- Germany

- /

- Electrical

- /

- XTRA:S92

SMA Solar Technology AG's (ETR:S92) Shares Bounce 41% But Its Business Still Trails The Market

SMA Solar Technology AG (ETR:S92) shares have continued their recent momentum with a 41% gain in the last month alone. But the last month did very little to improve the 62% share price decline over the last year.

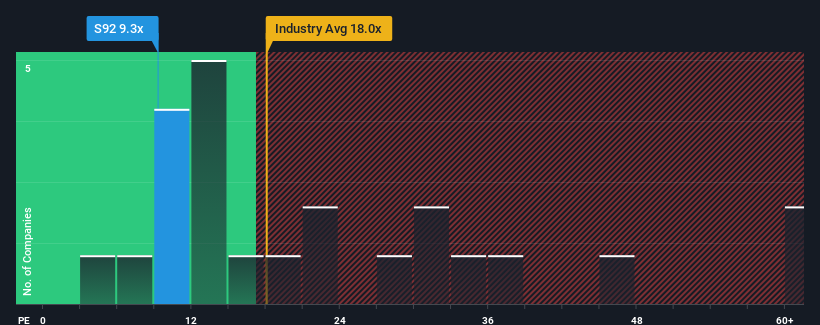

In spite of the firm bounce in price, SMA Solar Technology may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 9.3x, since almost half of all companies in Germany have P/E ratios greater than 18x and even P/E's higher than 31x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, SMA Solar Technology's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for SMA Solar Technology

Is There Any Growth For SMA Solar Technology?

The only time you'd be truly comfortable seeing a P/E as low as SMA Solar Technology's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 64%. Still, the latest three year period has seen an excellent 134% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 83% as estimated by the five analysts watching the company. Meanwhile, the broader market is forecast to expand by 18%, which paints a poor picture.

With this information, we are not surprised that SMA Solar Technology is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

The latest share price surge wasn't enough to lift SMA Solar Technology's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that SMA Solar Technology maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 4 warning signs we've spotted with SMA Solar Technology (including 2 which are a bit unpleasant).

Of course, you might also be able to find a better stock than SMA Solar Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:S92

SMA Solar Technology

Develops, produces, and sells PV and battery inverters, monitoring systems for PV systems, and charging solutions for electric vehicles in Germany and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives