- Germany

- /

- Hospitality

- /

- XTRA:DHER

Increasing losses over year doesn't faze investors as stock ascends 8.8% this past week

Taking the occasional loss comes part and parcel with investing on the stock market. And unfortunately for Delivery Hero SE (ETR:DHER) shareholders, the stock is a lot lower today than it was a year ago. In that relatively short period, the share price has plunged 63%. The silver lining (for longer term investors) is that the stock is still 24% higher than it was three years ago. Shareholders have had an even rougher run lately, with the share price down 58% in the last 90 days.

While the stock has risen 8.8% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Delivery Hero

Because Delivery Hero made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last twelve months, Delivery Hero increased its revenue by 136%. That's well above most other pre-profit companies. In contrast the share price is down 63% over twelve months. Yes, the market can be a fickle mistress. Typically a growth stock like this will be volatile, with some shareholders concerned about the red ink on the bottom line (that is, the losses). We'd definitely consider it a positive if the company is trending towards profitability. If you can see that happening, then perhaps consider adding this stock to your watchlist.

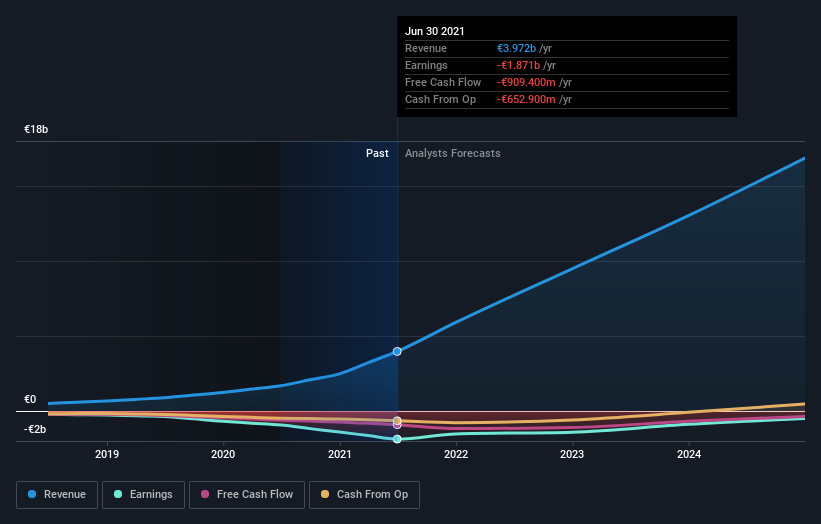

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Delivery Hero is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

The last twelve months weren't great for Delivery Hero shares, which performed worse than the market, costing holders 63%. Meanwhile, the broader market slid about 1.2%, likely weighing on the stock. Investors are up over three years, booking 7% per year, much better than the more recent returns. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Delivery Hero you should be aware of.

But note: Delivery Hero may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:DHER

Delivery Hero

Provides online food ordering, quick commerce, and delivery services.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Rare Disease Monopoly" – Commercial Execution Play

The "Landlord of Orbit" – A Deep Value Play Ahead of the Starlab Era

The "AI-Immunology" Asymmetric Opportunity – Validated by Merck (MSD)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026