- Germany

- /

- Real Estate

- /

- XTRA:VIH1

VIB Vermögen AG (ETR:VIH1) Shares Fly 26% But Investors Aren't Buying For Growth

Those holding VIB Vermögen AG (ETR:VIH1) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 35% in the last twelve months.

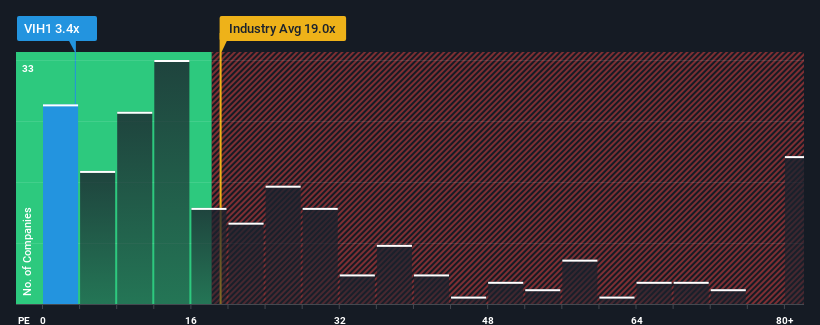

Even after such a large jump in price, given about half the companies in Germany have price-to-earnings ratios (or "P/E's") above 17x, you may still consider VIB Vermögen as a highly attractive investment with its 3.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

While the market has experienced earnings growth lately, VIB Vermögen's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for VIB Vermögen

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as VIB Vermögen's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 3.5%. Still, the latest three year period has seen an excellent 37% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the only analyst covering the company suggest earnings growth is heading into negative territory, declining 17% each year over the next three years. Meanwhile, the broader market is forecast to expand by 15% per year, which paints a poor picture.

With this information, we are not surprised that VIB Vermögen is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Shares in VIB Vermögen are going to need a lot more upward momentum to get the company's P/E out of its slump. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of VIB Vermögen's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 3 warning signs for VIB Vermögen (2 are a bit concerning!) that you need to take into consideration.

You might be able to find a better investment than VIB Vermögen. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:VIH1

VIB Vermögen

Engages in the development, acquisition, and management of commercial real estate properties in Germany.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives