Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that The Grounds Real Estate Development AG (ETR:AMM) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

What Is Grounds Real Estate Development's Net Debt?

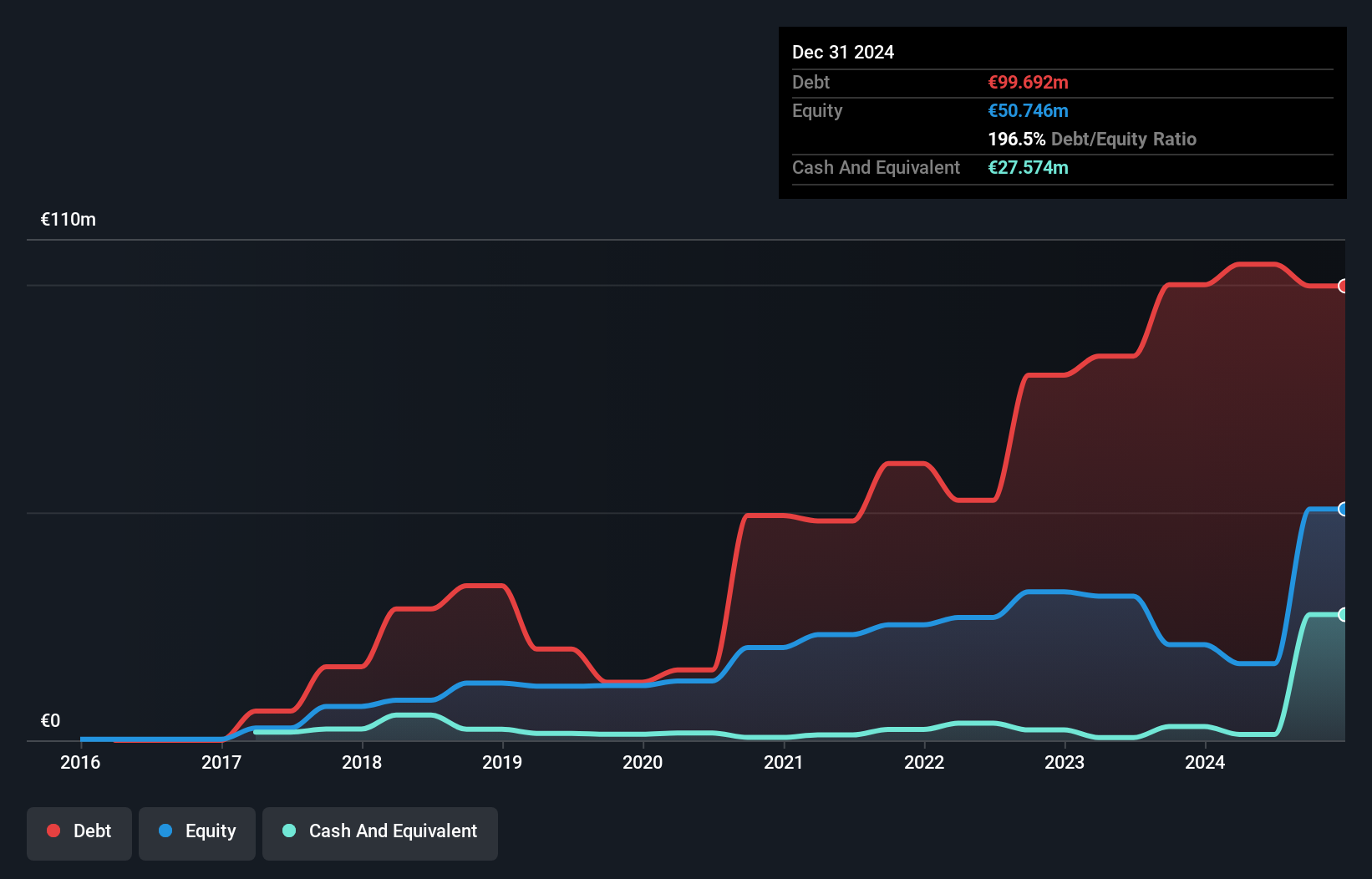

As you can see below, Grounds Real Estate Development had €99.7m of debt, at December 2024, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has €27.6m in cash leading to net debt of about €72.1m.

A Look At Grounds Real Estate Development's Liabilities

According to the last reported balance sheet, Grounds Real Estate Development had liabilities of €62.6m due within 12 months, and liabilities of €55.0m due beyond 12 months. Offsetting these obligations, it had cash of €27.6m as well as receivables valued at €4.84m due within 12 months. So its liabilities total €85.2m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the €27.7m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Grounds Real Estate Development would probably need a major re-capitalization if its creditors were to demand repayment. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Grounds Real Estate Development can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

View our latest analysis for Grounds Real Estate Development

Over 12 months, Grounds Real Estate Development made a loss at the EBIT level, and saw its revenue drop to €13m, which is a fall of 46%. To be frank that doesn't bode well.

Caveat Emptor

While Grounds Real Estate Development's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost a very considerable €9.3m at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. That said, it is possible that the company will turn its fortunes around. Nevertheless, we would not bet on it given that it vaporized €10m in cash over the last twelve months, and it doesn't have much by way of liquid assets. So we think this stock is risky, like walking through a dirty dog park with a mask on. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 4 warning signs with Grounds Real Estate Development (at least 3 which are a bit concerning) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:AMM

Grounds Real Estate Development

A real estate company, engages in the development, management, rental, and sale of residential properties in Germany.

Slight risk and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success