- Germany

- /

- Real Estate

- /

- XTRA:AMM

Investors Still Aren't Entirely Convinced By The Grounds Real Estate Development AG's (ETR:AMMN) Revenues Despite 27% Price Jump

The Grounds Real Estate Development AG (ETR:AMMN) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 39% in the last twelve months.

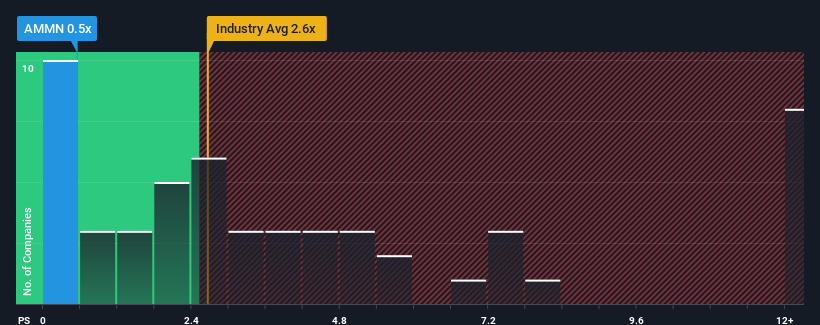

Although its price has surged higher, Grounds Real Estate Development's price-to-sales (or "P/S") ratio of 0.5x might still make it look like a strong buy right now compared to the wider Real Estate industry in Germany, where around half of the companies have P/S ratios above 2.6x and even P/S above 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Grounds Real Estate Development

What Does Grounds Real Estate Development's P/S Mean For Shareholders?

Grounds Real Estate Development has been doing a reasonable job lately as its revenue hasn't declined as much as most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. But at the very least, you'd be hoping that revenue doesn't fall off a cliff completely if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Grounds Real Estate Development will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Grounds Real Estate Development's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 33% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 22% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue growth will be highly resilient over the next three years growing by 62% per year. With the rest of the industry predicted to shrink by 8.4% per year, that would be a fantastic result.

With this in mind, we find it intriguing that Grounds Real Estate Development's P/S falls short of its industry peers. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Grounds Real Estate Development's P/S?

Even after such a strong price move, Grounds Real Estate Development's P/S still trails the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Grounds Real Estate Development currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Grounds Real Estate Development (2 are significant!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:AMM

Grounds Real Estate Development

A real estate company, engages in the development, management, rental, and sale of residential properties in Germany.

Slight risk and fair value.

Market Insights

Community Narratives