- Italy

- /

- Electrical

- /

- BIT:CMB

3 Dividend Stocks Offering Yields Up To 7.2%

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are closely watching sector performances and interest rate expectations. Amidst these dynamics, dividend stocks have gained attention for their potential to provide steady income streams, particularly in a volatile economic environment. In such conditions, a good dividend stock often combines reliable yield with strong fundamentals to weather market fluctuations effectively.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.61% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.57% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.15% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.76% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.75% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.84% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.85% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.57% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.46% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

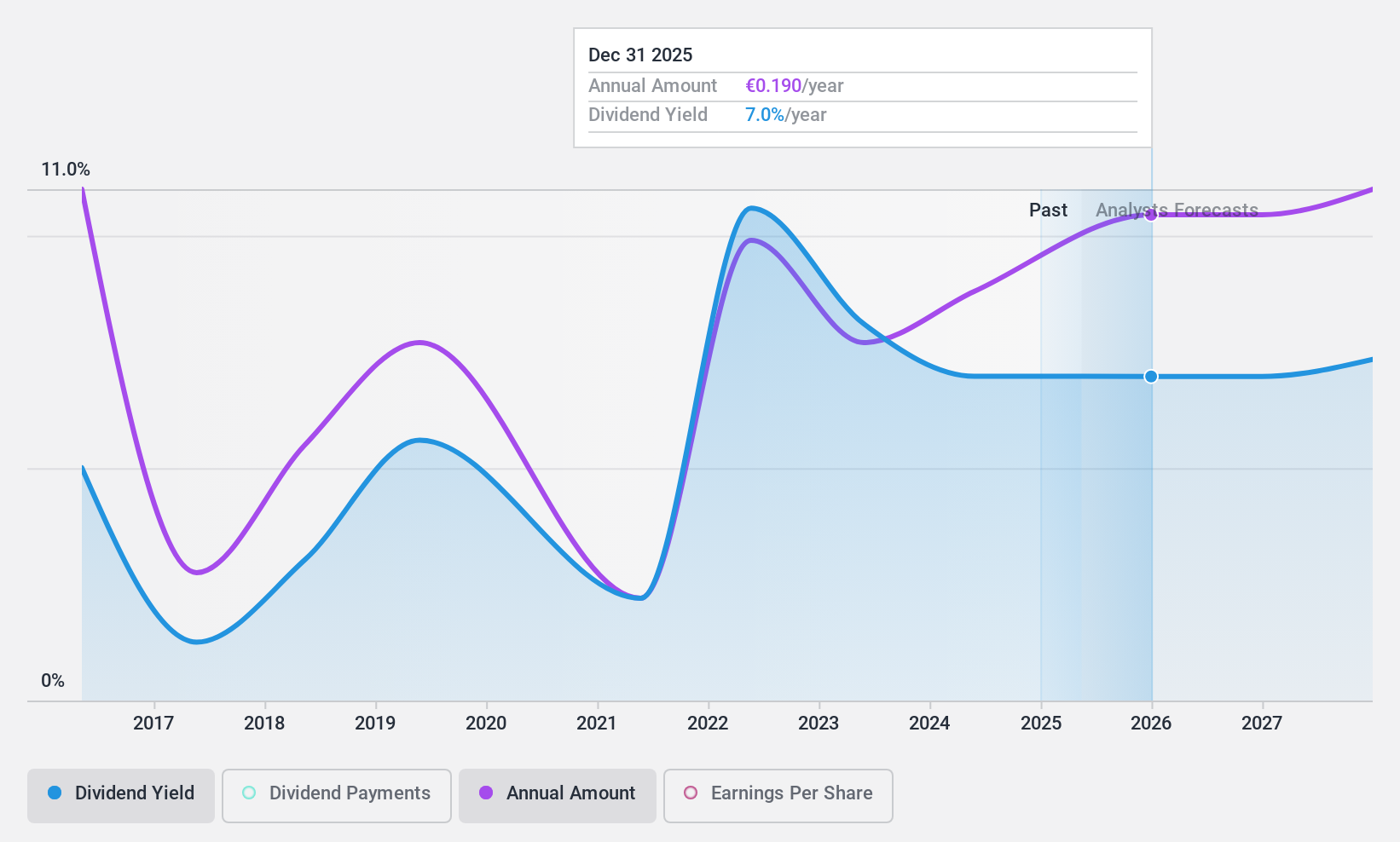

Cairo Communication (BIT:CAI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cairo Communication S.p.A. is a communication company operating mainly in Italy and Spain, with a market cap of €296.39 million.

Operations: Cairo Communication S.p.A. generates revenue through its operations in the communication sector, focusing on activities primarily in Italy and Spain.

Dividend Yield: 7.2%

Cairo Communication's dividend yield is among the top 25% in Italy, offering a 7.22% return, though its dividends have been volatile over the past decade. Despite this instability, current dividends are well-covered by earnings and cash flows with payout ratios of 50.2% and 23.8%, respectively. The stock trades significantly below estimated fair value, suggesting potential for capital appreciation alongside income generation. Recent earnings show improved net income to €16.7 million despite slightly lower sales revenue.

- Get an in-depth perspective on Cairo Communication's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Cairo Communication is trading behind its estimated value.

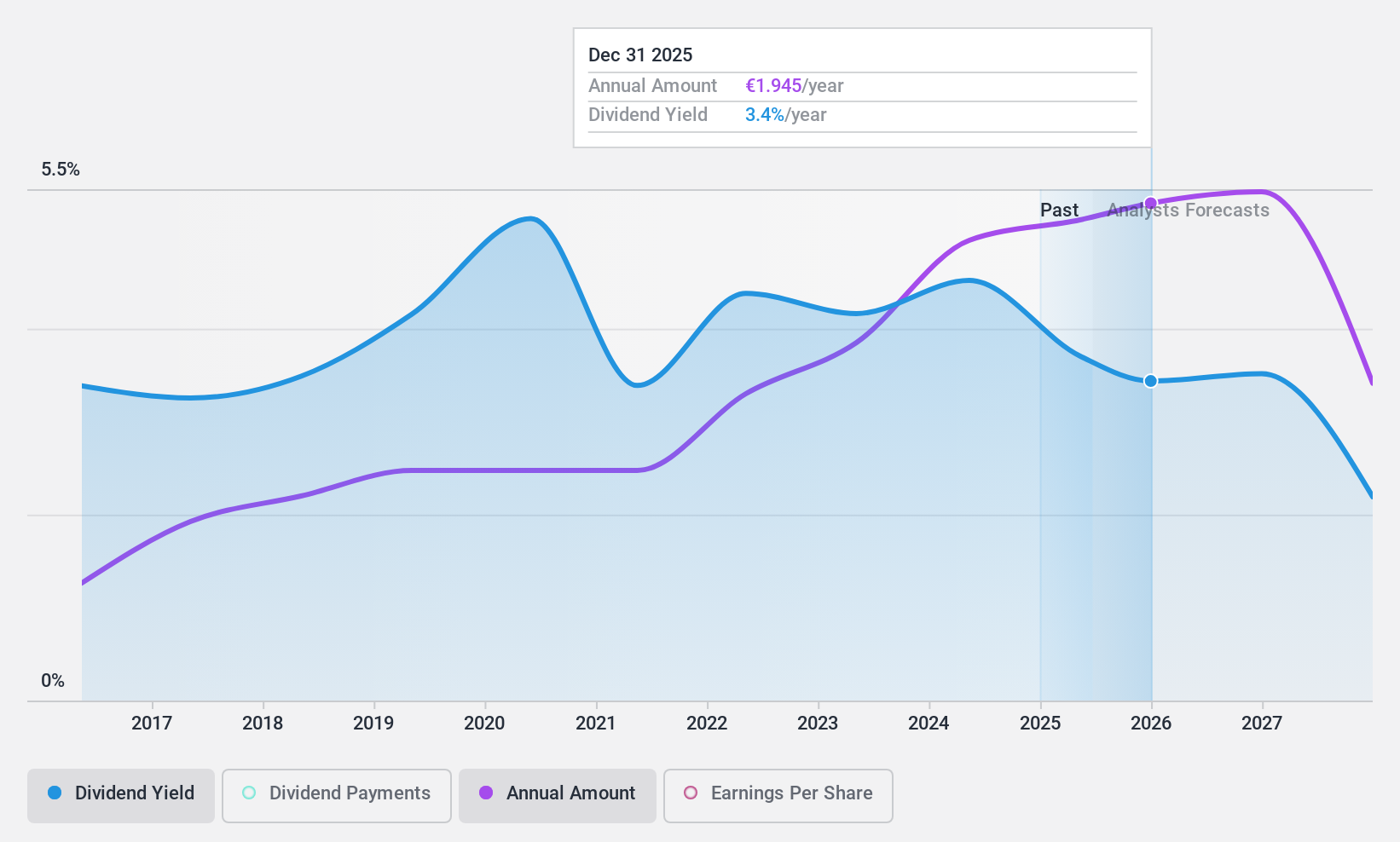

Cembre (BIT:CMB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cembre S.p.A. manufactures and sells electrical connectors, cable accessories, and related tools in Italy, Europe, and internationally with a market cap of €655.10 million.

Operations: Cembre S.p.A.'s revenue is primarily derived from the manufacture and sale of electrical connectors, cable accessories, and related tools across Italy, Europe, and international markets.

Dividend Yield: 4.5%

Cembre's dividend yield of 4.52% is below the top quartile in Italy, and its high cash payout ratio of 148% indicates dividends are not well covered by free cash flows, though earnings coverage is adequate with an 80% payout ratio. Dividends have been stable and growing over the past decade, reflecting reliability despite sustainability concerns. Recent earnings show net income declined to €29.13 million for nine months ending September 2024, amidst modest sales growth to €171.3 million.

- Take a closer look at Cembre's potential here in our dividend report.

- The analysis detailed in our Cembre valuation report hints at an inflated share price compared to its estimated value.

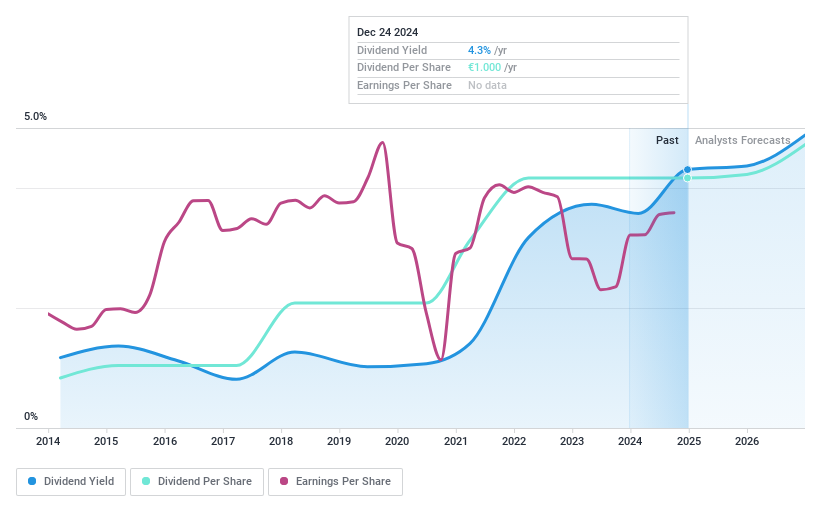

Cancom (XTRA:COK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cancom SE, along with its subsidiaries, offers information technology services both in Germany and internationally, with a market capitalization of approximately €765.19 million.

Operations: Cancom SE's revenue is primarily derived from its information technology services offered in Germany and abroad.

Dividend Yield: 4.1%

Cancom's dividend yield of 4.11% is lower than the top quartile in Germany, yet dividends are well covered by cash flows with a low cash payout ratio of 22.8%. Despite recent earnings guidance being lowered due to market uncertainties, Cancom's dividends have been stable and growing over the past decade. Earnings grew significantly by 47.8% over the past year, supporting its reliable dividend payments despite a high payout ratio of 87.1%.

- Delve into the full analysis dividend report here for a deeper understanding of Cancom.

- Our valuation report here indicates Cancom may be overvalued.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1956 Top Dividend Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CMB

Cembre

Engages in the manufacture and sale of electrical connectors, cable accessories, and related tools in Italy, the rest of Europe, and internationally.

Flawless balance sheet average dividend payer.