- Germany

- /

- Real Estate

- /

- XTRA:AMM

The Grounds Real Estate Development AG (ETR:AMMN) Might Not Be As Mispriced As It Looks

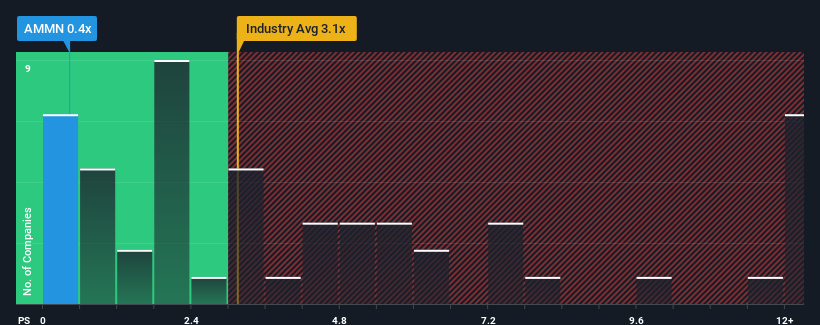

You may think that with a price-to-sales (or "P/S") ratio of 0.4x The Grounds Real Estate Development AG (ETR:AMMN) is definitely a stock worth checking out, seeing as almost half of all the Real Estate companies in Germany have P/S ratios greater than 3.1x and even P/S above 7x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Grounds Real Estate Development

How Has Grounds Real Estate Development Performed Recently?

Grounds Real Estate Development has been struggling lately as its revenue has declined faster than most other companies. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Grounds Real Estate Development's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

Grounds Real Estate Development's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 34%. Still, the latest three year period has seen an excellent 129% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth will be highly resilient over the next three years growing by 32% each year. Meanwhile, the broader industry is forecast to contract by 17% per year, which would indicate the company is doing very well.

With this in mind, we find it intriguing that Grounds Real Estate Development's P/S falls short of its industry peers. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Grounds Real Estate Development currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Grounds Real Estate Development (1 is significant) you should be aware of.

If these risks are making you reconsider your opinion on Grounds Real Estate Development, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:AMM

Grounds Real Estate Development

A real estate company, engages in the development, management, rental, and sale of residential properties in Germany.

Slight risk and slightly overvalued.

Market Insights

Community Narratives