Stock Analysis

High Growth Tech Stocks Featuring ALSO Holding And 2 More

Reviewed by Simply Wall St

In the wake of recent U.S. elections, global markets have experienced significant shifts, with major indices like the small-cap Russell 2000 Index showing notable gains as investors anticipate potential policy changes that could spur economic growth. Amidst this dynamic landscape, identifying high-growth tech stocks becomes crucial for investors seeking to capitalize on emerging opportunities; factors such as innovation potential and adaptability to regulatory changes are key considerations in evaluating these stocks.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Travere Therapeutics | 31.19% | 72.58% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1284 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

ALSO Holding (SWX:ALSN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ALSO Holding AG is a technology services provider for the ICT industry, operating in Switzerland, Germany, the Netherlands, Poland, and internationally with a market capitalization of CHF2.90 billion.

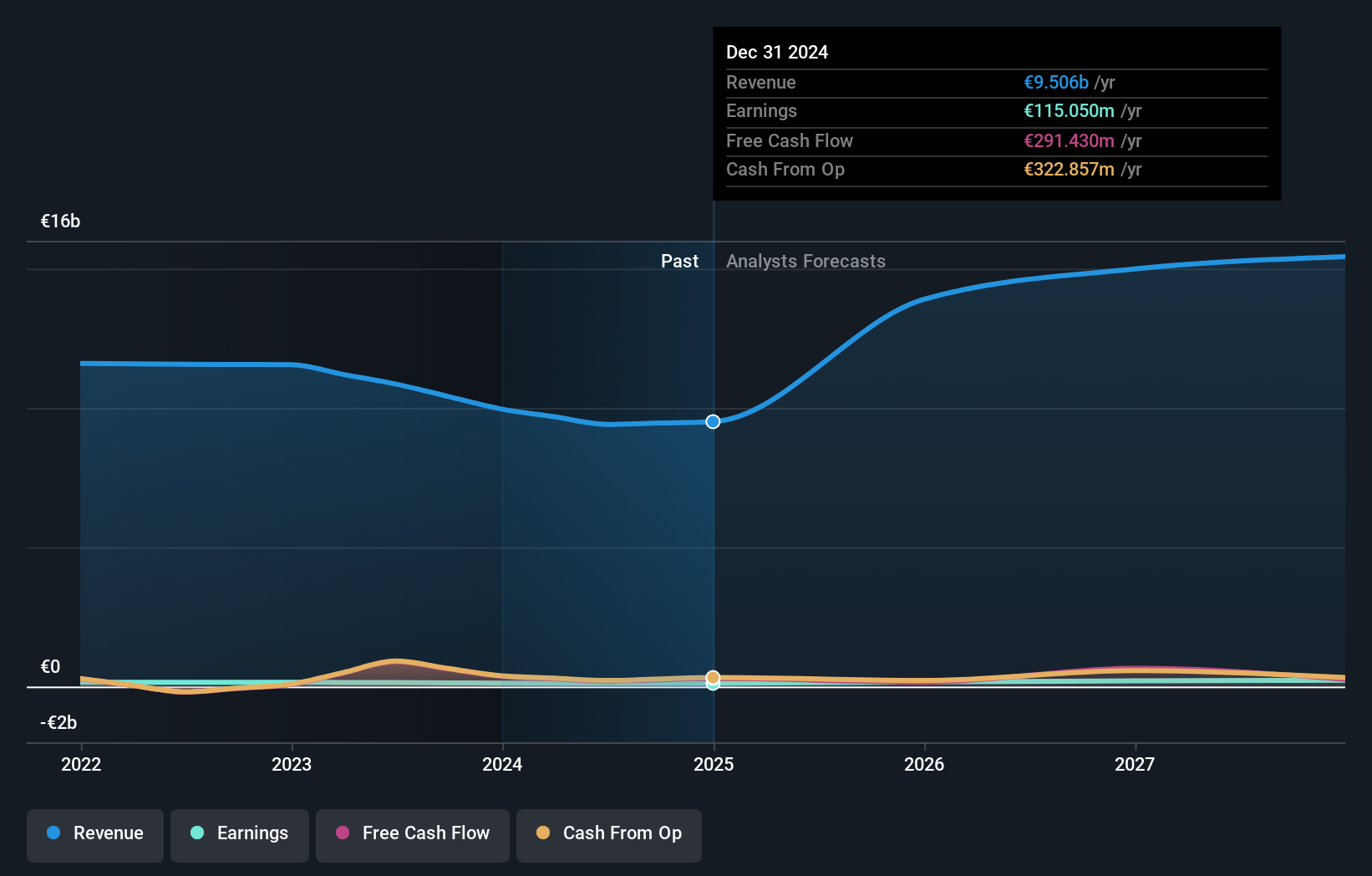

Operations: The company generates revenue primarily from its operations in Central Europe (€4.62 billion) and Northern/Eastern Europe (€5.24 billion). The business model focuses on providing technology services within the ICT industry across multiple regions, with a notable presence in both Central and Northern/Eastern Europe.

ALSO Holding AG, navigating through a challenging tech landscape, has demonstrated resilience with a projected revenue growth of 13% annually, outpacing the Swiss market's 4.1%. Despite a recent downturn in earnings by 20.4%, contrasting with the industry's average of -12.4%, the company is poised for significant recovery with expected earnings growth at an impressive rate of 26.8% per year. This rebound is underscored by their robust R&D investments which have strategically positioned them for future innovations and market competitiveness. At the Baader Investment Conference, ALSO highlighted these strategies, reinforcing their commitment to evolving in high-tech arenas despite current volatilities.

- Unlock comprehensive insights into our analysis of ALSO Holding stock in this health report.

Understand ALSO Holding's track record by examining our Past report.

Fixstars (TSE:3687)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fixstars Corporation is a software company with operations in Japan and internationally, and it has a market cap of ¥50.32 billion.

Operations: Fixstars focuses on software development, offering solutions in high-performance computing and storage optimization. The company generates revenue primarily from its software products and services, with a significant portion of costs attributed to research and development. Its net profit margin reflects the efficiency of its operations in managing expenses relative to income.

Amidst a dynamic tech landscape, Fixstars has demonstrated notable agility with its R&D investments, which have grown significantly to support its strategic positioning in software innovation. With a 14.7% annual revenue growth rate, the company is outpacing the Japanese market average of 4.2%. Furthermore, earnings are projected to surge by 20.5% annually, reflecting robust operational efficiency and market adaptability. Recent developments include a special dividend announced on November 7th and an optimistic earnings report released on September 27th for fiscal year 2024, underlining Fixstars' commitment to shareholder value and its potential for sustained growth in high-tech sectors.

adesso (XTRA:ADN1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: adesso SE, along with its subsidiaries, offers IT services across Germany, Austria, Switzerland, and other international markets with a market capitalization of approximately €434 million.

Operations: The company generates revenue primarily from IT services (€1.39 billion) and IT solutions (€128.12 million). Its business focuses on delivering comprehensive IT solutions across various regions, with a notable emphasis on Germany, Austria, and Switzerland.

Adesso SE, navigating through a challenging tech landscape, reported a significant revenue increase to €633.47 million, up from €548.19 million last year, showcasing its resilience and adaptability in the software sector. Despite this growth, the company faced a net loss of €9.86 million, reflecting ongoing investments in innovation and market expansion efforts. Impressively, earnings are expected to grow by 47.4% annually, positioning Adesso well for future profitability as it continues to enhance its technological offerings and client engagements.

- Take a closer look at adesso's potential here in our health report.

Review our historical performance report to gain insights into adesso's's past performance.

Summing It All Up

- Unlock our comprehensive list of 1284 High Growth Tech and AI Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3687

Fixstars

Operates as a software company in Japan and internationally.