- Germany

- /

- Real Estate

- /

- XTRA:NUVA

Take Care Before Jumping Onto Noratis AG (ETR:NUVA) Even Though It's 25% Cheaper

To the annoyance of some shareholders, Noratis AG (ETR:NUVA) shares are down a considerable 25% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 77% loss during that time.

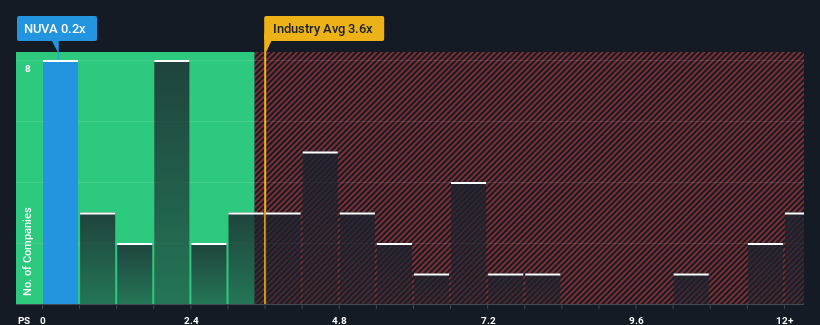

After such a large drop in price, Noratis may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Real Estate industry in Germany have P/S ratios greater than 3.6x and even P/S higher than 6x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Noratis

What Does Noratis' P/S Mean For Shareholders?

Noratis has been doing a reasonable job lately as its revenue hasn't declined as much as most other companies. It might be that many expect the comparatively superior revenue performance to degrade substantially, which has repressed the P/S. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. In saying that, existing shareholders probably aren't pessimistic about the share price if the company's revenue continues outplaying the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Noratis.How Is Noratis' Revenue Growth Trending?

Noratis' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 30%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 110% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should demonstrate the company's robustness, generating growth of 20% per annum as estimated by the one analyst watching the company. That would be an excellent outcome when the industry is expected to decline by 1.1% per year.

In light of this, it's quite peculiar that Noratis' P/S sits below the majority of other companies. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

The Bottom Line On Noratis' P/S

Shares in Noratis have plummeted and its P/S has followed suit. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Noratis currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Noratis (1 is significant) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Noratis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:NUVA

Noratis

A real estate company, invests in, develops, manages, and sells residential property portfolios in Germany.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives