- Germany

- /

- Real Estate

- /

- XTRA:VNA

Vonovia (XTRA:VNA) Valuation in Focus After Strong Earnings Turnaround

Reviewed by Simply Wall St

Vonovia (XTRA:VNA) just reported a sharp turnaround in its latest earnings, moving from a net loss last year to a strong net profit for both the third quarter and nine-month period in 2025.

See our latest analysis for Vonovia.

After last year's challenges, Vonovia's latest profit surge has caught the attention of investors, but the share price tells a more cautious story. Despite positive earnings momentum, the stock's recent 90-day price return is down 10.47%, and its year-to-date share price has slipped by 14.4%. Over the past year, total shareholder return sits at -9.8%, while the longer-term five-year total return remains deep in negative territory. This suggests that while fundamentals may be stabilizing, the market remains wary for now.

If you're looking to spot other market movers beyond real estate, now is the perfect chance to broaden your search and discover fast growing stocks with high insider ownership

With shares still lagging despite the turnaround, the question now is whether Vonovia is trading at a discount that signals a buying opportunity or if the market is already factoring in future growth.

Price-to-Earnings of 67.4x: Is it justified?

Vonovia is trading at a price-to-earnings ratio of 67.4x, making its shares look significantly more expensive than both the industry and its peers based on recent profits. With a last close price of €25.39, this high multiple suggests that investors are paying a premium for each euro of earnings compared to other German real estate companies.

The price-to-earnings ratio (P/E) measures how much investors are willing to pay for one euro of current earnings. For property companies, it indicates expectations for future growth, recurring rental income and perceived stability. A higher P/E can signal optimism about growth or be distorted by one-off profits.

Vonovia’s premium multiple stands out. The German real estate industry average is just 14.1x. The average of direct peers is only 6.7x. Even when comparing to an estimated fair P/E of 48.9x, the current ratio appears elevated. This means the stock could be pricing in aggressive profit growth, non-recurring gains, or optimism that may be hard to sustain if fundamentals weaken.

Explore the SWS fair ratio for Vonovia

Result: Price-to-Earnings of 67.4x (OVERVALUED)

However, continued revenue declines and long-term share price underperformance raise questions about whether recent profits are truly signaling a sustained recovery.

Find out about the key risks to this Vonovia narrative.

Another View: Discounted Cash Flow Challenges the Premium

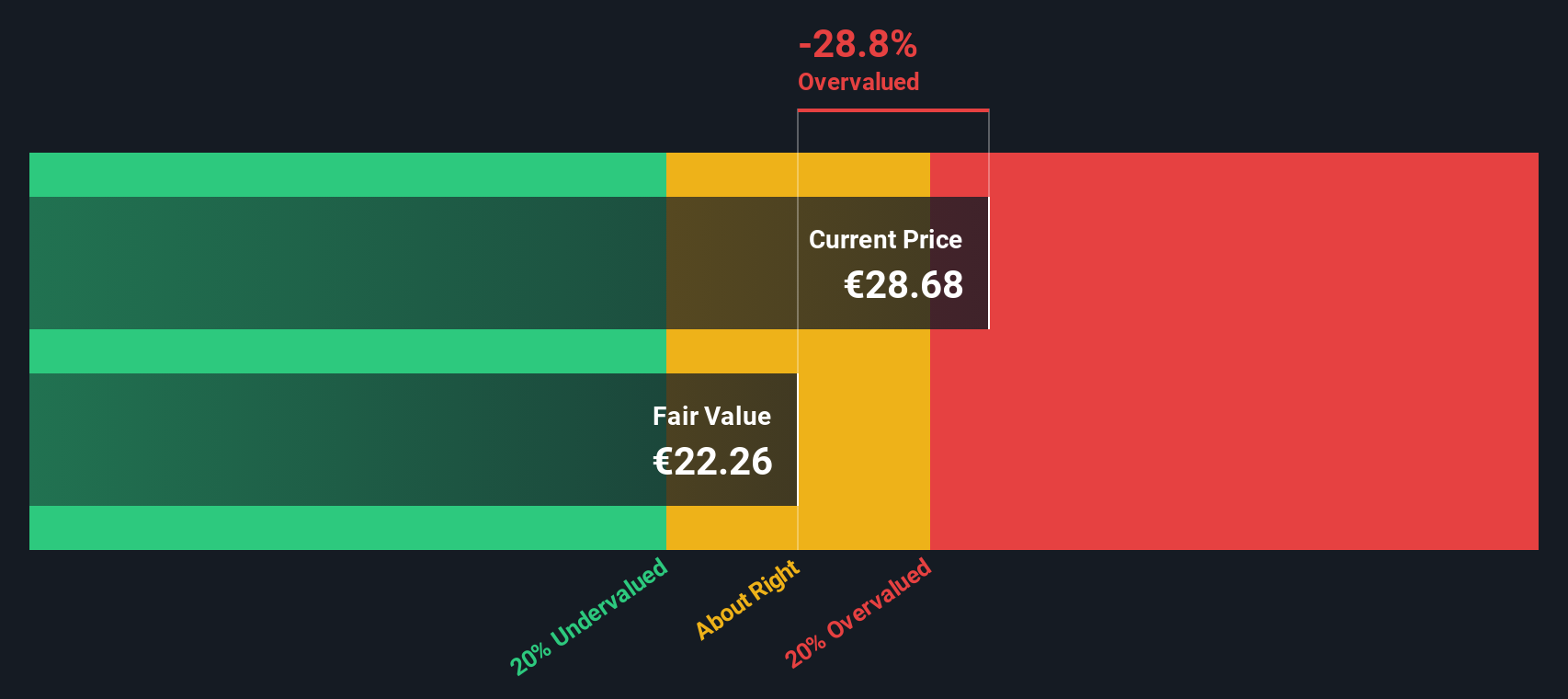

While the price-to-earnings ratio presents Vonovia as expensive, our DCF model tells a different story. According to the SWS DCF model, Vonovia’s fair value is €17.59, which is well below its current price of €25.28. This suggests the market could be overestimating future growth.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vonovia for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 838 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vonovia Narrative

Keep in mind that if you see things differently or want to dive deeper, you can quickly build your own analysis and narrative in just a few minutes. Why not Do it your way

A great starting point for your Vonovia research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

There are always smart opportunities waiting for you beyond Vonovia. The best move is to start searching now before the next breakout leaves you behind.

- Unlock high-yield potential and stay ahead of the market by checking out these 20 dividend stocks with yields > 3%, which offer robust dividend payouts and financial strength.

- Tap into the hottest trends in automation and digital intelligence by jumping into these 25 AI penny stocks, making waves in the AI revolution.

- Get an edge with undervalued opportunities no one else is watching. Browse these 838 undervalued stocks based on cash flows to see which companies could be the next breakout stars.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VNA

Vonovia

Operates as an integrated residential real estate company in Europe.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives