- Germany

- /

- Semiconductors

- /

- XTRA:AIXA

AIXTRON (XTRA:AIXA) Margin Decline Challenges Optimism as Premium Valuation Persists

Reviewed by Simply Wall St

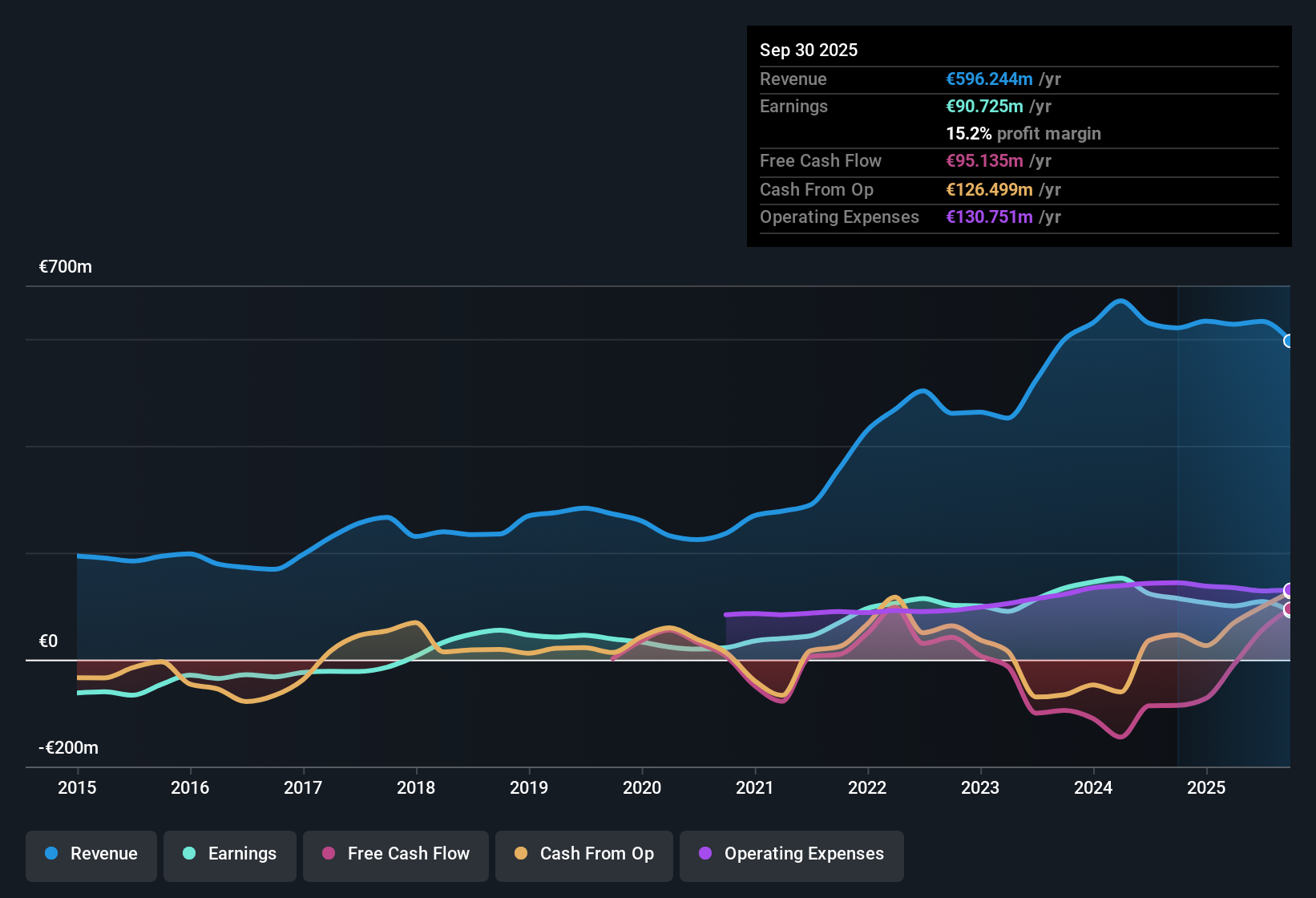

AIXTRON (XTRA:AIXA) reported earnings growth that continues to outpace the broader German market, with forecasts calling for an 18.4% increase in earnings per year and a 9.4% rise in revenue. Both of these figures are ahead of the market’s 6.1% growth expectation. Over the past five years, the company’s earnings have grown at a robust 19.4% annualized rate, though the most recent net profit margin fell to 17.2% from last year’s 19.6%. Investors are watching closely as margins compress, but consistent growth forecasts and high quality past performance offer reasons for optimism.

See our full analysis for AIXTRON.Next, we’ll see how these headline results compare to the widely followed narratives and investor expectations for AIXTRON, highlighting where the numbers support or challenge the story.

See what the community is saying about AIXTRON

Margins Trend Down as Growth Remains

- AIXTRON's net profit margin slipped to 17.2%, down from 19.6% the previous year, even as high-quality earnings growth continues.

- Analysts' consensus view emphasizes that margin pressure has not derailed long-term optimism:

- The push into advanced compound semiconductors like SiC and GaN is creating significant new market opportunities. The flexible G10 platform is positioned to capture these opportunities, which may support future margin improvement once overcapacity is digested.

- Recurring high-margin service and aftersales revenue is set to stabilize and boost profits as the installed G10 tool base grows across diverse regions. This provides a buffer against short-term margin swings in equipment sales.

- To see if analysts think margin pressure or product innovation will win out over the next several years, check the full AIXTRON consensus narrative for details.📊 Read the full AIXTRON Consensus Narrative.

Share Price Trades Above DCF Fair Value

- With the current share price at €13.88, AIXTRON trades well above its DCF fair value estimate of €4.30. This raises valuation questions among investors.

- According to the analysts' consensus view, investors are paying a premium for sustained revenue growth and sector leadership:

- The company’s 14.4x price-to-earnings multiple is above peer averages (12.3x), but still significantly below the European semiconductor industry average of 33.8x. This suggests both room for upside and caution regarding paying too much for future growth.

- Consensus price targets reflect divided opinion. The average target is €15.05, with a range from as conservative as €10.90 to as bullish as €22.00. This underlines sensitivity to shifts in margin trends and technology adoption rates.

Profit Forecasts Show Wide Analyst Split

- For 2028, analysts expect AIXTRON's earnings to reach €113.5 million, but estimates range significantly from €90.2 million on the low end to €148 million on the high end, reflecting considerable uncertainty.

- Within the consensus narrative, this division hinges on fast-evolving end-market demand:

- Bulls argue new growth in optoelectronics and next-generation semiconductors will push earnings toward the high end of forecasts, especially as global digital infrastructure ramps up and the product mix shifts toward higher-value equipment.

- Bears point to risks such as persistent overcapacity, sluggish adoption in emerging applications like micro LED, and exposure to Asian demand and forex volatility, which could keep actual results closer to the lower range.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AIXTRON on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures above? Use just a few minutes to craft your own narrative and share your viewpoint. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding AIXTRON.

See What Else Is Out There

Despite AIXTRON’s ongoing revenue growth, its compressed profit margins and share price premium highlight valuation risks that could limit near-term upside.

Want more attractive entry points? Use these 833 undervalued stocks based on cash flows to spot companies that offer better value based on robust cash flow fundamentals and analyst price targets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:AIXA

AIXTRON

Provides deposition equipment to the semiconductor industry in Asia, Europe, and the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives