- Germany

- /

- Specialty Stores

- /

- XTRA:ZAL

A Look at Zalando (XTRA:ZAL) Valuation Following Anna Dimitrova’s Appointment as CFO

Reviewed by Simply Wall St

Zalando (XTRA:ZAL) just named Anna Dimitrova as its new Chief Financial Officer. The company is bringing in a seasoned finance leader as it sharpens its focus on growth and its evolving e-commerce strategy.

See our latest analysis for Zalando.

Zalando’s shares have faced a challenging run in 2024, with a 1-year total shareholder return of -10.8% and a 5-year total return of -71.9%. This reflects ongoing pressure across the sector despite recent leadership changes. While the latest executive appointment could signal a push for renewed momentum, the share price remains down nearly 24% year-to-date. This suggests investors are still weighing growth prospects against risk as the company navigates its next chapter.

If Zalando’s leadership moves have you thinking about what’s next in retail, it might be the right moment to broaden your search and discover fast growing stocks with high insider ownership

Given Zalando’s steep share price declines, along with improving growth metrics and a sizable discount to analyst price targets, is the market overlooking a bargain or are all the future gains already reflected in the current valuation?

Most Popular Narrative: 33.2% Undervalued

With Zalando’s current share price well below its most widely followed narrative fair value, attention is turning to what could drive a re-rating from here. The gap between consensus projection and today’s market value invites a closer look at the growth and margin assumptions behind this premium outlook.

The rollout of Zalando's new AI-powered discovery feed and continued investment in personalized, curated shopping experiences are expected to increase user engagement, shopping frequency, and ultimately drive higher average order value and revenue per customer. This approach leverages broader consumer migration to mobile and online channels, along with personalization.

Want to know why analysts believe this strategy could reset Zalando’s value? The secret may lie in ambitious profit forecasts and bold margin expansion targets. Tempted to see how these expectations add up, and what could power a major share price jump? Dive into the full narrative to uncover the underlying numbers.

Result: Fair Value of €36.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if muted consumer demand persists or competition intensifies, the growth outlook and margin expansion narrative for Zalando could quickly come under pressure.

Find out about the key risks to this Zalando narrative.

Another View: What Do Valuation Ratios Say?

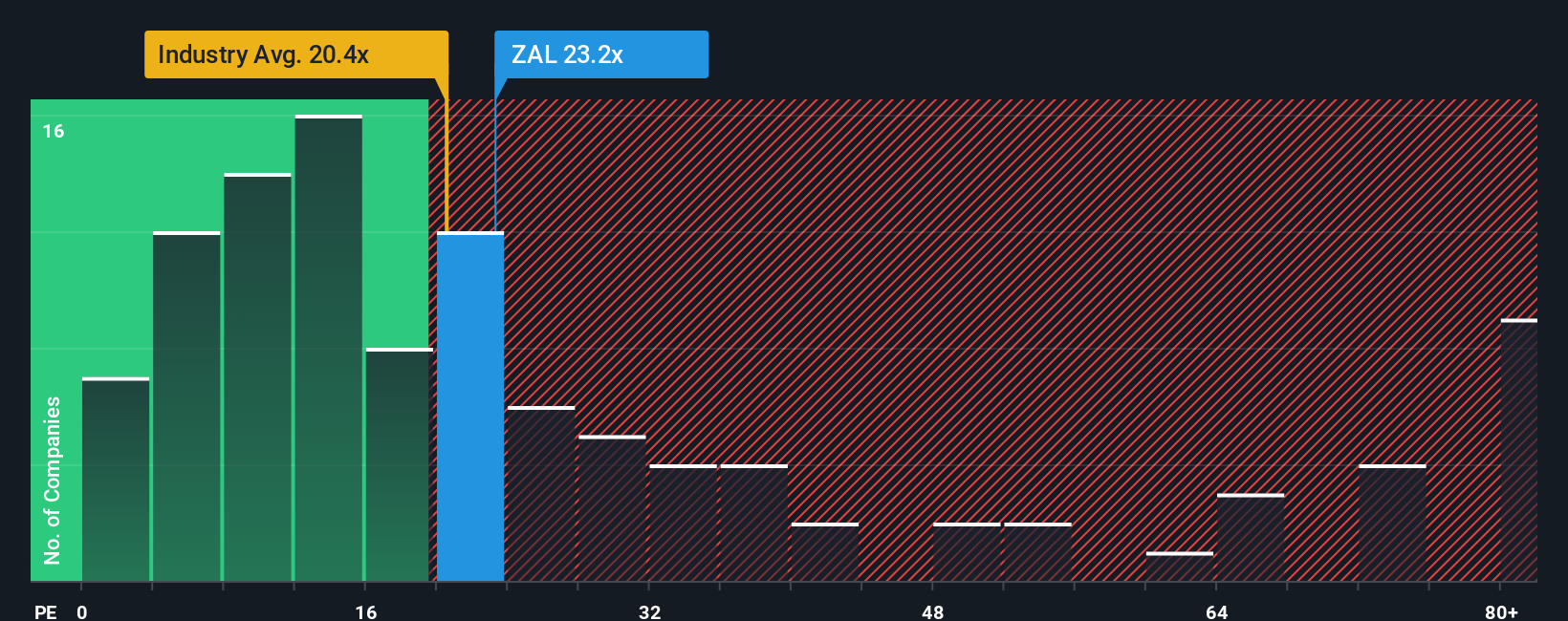

Taking a step back from growth projections, Zalando’s current price-to-earnings ratio stands at 23.6x, which is slightly above both the industry average of 20.6x and our fair ratio estimate of 23.3x. This suggests that while Zalando is not the most expensive among its peers, it is priced at a slight premium, potentially reflecting optimism about future growth. Could this premium expose investors to more downside risk if profit growth disappoints?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zalando Narrative

Prefer diving into the numbers on your own or want to put a different spin on the story? You can analyze the data and shape your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Zalando.

Looking for More Investment Ideas?

Smart investing means always staying a step ahead. Don’t miss your edge by using these powerful screeners to uncover fresh stocks and unique opportunities beyond Zalando:

- Target stable income streams by tapping into these 24 dividend stocks with yields > 3% with yields above 3% and robust payout histories.

- Ride the next wave of AI innovation by selecting these 26 AI penny stocks positioned to benefit from breakthroughs in artificial intelligence technologies.

- Tilt your portfolio towards true value by pinpointing these 848 undervalued stocks based on cash flows currently trading well below intrinsic worth based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zalando might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ZAL

Zalando

Operates an online platform for fashion and lifestyle products in Germany and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives