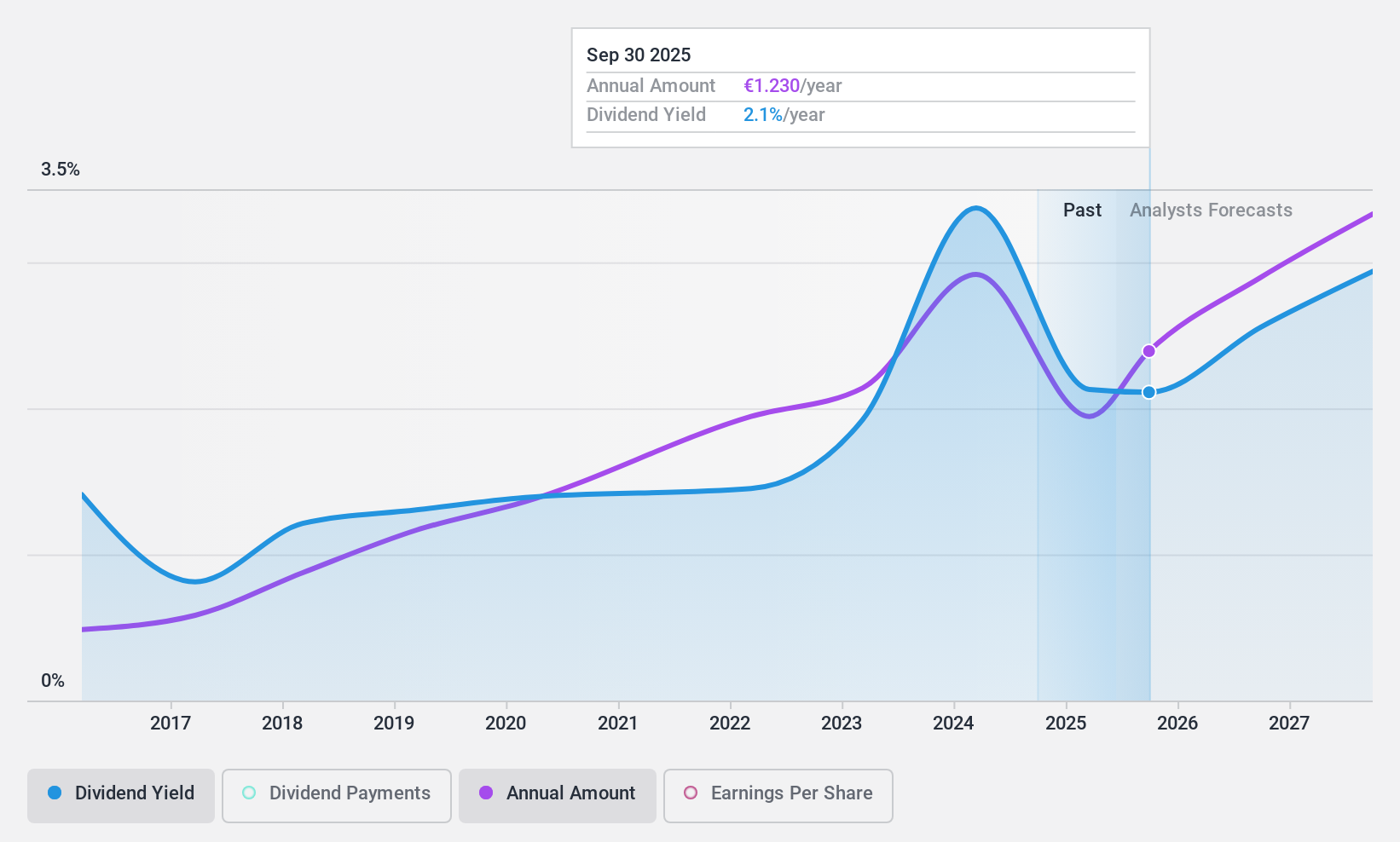

DATAGROUP (XTRA:D6H)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DATAGROUP SE offers information technology solutions both in Germany and internationally, with a market cap of €361.59 million.

Operations: DATAGROUP SE generates revenue primarily from its Services segment, which accounts for €456.25 million, and its Solutions & Consulting segment, contributing €77.59 million.

Dividend Yield: 3.5%

DATAGROUP, recently added to the S&P Global BMI Index, offers a mixed picture for dividend investors. While its dividend payments have grown over the past decade and are well-covered by earnings and cash flows with payout ratios of 48.1% and 28.2%, respectively, they have been volatile and unreliable historically. Trading at a significant discount to its estimated fair value, DATAGROUP's current yield of 3.46% is lower than top-tier German dividend payers.

- Click here and access our complete dividend analysis report to understand the dynamics of DATAGROUP.

- Our valuation report unveils the possibility DATAGROUP's shares may be trading at a discount.

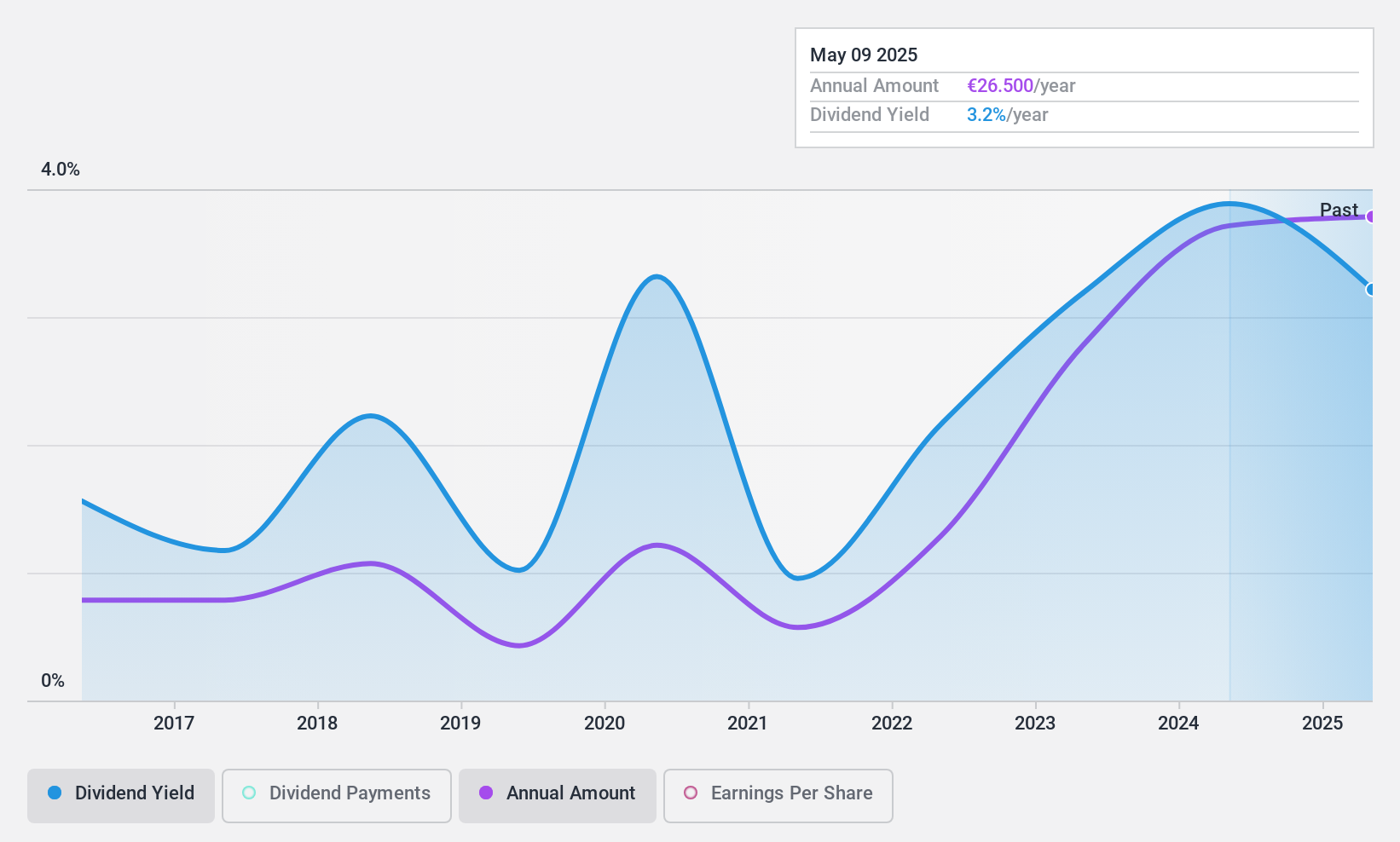

KSB SE KGaA (XTRA:KSB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KSB SE & Co. KGaA, along with its subsidiaries, manufactures and supplies pumps, valves, and related services globally with a market capitalization of approximately €1.09 billion.

Operations: KSB SE & Co. KGaA generates revenue from its three main segments: Pumps (€1.52 billion), Fittings (€370.94 million), and KSB Supremeserv (€978.20 million).

Dividend Yield: 3.9%

KSB SE KGaA's dividend payments have grown over the past decade but remain volatile and unreliable. The current yield of 3.91% is below top-tier German dividend payers, yet dividends are well-covered by earnings and cash flows with payout ratios of 29.9% and 24.2%, respectively. Trading at a considerable discount to its fair value, KSB reported sales of €1.44 billion for H1 2024, with net income slightly down from the previous year.

- Dive into the specifics of KSB SE KGaA here with our thorough dividend report.

- Our valuation report here indicates KSB SE KGaA may be undervalued.

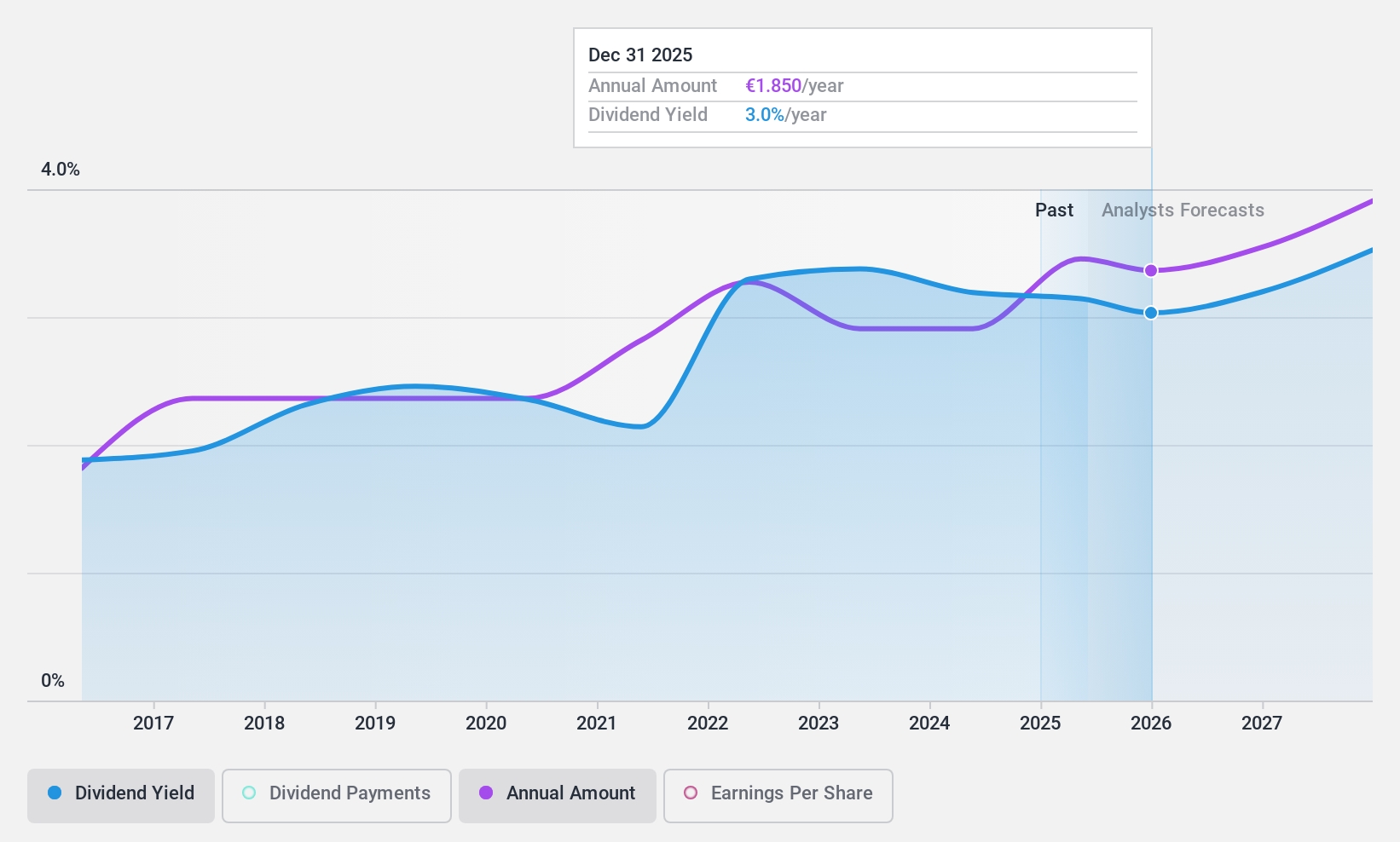

Uzin Utz (XTRA:UZU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Uzin Utz SE develops, manufactures, and sells construction chemical system products in Germany, the United States, Netherlands, and internationally with a market cap of €240.11 million.

Operations: Uzin Utz SE generates revenue from several segments, including Germany - Laying Systems (€209.68 million), Western Europe (€81.64 million), Netherlands - Laying Systems (€83.59 million), USA - Laying Systems (€73.60 million), Netherlands - Wholesale (€33.66 million), Germany - Surface Care and Refinement (€34.21 million), South/Eastern Europe (€27.70 million), and Germany - Machinery and Tools (€31.94 million).

Dividend Yield: 3.4%

Uzin Utz SE maintains stable and growing dividend payments, supported by a low payout ratio of 33.8% and a cash payout ratio of 19.9%, ensuring sustainability. While its dividend yield of 3.36% is below top-tier German payers, it remains reliable over the past decade. The company's price-to-earnings ratio of 10x suggests good value compared to the broader market. Recent earnings show improved net income at €12.38 million for H1 2024 despite slightly lower sales revenue.

- Navigate through the intricacies of Uzin Utz with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Uzin Utz is priced higher than what may be justified by its financials.

Next Steps

- Access the full spectrum of 34 Top German Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:D6H

DATAGROUP

Provides information technology (IT) solutions in Germany and internationally.

Very undervalued with adequate balance sheet and pays a dividend.