Stock Analysis

High Growth Tech Stocks To Watch In Germany August 2024

Reviewed by Simply Wall St

As the European market experiences a boost from growing hopes of interest rate cuts by the ECB, Germany's DAX has shown notable gains, reflecting positive sentiment among investors. In this environment, identifying high-growth tech stocks becomes crucial as these companies are often well-positioned to capitalize on favorable economic conditions and investor optimism.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ströer SE KGaA | 7.39% | 29.86% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| NAGA Group | 25.85% | 78.32% | ★★★★★☆ |

| medondo holding | 34.52% | 71.99% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| cyan | 27.51% | 67.79% | ★★★★★☆ |

| Rubean | 59.40% | 73.87% | ★★★★★☆ |

| asknet Solutions | 20.06% | 74.86% | ★★★★★☆ |

We'll examine a selection from our screener results.

Northern Data (DB:NB2)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Northern Data AG develops and operates high-performance computing (HPC) infrastructure solutions for businesses and research institutions worldwide, with a market cap of €1.56 billion.

Operations: Northern Data AG generates revenue primarily from its Peak Mining (€156.13 million), Taiga Cloud (€22.13 million), and Ardent Data Centers (€31.46 million) segments, while the Consolidation segment shows a negative contribution (-€178.50 million). The company focuses on providing high-performance computing infrastructure solutions globally.

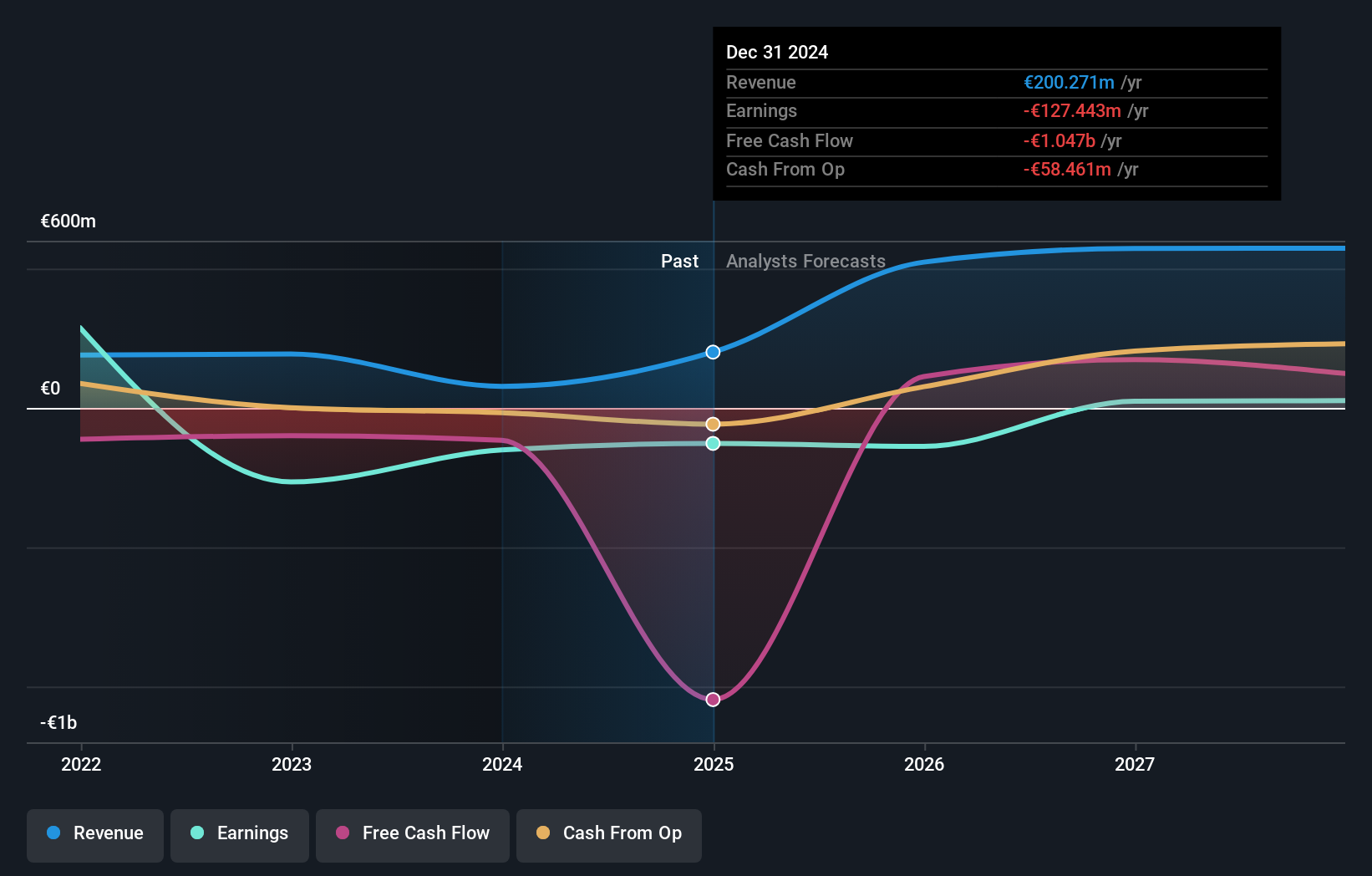

Northern Data AG has shown significant potential in the tech sector, particularly with its AI and cloud computing segments. The company reaffirmed its fiscal year 2024 revenue guidance, targeting €200 million to €240 million, a substantial increase from previous years. Notably, R&D expenses have been pivotal; the company invested heavily in innovation, contributing to a forecasted annual revenue growth of 32.5%. Additionally, Northern Data's earnings are expected to grow by 68.2% annually over the next few years, highlighting robust future prospects despite recent financial challenges.

- Delve into the full analysis health report here for a deeper understanding of Northern Data.

Evaluate Northern Data's historical performance by accessing our past performance report.

All for One Group (XTRA:A1OS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: All for One Group SE, along with its subsidiaries, offers business software solutions for SAP, Microsoft, and IBM across Germany, Switzerland, Austria, Poland, Luxembourg, and internationally; it has a market cap of €227.69 million.

Operations: The company generates revenue primarily from its CORE segment, which contributes €442.47 million, and the LOB segment, which adds €77.01 million. The total market cap stands at €227.69 million.

All for One Group SE has demonstrated notable growth in the tech sector, with a forecasted annual revenue increase of 6.4%, outpacing the German market average of 5.1%. The company has been proactive in R&D, allocating significant resources to innovation, which is reflected in their earnings growth of 59.6% over the past year and a projected annual profit growth rate of 24.6%. Recent financial results show a net income rise to €10.29 million for the nine months ending June 30, 2024, compared to €6.76 million previously, indicating robust operational performance and strategic focus on high-value segments like cloud services and digital transformation solutions.

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Formycon AG, a biotechnology company, develops biosimilar drugs in Germany and Switzerland with a market cap of approximately €937.58 million.

Operations: Formycon AG generates revenue primarily from its drug delivery systems, amounting to €60.80 million. The company focuses on developing biosimilar drugs in Germany and Switzerland.

Formycon AG has shown significant growth potential, with a projected annual revenue increase of 32.5% and earnings forecasted to grow at 30.9% per year, outpacing the German market's average growth rates. Despite a challenging first half in 2024, with sales dropping to €26.89 million from €43.79 million and a net loss of €10.09 million compared to a previous net income of €1.8 million, the company's strategic focus on biosimilars positions it well for future recovery and expansion in the biotech sector through robust R&D investments.

- Dive into the specifics of Formycon here with our thorough health report.

Assess Formycon's past performance with our detailed historical performance reports.

Summing It All Up

- Click this link to deep-dive into the 48 companies within our German High Growth Tech and AI Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FYB

Formycon

A biotechnology company, develops biosimilar drugs in Germany and Switzerland.